October 2025 Eastside Market Update

Months of inventory — how we take the pulse of the market — are down based on pending sales. That’s not surprising, given September’s dip in interest rates ahead of the Fed Funds rate cut, which temporarily boosted buyer confidence. That said, the last two weeks have slowed buyers down. Economic uncertainty isn’t great for decision-making (which, ironically, is exactly what makes now a great time to buy — more on that later).

Median prices are up 2% month-over-month and 3% year-over-year. Interest rates are hovering between 6% and 6.5%, and realistically, that’s probably where they’ll stay for the foreseeable future. (Reason #2 not to delay buying.)

At 2.3 months of inventory, we’re in a balanced market with a slight lean toward sellers. However, we still have more active inventory than we’ve seen in the last five years — (Reason #3 to buy now.) Homes that are well priced are selling fast — 12% of the market sold in the first weekend. But if a home has challenges that pricing doesn’t account for, or it’s simply overpriced, it won’t move without a reduction.

What does this mean?

Sellers: Price conservatively (yes, that means low).

Buyers: Honestly, now is the time — as long as you can afford the payment and plan to stay 3+ years (ideally 5+). Inventory is solid, rates are likely to hold (and can be refinanced later), and economic uncertainty is causing other buyers to pause. That combination creates opportunity.

September Stats

Year-over-year, median prices are basically flat, but they did slip month-over-month for the 4th month in a row. As always, take pricing with a grain of salt—it’s one of the trickiest stats to pin down. With September’s burst of activity and (slightly) lower interest rates, buyer demand will likely keep prices steady through the rest of the year.

Inventory now sits at 2.5 months—technically a balanced market. But here’s the kicker: this is the first time in a decade we’ve seen August’s months of inventory at this level. It feels dramatic because it’s new, but it’s not doomsday. Think of it as shifting from the freeway fast lane at 85 mph down to a solid 55 mph. Is it slower? Sure. But you’re still moving forward.

And the sky? Definitely not falling. Roughly one-third of homes are still selling at or above asking, and two-thirds are going under contract within 30 days. That’s not weakness—it’s recalibration toward a healthier, more sustainable pace.

Buyers: enjoy the breathing room, but stay sharp—19% of homes still sold with multiple offers last month.

Sellers: pricing and presentation matter more than ever. Nail both in the first two weeks if you want top results.

What a Fed Rate Cut Could Mean for Mortgage Rates

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.

The Fed Doesn’t Directly Set Mortgage Rates

Right now, all eyes are on the Fed. Most economists expect they’ll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.

