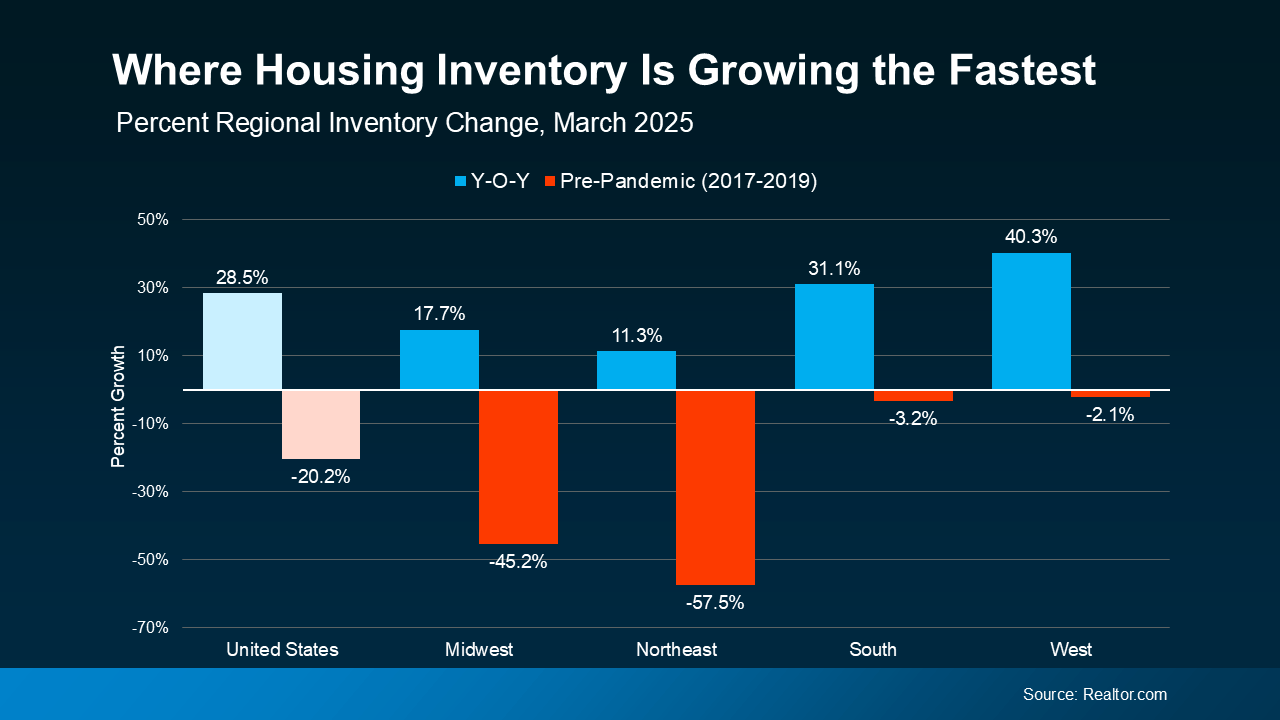

Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive.

What Are Concessions and Incentives?When a seller or builder gives you something extra to help with your purchase, that’s called either a concession or an incentive.

- A concession is something a seller gives up or agrees to in order to reach a compromise and close a deal.

- An incentive, on the other hand, is a benefit a builder or seller advertises and offers up front to attract and encourage buyers.

Today, some of the most common ones are:

- Help with closing costs

- Mortgage rate buy-downs (to temporarily lower your rate)

- Discounts or price reductions

- Upgrades or appliances

- Home warranties

- Minor repairs

For buyers, getting any of these things thrown in can be a big deal – especially if you’re working with a tight budget. As the National Association of Realtors (NAR) says:

“. . . they can help reduce the upfront costs associated with purchasing a home.”

Builders Are Making It Easier To Buy

It’s not just one builder willing to toss in a few extras. A lot of builders are using this tactic lately. As Zonda says:

“Incentives continued to be popular in March, offered by builders on 56% of to-be-built homes and 74% of quick move-in (QMI) homes, which can likely be occupied within 90 days.”

