The Eastside market is more balanced than it’s been in years—prices have softened and inventory is up, but homes are still selling, the sky isn’t falling, and smart pricing (for sellers) and confident, strategic buying (for buyers) wins the day.

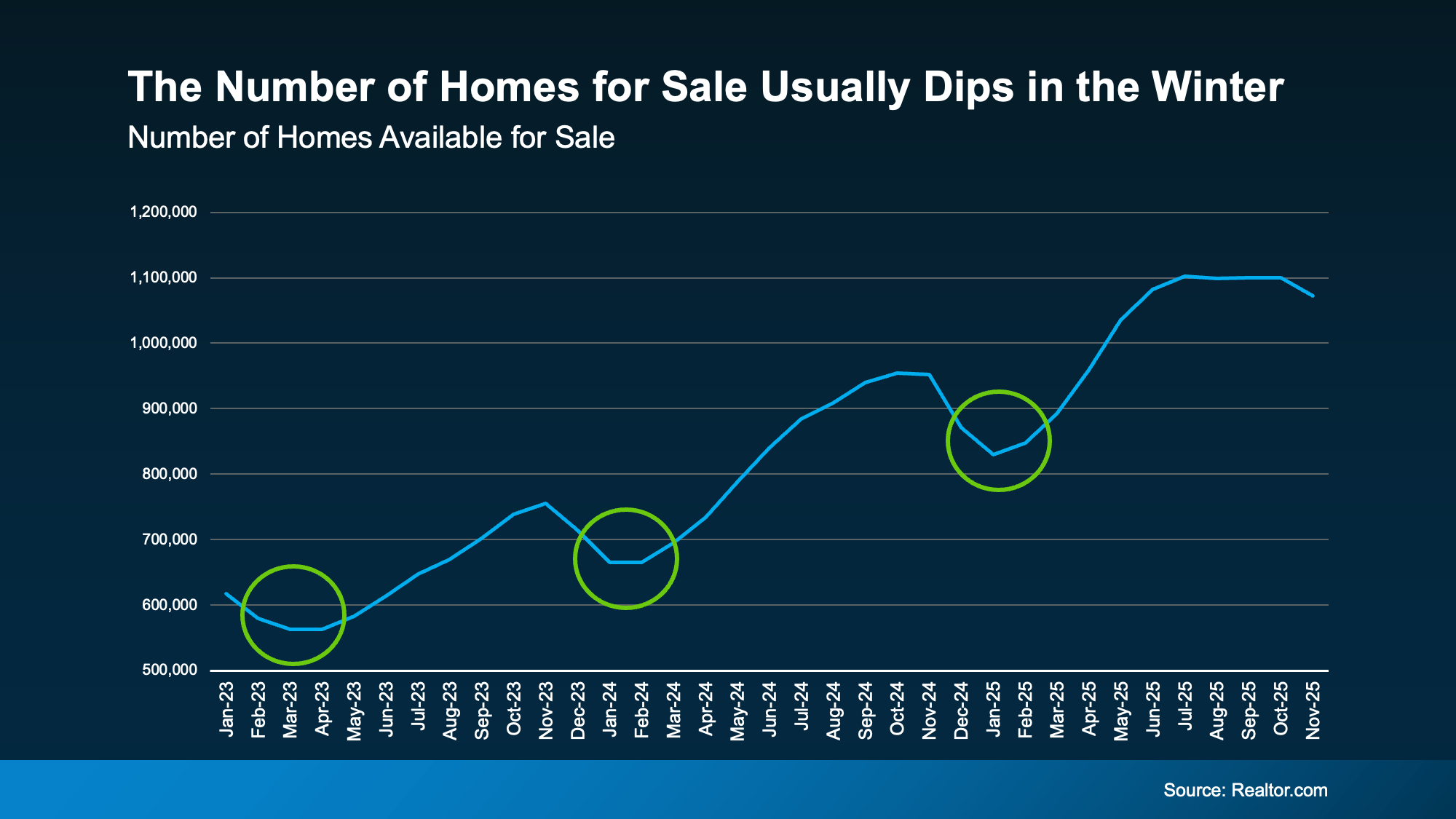

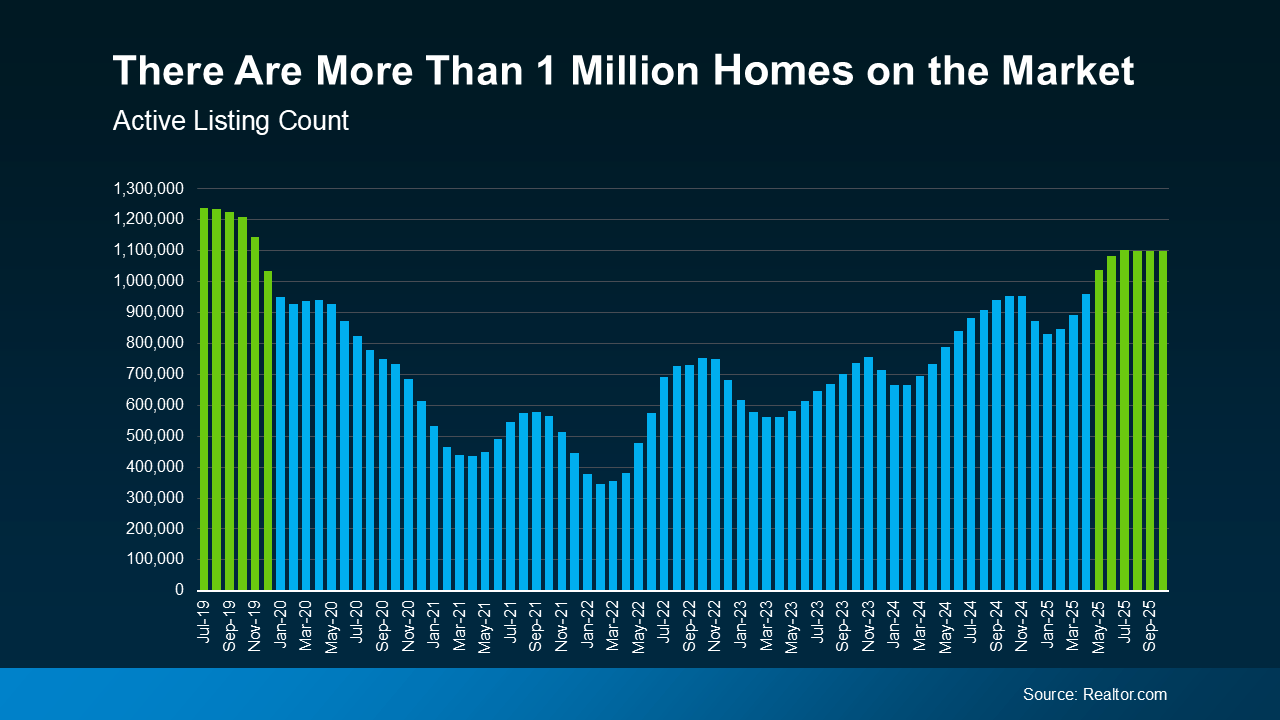

We’re starting the year with 67% more inventory than this time last year, which sounds alarming—but context matters. At 2.6 months of inventory, we’re still solidly in a balanced market, so there’s no need to panic. One of my favorite housing economists keeps saying we’re “back to a 2019 market.” On the Eastside, we actually have 13% more inventory than in 2019, and back then inventory sat at 1.4 months. So… I’m still chewing on that comparison.

Historically, the first quarter tends to start with a bang, though it’s too early to know if that pattern will hold. One wildcard: a meaningful number of sellers chose to cancel listings late last year with plans to relist in 2025. If that’s the case, some of today’s inventory may simply be deferred from Q4. As always—time will tell.

It’s also worth noting that the Eastside is lagging King County overall, which currently sits at 2.1 months of inventory and is “only” 36% higher than last year (and 19% higher than 2019). So while inventory is elevated across the board, the Eastside is feeling it a bit more.