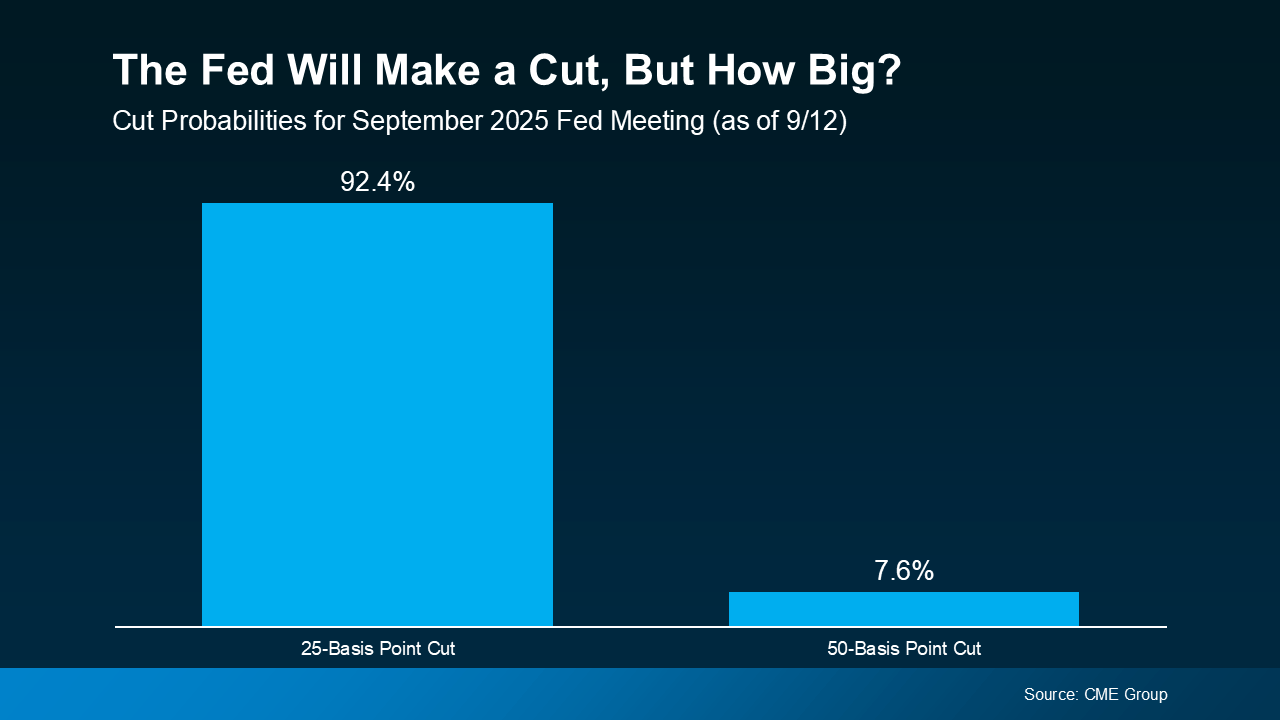

According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. And based on what we know now, there’s about a 92% chance it’ll be a small cut (25 basis points) and an 8% chance it will be a bigger cut (50 basis points):

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

Why Markets Already Saw This Cut Coming

Here’s the part that may surprise you. Mortgage rates tend to respond to what the financial markets think the Fed will do, before the Fed officially acts. Basically, when markets anticipate a Fed cut, that outlook gets priced into mortgage rates ahead of time.

That’s exactly what happened after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates ticked down as financial markets grew more confident a cut was coming soon. And even though inflation rose slightly in the latest CPI report, the Fed is still expected to make a cut.

So, if the Fed goes with a 25-basis point cut, as expected, that’s likely already baked in to current mortgage rates, and we may not see a dramatic drop.

But if they go bigger and drop their Federal Funds Rate by 50 basis points instead, mortgage rates could come down more than they already have.

So, Where Do Mortgage Rates Go from Here?