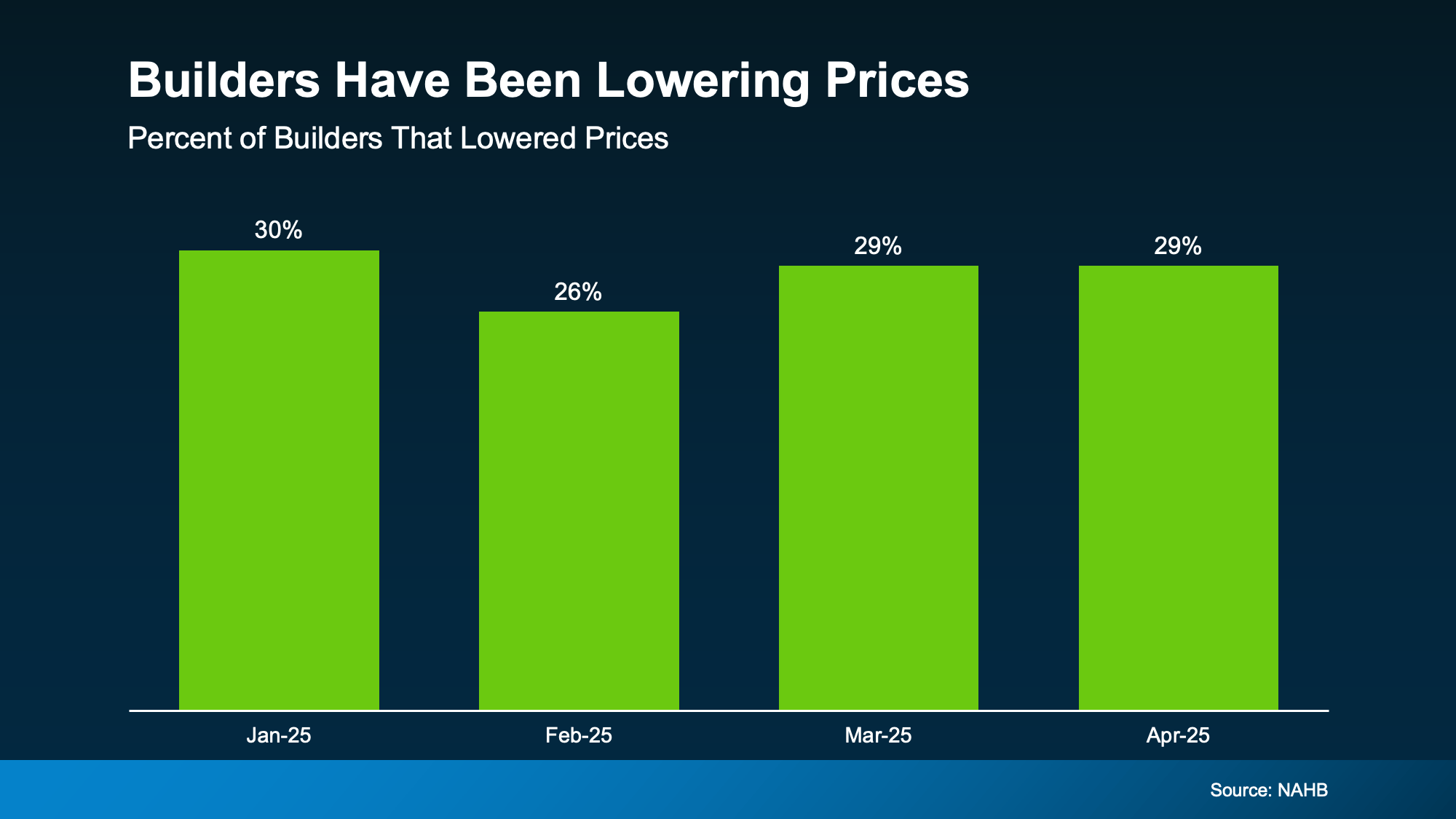

That’s because they don’t want to sit on inventory for too long. They want it to sell. And according to the National Association of Home Builders (NAHB), one of the strategies many builders are using to keep that inventory moving (and not just sitting) is a price adjustment (see graph below):

Around 30% of builders lowered prices in each of the first four months of the year. While that also means most builders aren’t lowering prices, it also shows some are willing to negotiate with buyers to get a deal done.

