October 2025 Eastside Market Update

Months of inventory — how we take the pulse of the market — are down based on pending sales. That’s not surprising, given September’s dip in interest rates ahead of the Fed Funds rate cut, which temporarily boosted buyer confidence. That said, the last two weeks have slowed buyers down. Economic uncertainty isn’t great for decision-making (which, ironically, is exactly what makes now a great time to buy — more on that later).

Median prices are up 2% month-over-month and 3% year-over-year. Interest rates are hovering between 6% and 6.5%, and realistically, that’s probably where they’ll stay for the foreseeable future. (Reason #2 not to delay buying.)

At 2.3 months of inventory, we’re in a balanced market with a slight lean toward sellers. However, we still have more active inventory than we’ve seen in the last five years — (Reason #3 to buy now.) Homes that are well priced are selling fast — 12% of the market sold in the first weekend. But if a home has challenges that pricing doesn’t account for, or it’s simply overpriced, it won’t move without a reduction.

What does this mean?

Sellers: Price conservatively (yes, that means low).

Buyers: Honestly, now is the time — as long as you can afford the payment and plan to stay 3+ years (ideally 5+). Inventory is solid, rates are likely to hold (and can be refinanced later), and economic uncertainty is causing other buyers to pause. That combination creates opportunity.

September Stats

Year-over-year, median prices are basically flat, but they did slip month-over-month for the 4th month in a row. As always, take pricing with a grain of salt—it’s one of the trickiest stats to pin down. With September’s burst of activity and (slightly) lower interest rates, buyer demand will likely keep prices steady through the rest of the year.

Inventory now sits at 2.5 months—technically a balanced market. But here’s the kicker: this is the first time in a decade we’ve seen August’s months of inventory at this level. It feels dramatic because it’s new, but it’s not doomsday. Think of it as shifting from the freeway fast lane at 85 mph down to a solid 55 mph. Is it slower? Sure. But you’re still moving forward.

And the sky? Definitely not falling. Roughly one-third of homes are still selling at or above asking, and two-thirds are going under contract within 30 days. That’s not weakness—it’s recalibration toward a healthier, more sustainable pace.

Buyers: enjoy the breathing room, but stay sharp—19% of homes still sold with multiple offers last month.

Sellers: pricing and presentation matter more than ever. Nail both in the first two weeks if you want top results.

What Everyone’s Getting Wrong About the Rise in New Home Inventory

You may have seen talk online that new home inventory is at its highest level since the crash. And if you lived through the crash back in 2008, seeing new construction is up again may feel a little scary.

But here’s what you need to remember: a lot of what you see online is designed to get clicks. So, you may not be getting the full story. A closer look at the data and a little expert insight can change your perspective completely.

Why This Isn’t Like 2008

While it’s true the number of new homes on the market hit its highest level since the crash, that’s not a reason to worry. That’s because new builds are just one piece of the puzzle. They don’t tell the full story of what’s happening today.

To get the real picture of how much inventory we have and how it compares to the surplus we saw back then, you’ve got to look at both new homes and existing homes (homes that were lived in by a previous owner).