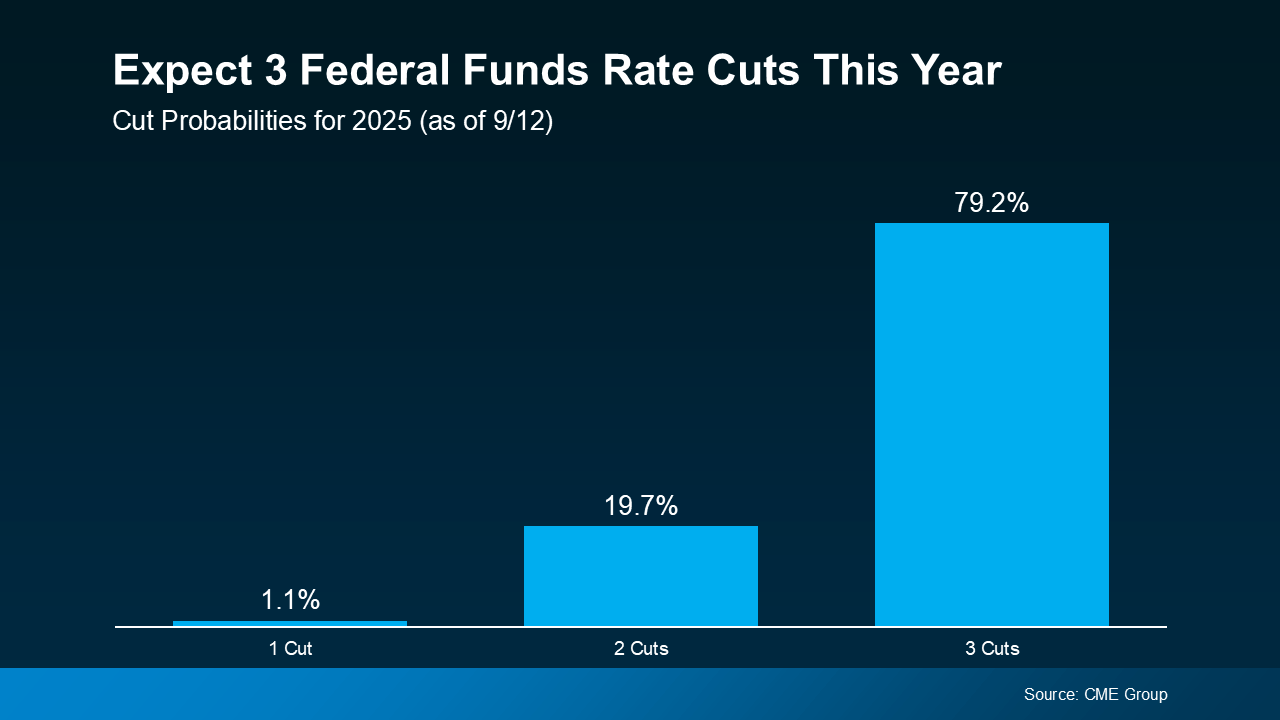

While the upcoming cut may not move the needle much, many experts expect the Fed could cut the Federal Funds Rate more than once before the end of the year. Of course, that’s if the economy continues to cool (see graph below):

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

If multiple rate cuts happen, or even if markets just believe they will, mortgage rates could ease further in the months ahead. But here’s the catch – all of this depends on how the economy evolves. Surprise inflation data or unexpected shifts could quickly change the outlook.

Bottom Line

Mortgage rates likely won’t drop sharply overnight, and they won’t mirror the Fed’s moves one-for-one. But if the Fed begins a rate-cutting cycle, and markets continue to expect it, mortgage rates could trend lower later this year and into 2026.

If you’ve been waiting and watching the housing market, now’s the time to talk strategy. Even small changes in rates can make a meaningful difference in affordability, and understanding what’s ahead helps you make the best decision for your situation.

What Everyone’s Getting Wrong About the Rise in New Home Inventory

You may have seen talk online that new home inventory is at its highest level since the crash. And if you lived through the crash back in 2008, seeing new construction is up again may feel a little scary.

But here’s what you need to remember: a lot of what you see online is designed to get clicks. So, you may not be getting the full story. A closer look at the data and a little expert insight can change your perspective completely.