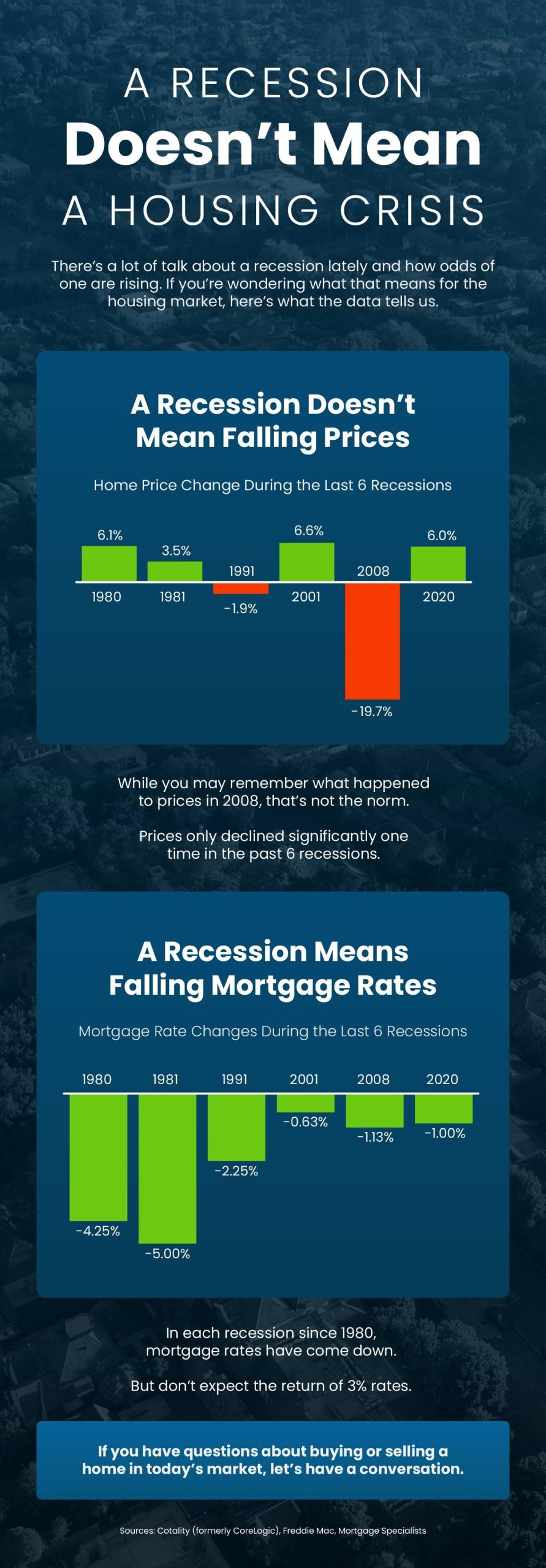

This isn’t a sign of trouble in the market, it’s an opportunity for you. The fact that the majority of builders offer incentives and roughly 3 in 10 are lowering prices means if you’re looking at a newly built home, your builder will probably try to make it easier for you to close the deal.