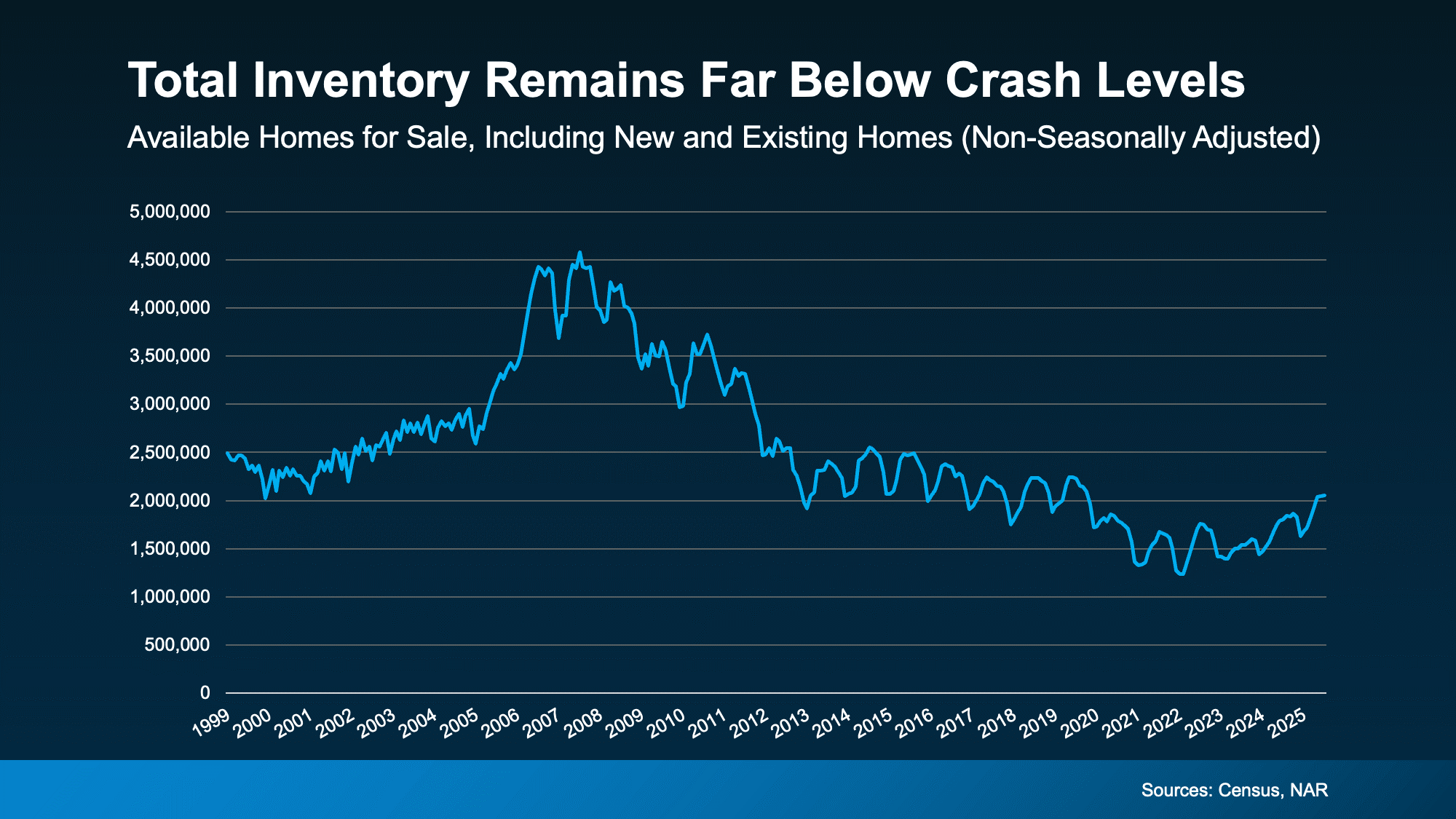

When you combine those two numbers, it’s clear overall supply looks very different today than it did around the crash (see graph below):

So, saying we’re near 2008 levels for new construction isn’t the same as the inventory surplus we did the last time.