Why This Isn’t Like 2008

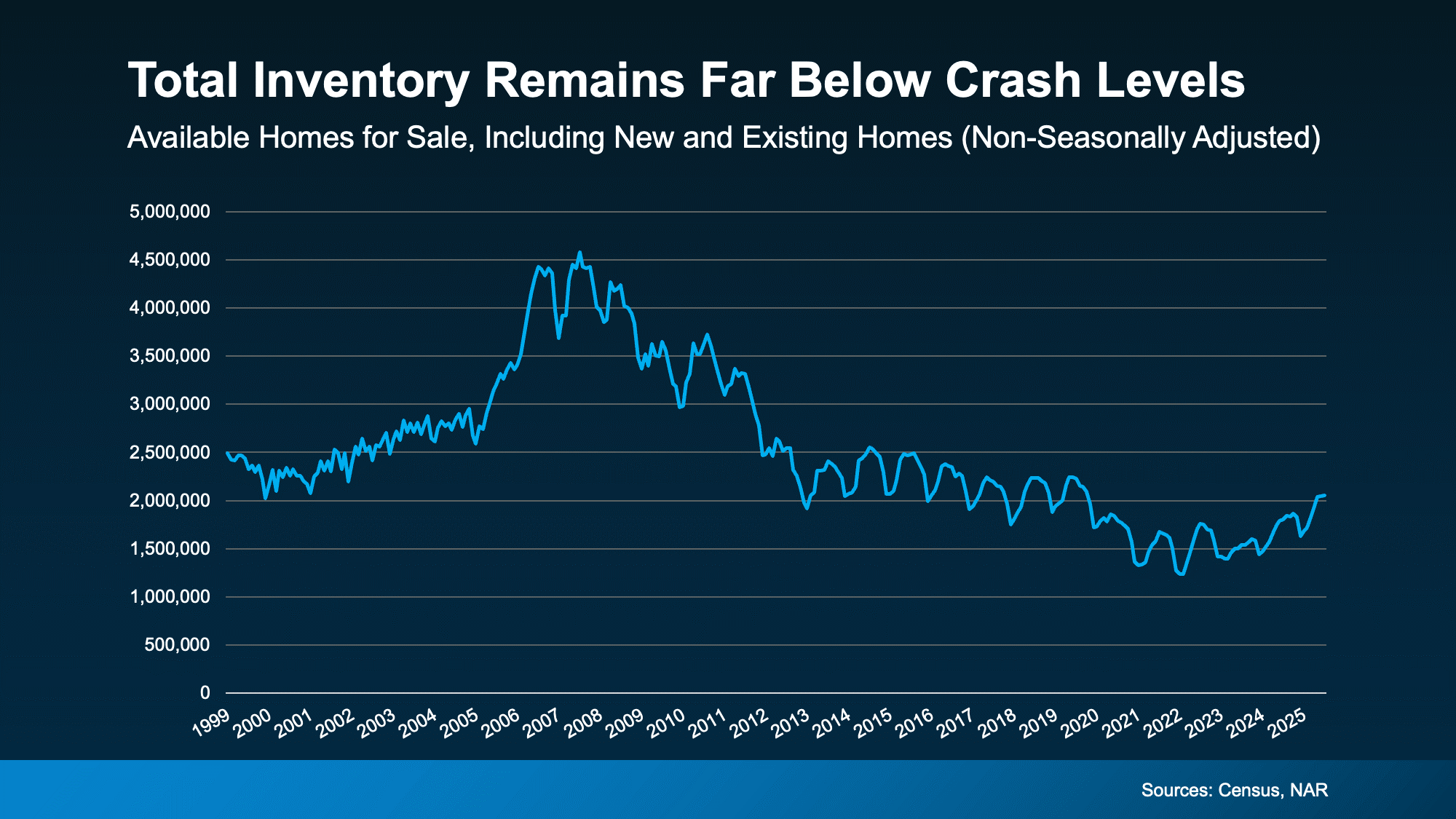

While it’s true the number of new homes on the market hit its highest level since the crash, that’s not a reason to worry. That’s because new builds are just one piece of the puzzle. They don’t tell the full story of what’s happening today.

To get the real picture of how much inventory we have and how it compares to the surplus we saw back then, you’ve got to look at both new homes and existing homes (homes that were lived in by a previous owner).

When you combine those two numbers, it’s clear overall supply looks very different today than it did around the crash (see graph below):

So, saying we’re near 2008 levels for new construction isn’t the same as the inventory surplus we did the last time.