Existing Home Sellers Are Offering More, Too

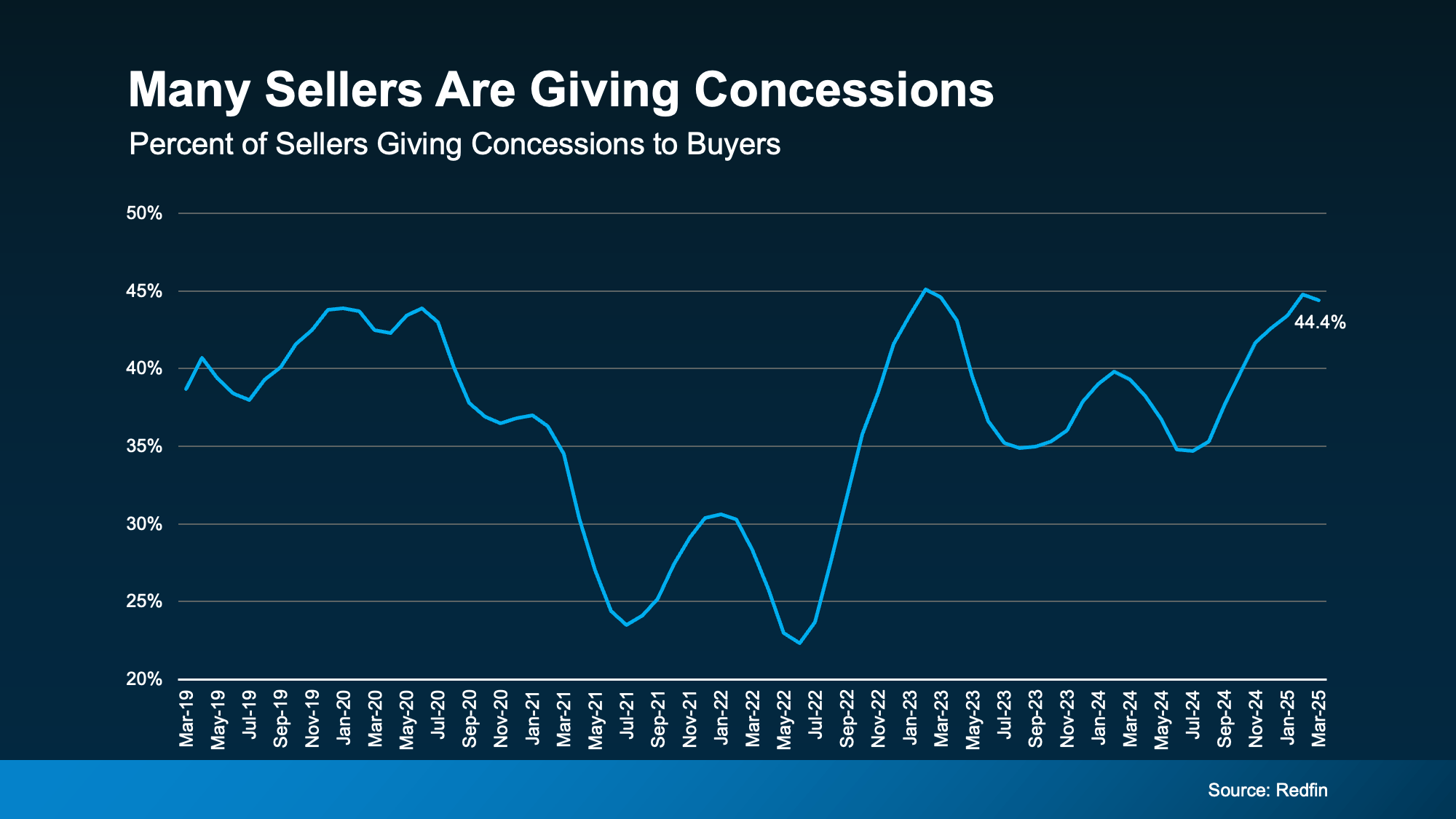

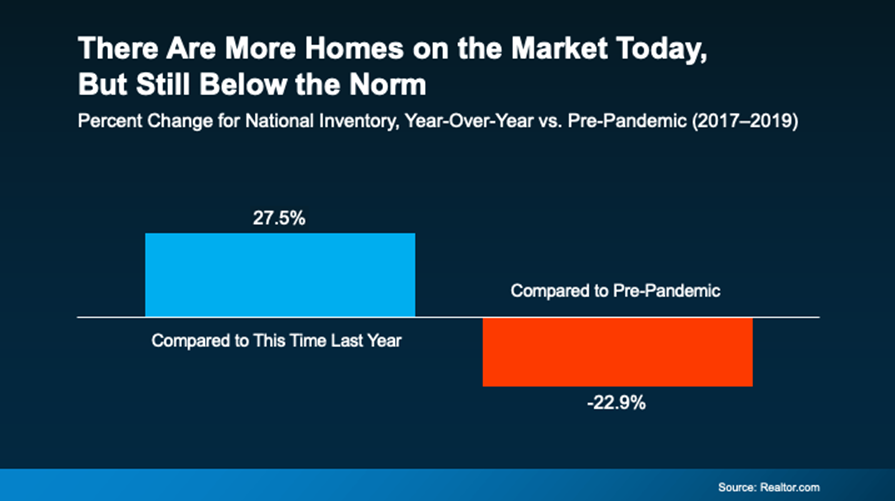

More existing homes (one that someone has lived in before) have been hitting the market, too – which means sellers are facing more competition. That’s why over 44% of sellers of existing homes gave concessions to buyers in March (see graph below):