Builders Have Actually Underbuilt for Over a Decade

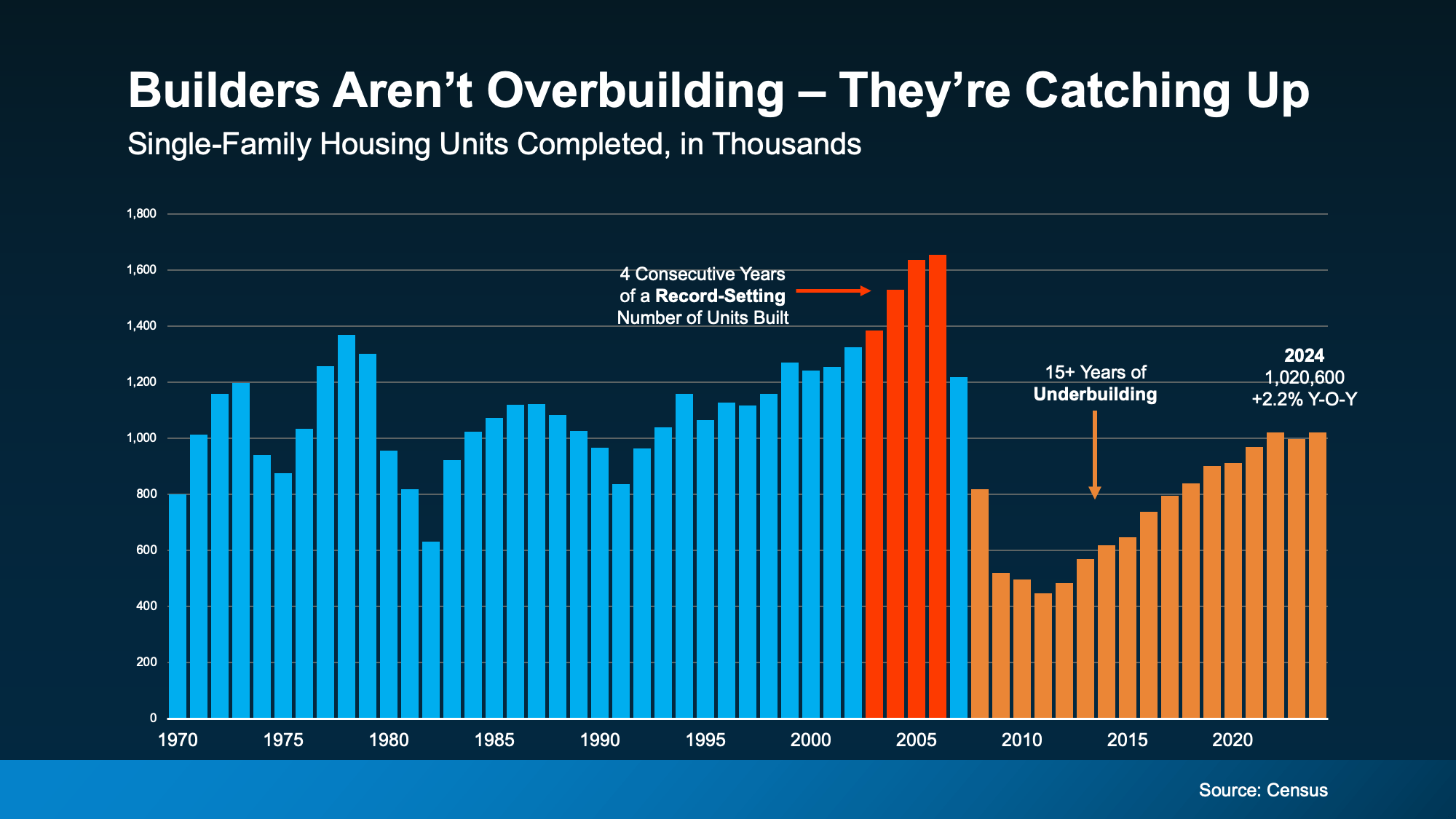

And here’s some other important perspective you’re not going to get from those headlines. After the 2008 crash, builders slammed on the brakes. For 15 years, they didn’t build enough homes to keep up with demand. That long stretch of underbuilding created a major housing shortage, which we’re still dealing with today.

The graph below uses Census data to show the overbuilding leading up to the crash (in red), and the period of underbuilding that followed (in orange):

Basically, we had more than 15 straight years of underbuilding – and we’re only recently starting to slowly climb out of that hole. But there’s still a long way to go (even with the growth we’ve seen lately). Experts at Realtor.com say it would take roughly 7.5 years to build enough homes to close the gap.

Of course, like anything else in real estate, the level of supply and demand is going to vary by market. Some markets may have more homes for sale, some less. But nationally, this isn’t like the last time.

Bottom Line

Just because there are more new homes for sale right now, it doesn’t mean we’re headed for a crash. The data shows today’s overall inventory situation is different.

If you have questions or want to talk about what builders are doing in our area, let’s connect.

Is the Housing Market Starting To Balance Out?

For years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things are starting to shift in many areas.

So, is the market finally balancing out? And does that mean buyers will have it a bit easier now? Here’s what you need to know.

What Makes It a Buyer’s Market or a Seller’s Market?