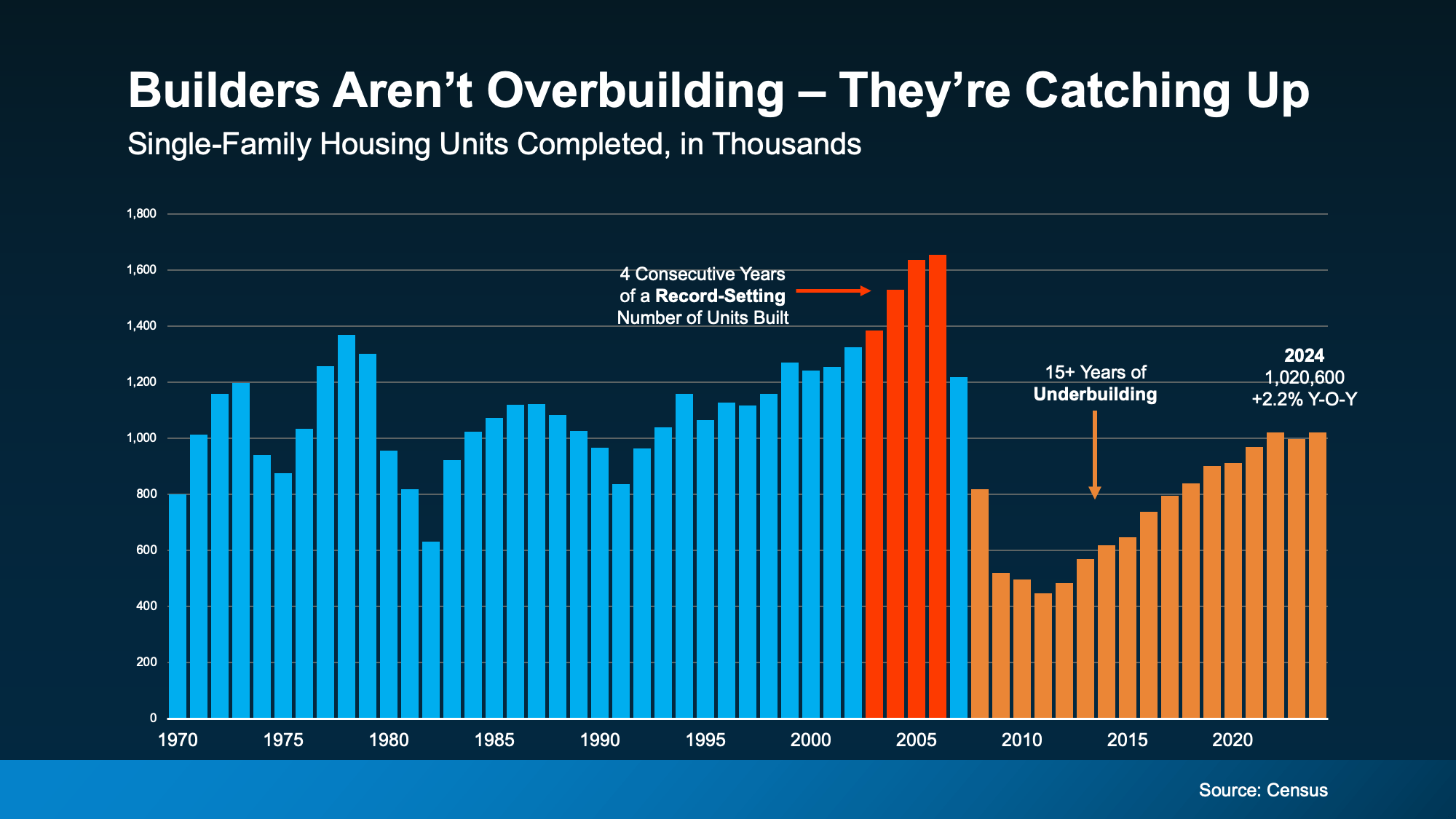

Builders Have Actually Underbuilt for Over a Decade

And here’s some other important perspective you’re not going to get from those headlines. After the 2008 crash, builders slammed on the brakes. For 15 years, they didn’t build enough homes to keep up with demand. That long stretch of underbuilding created a major housing shortage, which we’re still dealing with today.