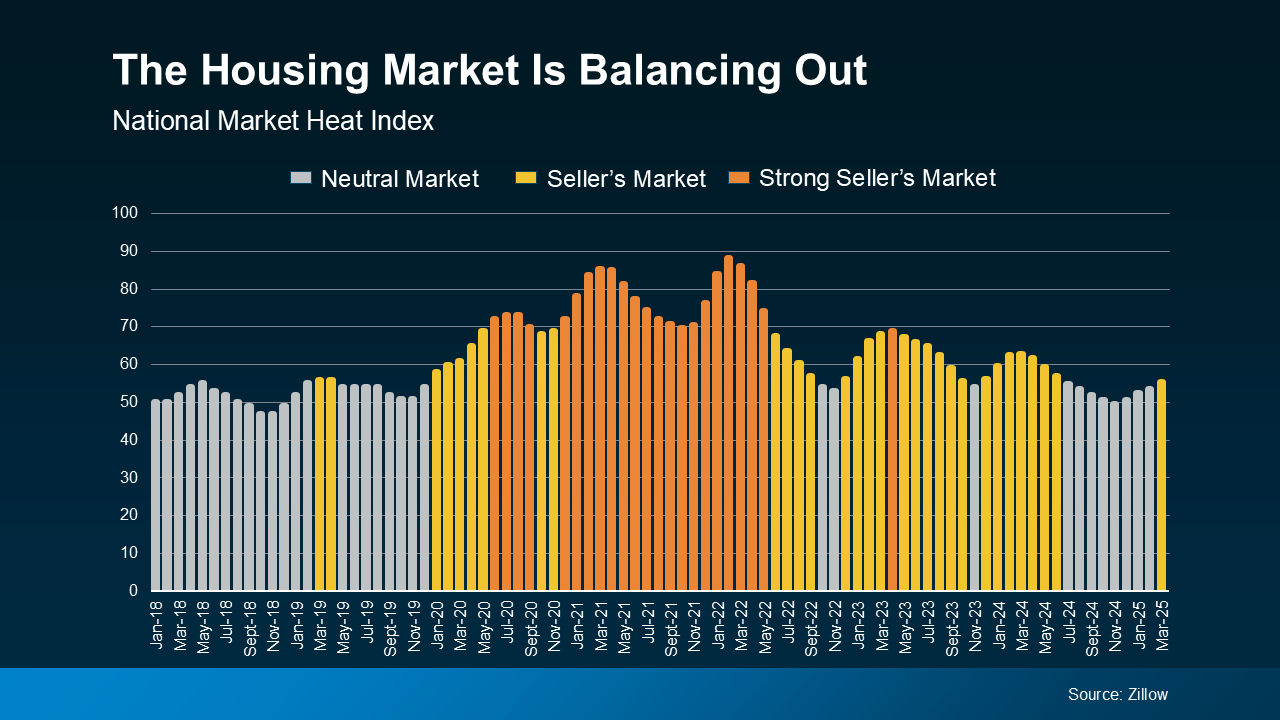

And, if you look back at pre-pandemic years on this graph, you’ll see 44% is pretty much returning to normal. After years of sellers having all the power, the market is balancing again, which can work in your favor as a buyer.

But remember, concessions don’t always mean a big discount. While more sellers are compromising on price, that’s not always the lever they pull. Sometimes it’s as simple as the seller paying for repairs, leaving appliances behind for you, or helping with your closing costs.

And considering that home values have risen by more than 57% over the course of the past 5 years, small concessions are a great way for sellers to make a house more attractive to buyers while still making a profit.

Bottom Line

Whether you’re looking at a newly built home or something a little older, there’s a good chance you can benefit from concessions or incentives.

If a seller or builder offered you something extra, what would make the biggest difference to help you move forward?

Let’s talk about it and see if it’s realistic based on inventory and competition in our local market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link