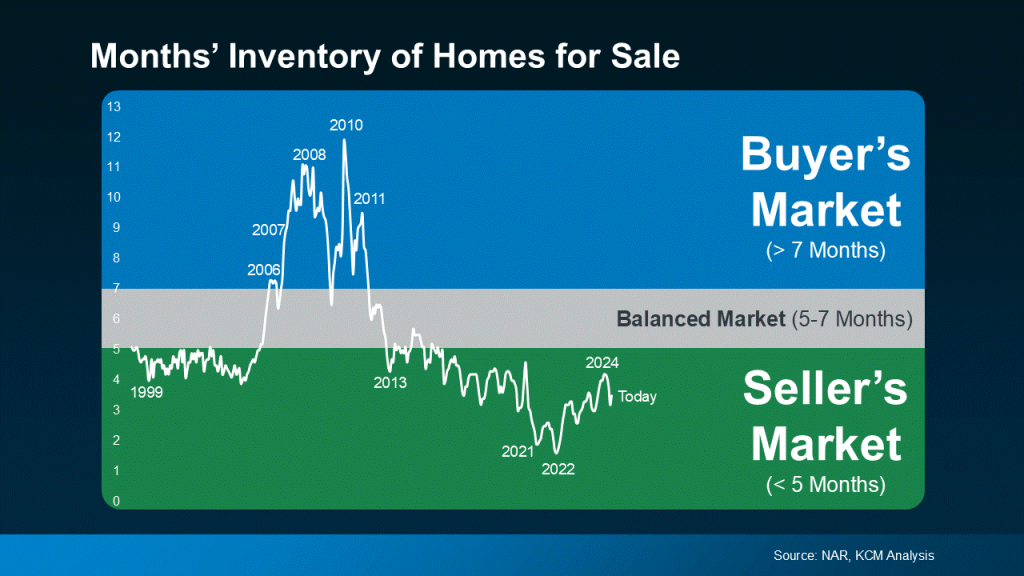

It all comes down to how many homes are for sale in an area compared to how many buyers want to buy there. That’s what ultimately determines who has the most leverage.

- A Seller’s Market is when there are more buyers than homes available, so sellers hold the power. This leads to rising prices, multiple offers, and homes selling quickly – often above the asking price – because there isn’t enough to go around.

- A Buyer’s Market is when there are more homes than buyers. In this case, the tables turn. Sellers may have to offer concessions and incentives, or negotiate more to get a deal done. That’s because buyers have more choices and can take their time making decisions.

You can see this play out over time using data from the National Association of Realtors (NAR) in the graph below:

Where the Market Stands Now

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years. And that’s thanks to how much inventory has grown lately. As Lance Lambert, Co-Founder of ResiClub, explains:

“Among the nation’s 200 largest metro area housing markets, 41 markets ended January 2025 with more active homes for sale than they had in pre-pandemic January 2019. These are the places where homebuyers will be able to find the most leverage or market balance in 2025.”

Here’s a look at some of the strongest seller’s markets and buyer’s markets today, according to that research:

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Clever strategies can make buying in a seller’s market easier – and vice versa. And that’s exactly why you need to hire a pro. A local real estate agent knows their market like the back of their hand. They’re super familiar with what the supply and demand balance looks like and how to help their clients get a deal done either way. So, as long as you have a skilled pro by your side, it doesn’t really matter if your town is on the list or not.

With their expertise, you’ll be able to plan ahead and buy (or sell) no matter what the market looks like.

Bottom Line

With inventory rising, the market may be starting to balance out – but it all depends on where you want to buy or sell.

Are you wondering if buyers or sellers have the upper hand in our area? Let’s connect so you can find out.

Eastside Market Update

Inventory is at a historic low, which is very challenging for buyers. The saving grace is that interest rates are also historically low. Prices are up a staggering 17%, but with the low interest rates monthly payments have only increased 3%. For most buyers, it’s all about monthly payment because you live in the payment not the price. Interest rates impact affordability more so than purchase price.

December had 49% of the homes sell with multiple offers. That is crazy for a December! December 2019, which was a busier than usual December, had only 18% of the homes sell with multiple offers. January appears to be off to its typical fast start—more on the seasonality of our market next week. Bottom line, sellers should get their home on the market ASAP and buyers should stay patient and calm as they navigate this competitive arena.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link