The graph below uses Census data to show the overbuilding leading up to the crash (in red), and the period of underbuilding that followed (in orange):

Basically, we had more than 15 straight years of underbuilding – and we’re only recently starting to slowly climb out of that hole. But there’s still a long way to go (even with the growth we’ve seen lately). Experts at Realtor.com say it would take roughly 7.5 years to build enough homes to close the gap.

Of course, like anything else in real estate, the level of supply and demand is going to vary by market. Some markets may have more homes for sale, some less. But nationally, this isn’t like the last time.

Bottom Line

Just because there are more new homes for sale right now, it doesn’t mean we’re headed for a crash. The data shows today’s overall inventory situation is different.

If you have questions or want to talk about what builders are doing in our area, let’s connect.

History Shows the Housing Market Always Recovers

Now that the market is slowing down, homeowners who haven’t sold at the price they were hoping for are increasingly pulling their homes off the market. According to the latest data from Realtor.com, the number of homeowners taking their homes off the market is up 38% since the start of this year and 48% since the same time last June. For every 100 new listings in June, about 21 homes were taken off the market.

And if you’ve made that same choice, you’re probably frustrated things didn’t go the way you wanted. It’s hard when you feel like the market isn’t working with you. But while slowdowns can be painful in the moment, history tells us they don’t last forever.

History Repeats Itself: Proof from the Past

This isn’t the first time the housing market has experienced a slowdown. Here are some other notable times when home sales dropped significantly:

- 1980s: When mortgage rates climbed past 18%, buyers stopped cold. Sales crawled for years. But as soon as rates came down, sales surged back, and the market found its footing again.

- 2008: The Great Financial Crisis was one of the toughest housing downturns in history. Sales and prices both dropped hard. Still, sales rebounded once the economy recovered.

- 2020: During COVID, sales disappeared overnight, and many people had to put their plans on hold. Yet the recovery was faster than anyone expected, with a surge of buyers re-entering the market as soon as restrictions eased.

The lesson is clear: no matter the cause, the market always rebounds.

Today’s Situation: Where We Stand Now

Over the past few years, home sales have been sluggish. And one big reason why is affordability. Mortgage rates rose at a record-breaking pace in 2022, and home prices were climbing at the same time. That combination put buying out of reach for many people. And when demand slows, home sales do too.

