Are big investors really buying up all the homes today?

If you’re trying to find a house to buy, this may be something you’re wondering about. Maybe you’ve read about it or seen reels on social media saying investors buying all the homes is making it even harder to find what the average buyer is looking for. But spoiler alert – there’s a lot of misinformation out there. To clear things up, here’s the scoop on what’s really happening. A lot of the big investor activity is actually in the rearview mirror already.

The Wall Street Journal (WSJ) explains:

“Investors of all sizes spent billions of dollars buying homes during the pandemic. At the 2022 peak, they bought more than one in every four single-family homes sold, though more recently their activity has slowed as interest rates rose and supply became tighter.”

The key here is investor activity has slowed significantly, and even during the peak of investor buying, 3 out of every 4 single-family homes purchased were by regular, everyday buyers – not investors. And of the investors who bought over the past few years, most weren’t the big investors you may be hearing about. The vast majority were small mom-and-pop investors – people like your neighbors who own only a couple of homes, maybe even just their main residence and a vacation home.

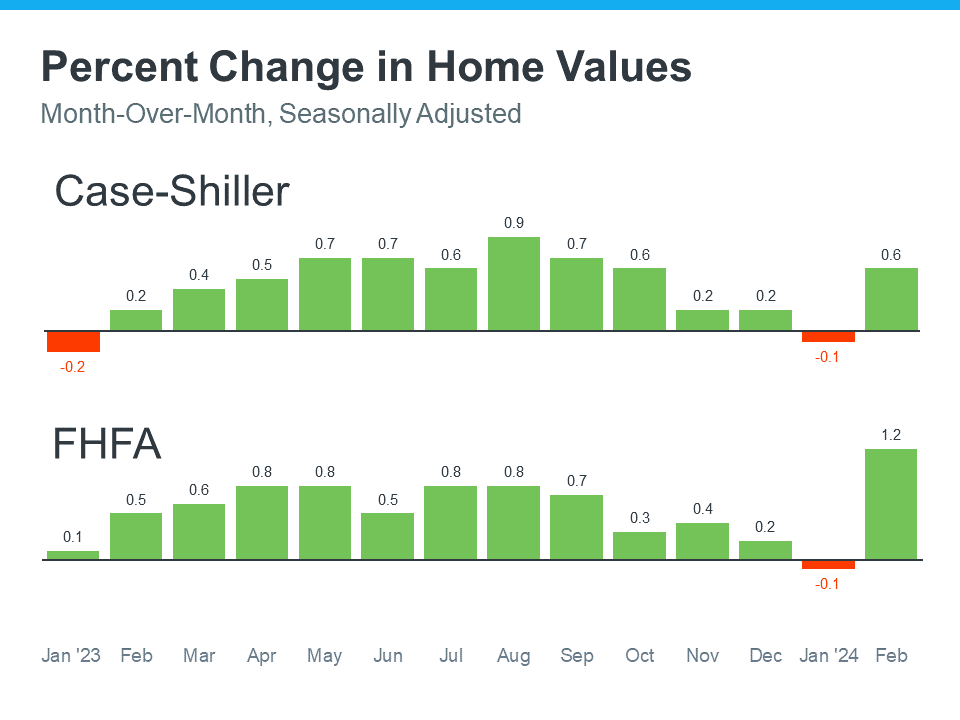

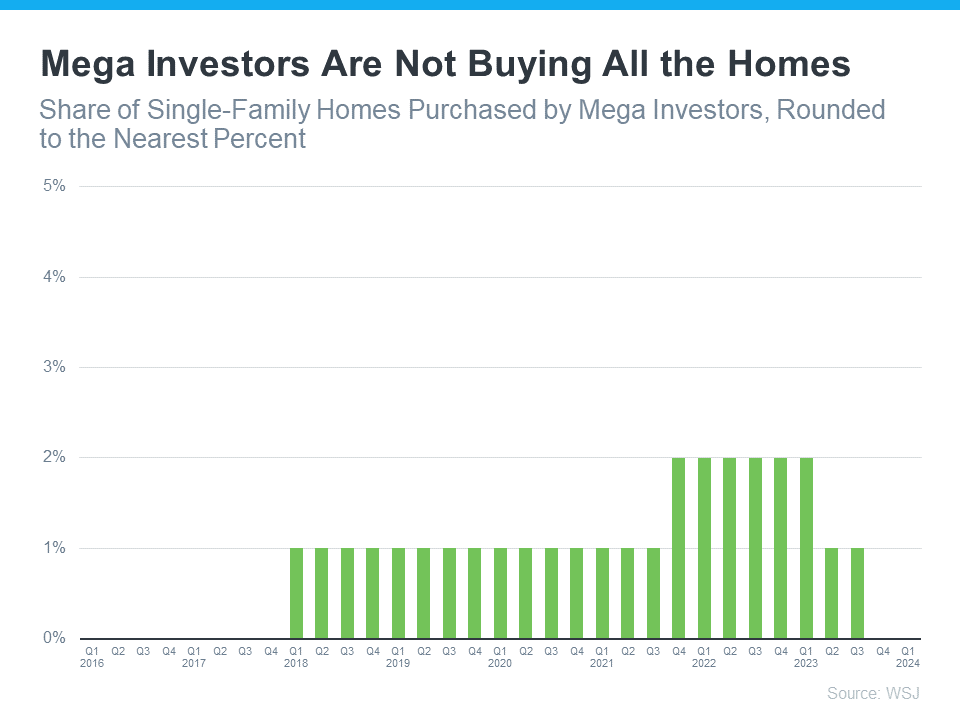

But let’s focus on the giant, mega-investor firms since that’s what is being talked about so frequently on social media right now. Mega investors are those who own 1,000+ properties. You may be surprised to see that, according to the Wall Street Journal, they don’t buy all that many homes (see graph below):

This graph tells us two things. First, institutional investors were never buying a large percentage of available homes. During the peak in 2022, they bought about 2% of available single-family homes. Second, that percentage has gotten even smaller recently (so small the number rounds down to 0%).

In an effort to understand why that percentage is trending down, private lender RCN Capital asked investors about the challenges they’re facing. Here’s what Jeffrey Tesch, CEO of RCN Capital, found out:

“Investors are already facing many challenges in today’s housing market – rising prices, limited inventory, and higher financing costs.”

Understanding these challenges is important because they show big, mega investors aren’t taking over the housing market.

So, don’t fall for everything you hear. They aren’t snatching up all the homes and making it impossible for regular people to buy.

Bottom Line

Big investors aren’t buying all the homes out there. If you’ve got questions about what you’re hearing about the housing market, let’s chat. I can help you understand what’s really going on.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link