The Outlook: Why Things Will Improve

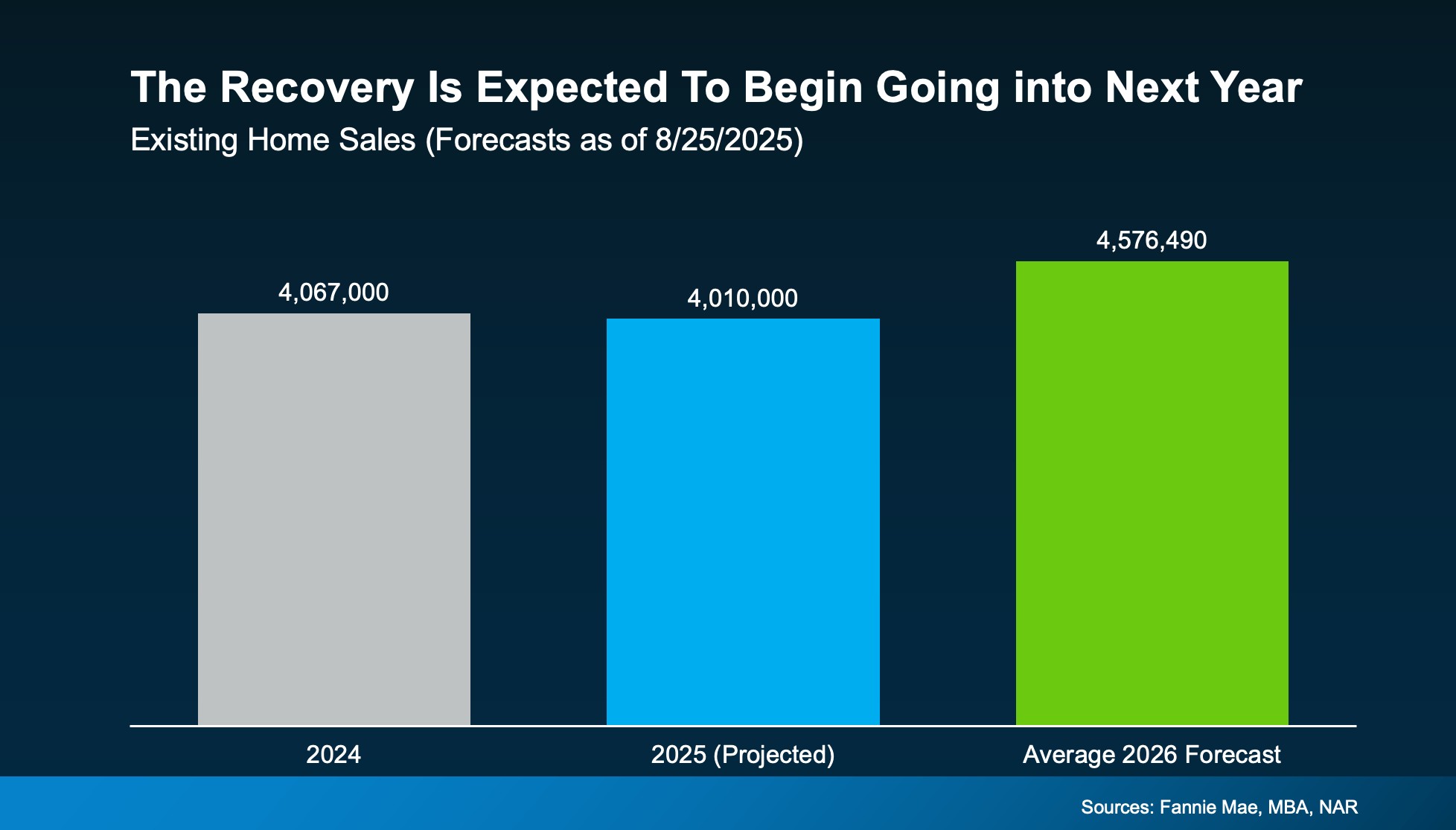

But here’s the encouraging part. Forecasts show sales are expected to pick up again moving into 2026.

Last year, just about 4 million homes sold (shown in gray in the graph below). And this year is looking very similar (shown in blue). But the average of the latest forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) show the experts believe there will be around 4.6 million home sales in 2026 (shown in green).

And a big reason behind that projection is the expectation that mortgage rates will come down a bit, making it easier for more buyers to jump back in.

That means what’s happening now is part of a cycle we’ve seen before. Every slowdown in the past has eventually given way to more activity, and this one will too.

Just like the 1980s, 2008, and 2020, today’s dip in home sales is temporary.

What That Means for You

If you’ve paused your moving plans, you did what you thought was right. Your frustration is valid. But it’s also important to remember the bigger picture. Housing slowdowns don’t last forever.

That’s where your local real estate agent comes in. Their job is to keep a close eye on the market for you. When the first signs of a rebound appear, they’ll help you spot the shift early so you can relist with confidence.

Bottom Line

If today’s housing market feels stuck, remember it’s never stayed down for good. Slowdowns end, activity returns, and people get moving again. So, let’s connect, because when the next wave of buyers shows up, you won’t want to miss it.

As activity picks up again, will you be ready to put your house back on the market, or do you need to move sooner?

The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years.

And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

- The average projection is about 3.3% price growth per year, through 2029.

- The optimists see growth closer to 5.0% per year.

- The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

Bottom Line

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link