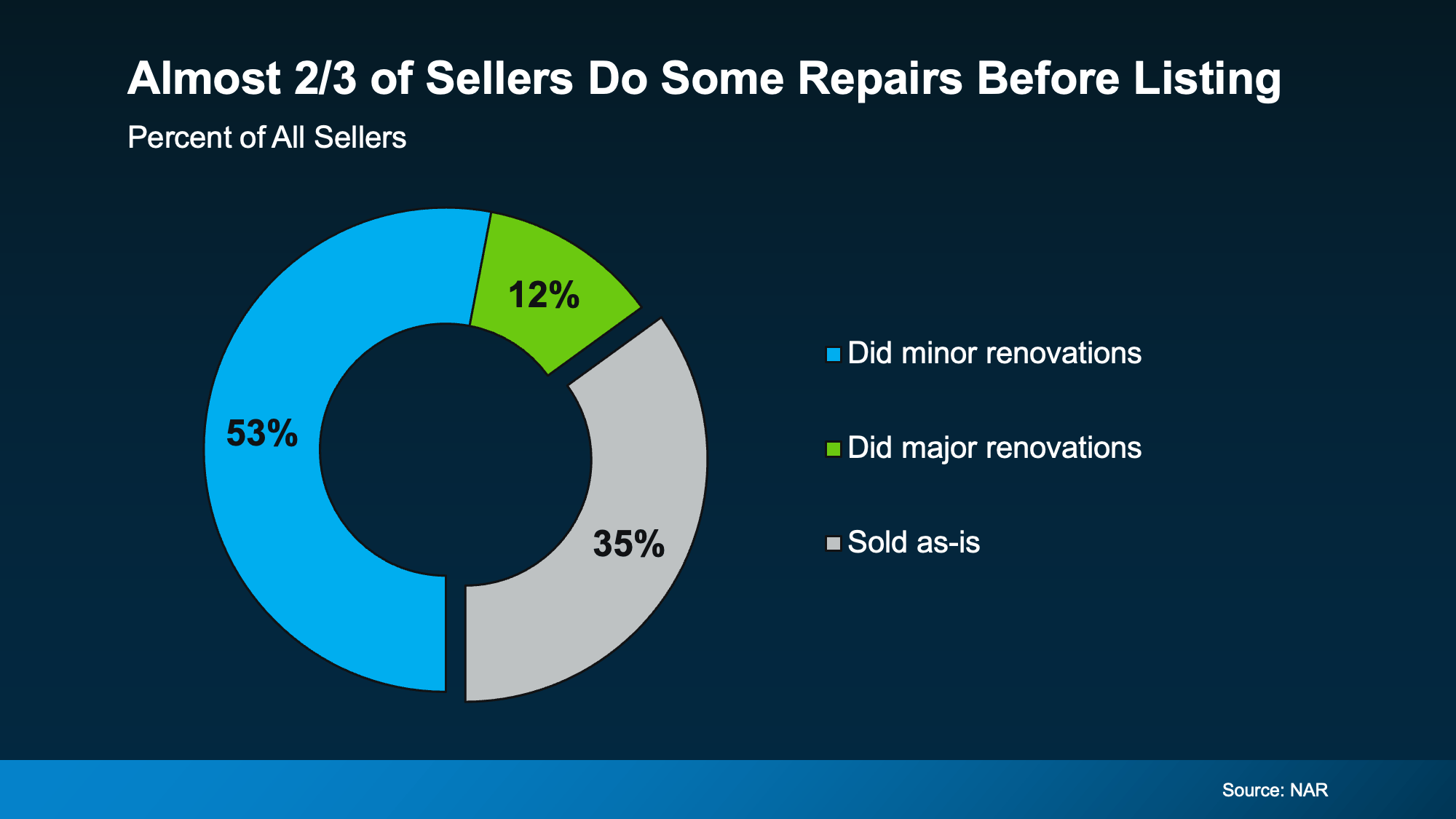

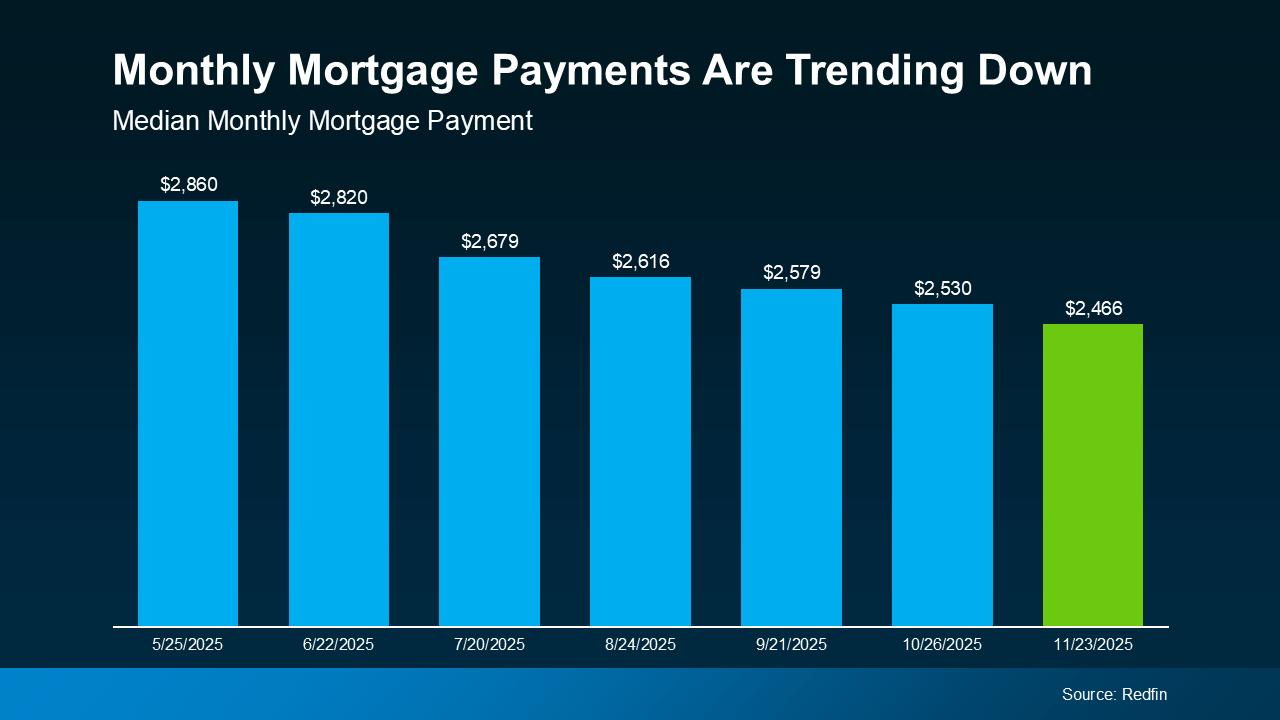

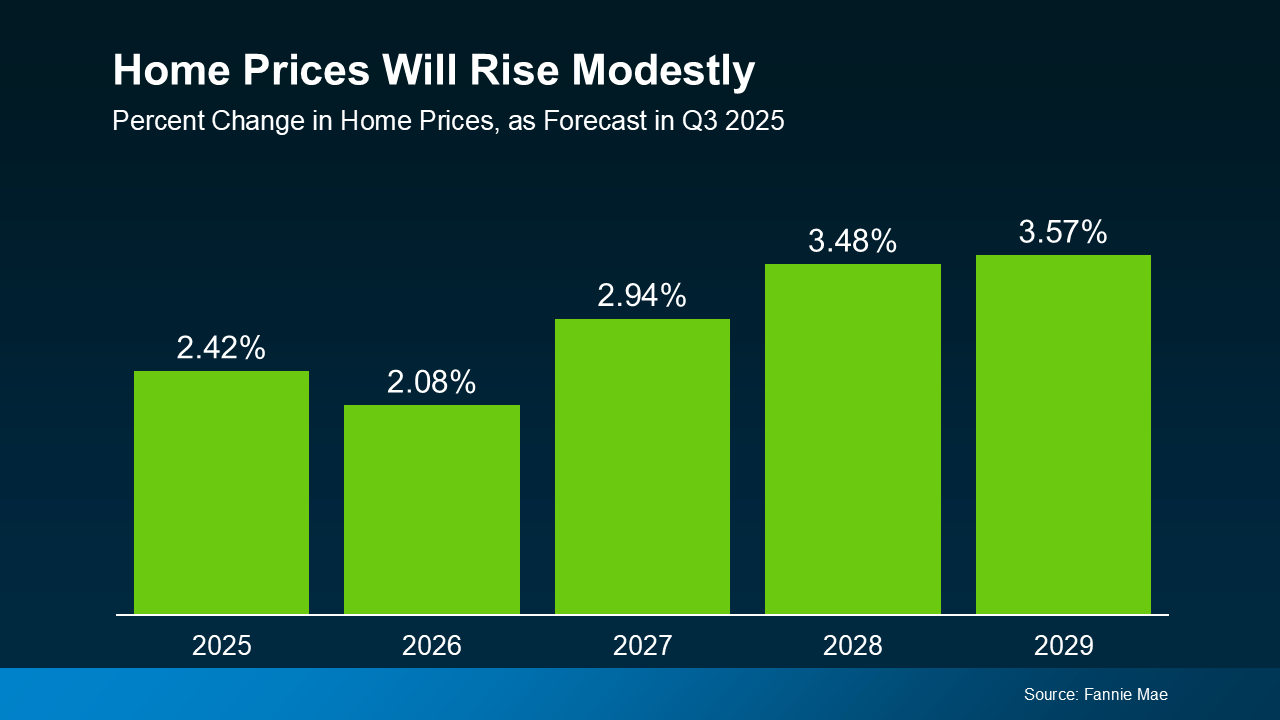

With about half of homes selling within 30 days, the sky is clearly not falling. That said, 57% of sellers needed a price reduction to get sold, so yes—pricing has softened. January is a notoriously wonky month for median price data, but we’re currently down 3% year over year (and up 5% month over month—though that follows an 8% drop the month prior). Zoom out a bit further and the picture changes: since 2020, Eastside prices are up 36%, averaging roughly 7% per year, or about $400,000. Not too shabby.

So what does this all mean?

First: the sky isn’t falling.

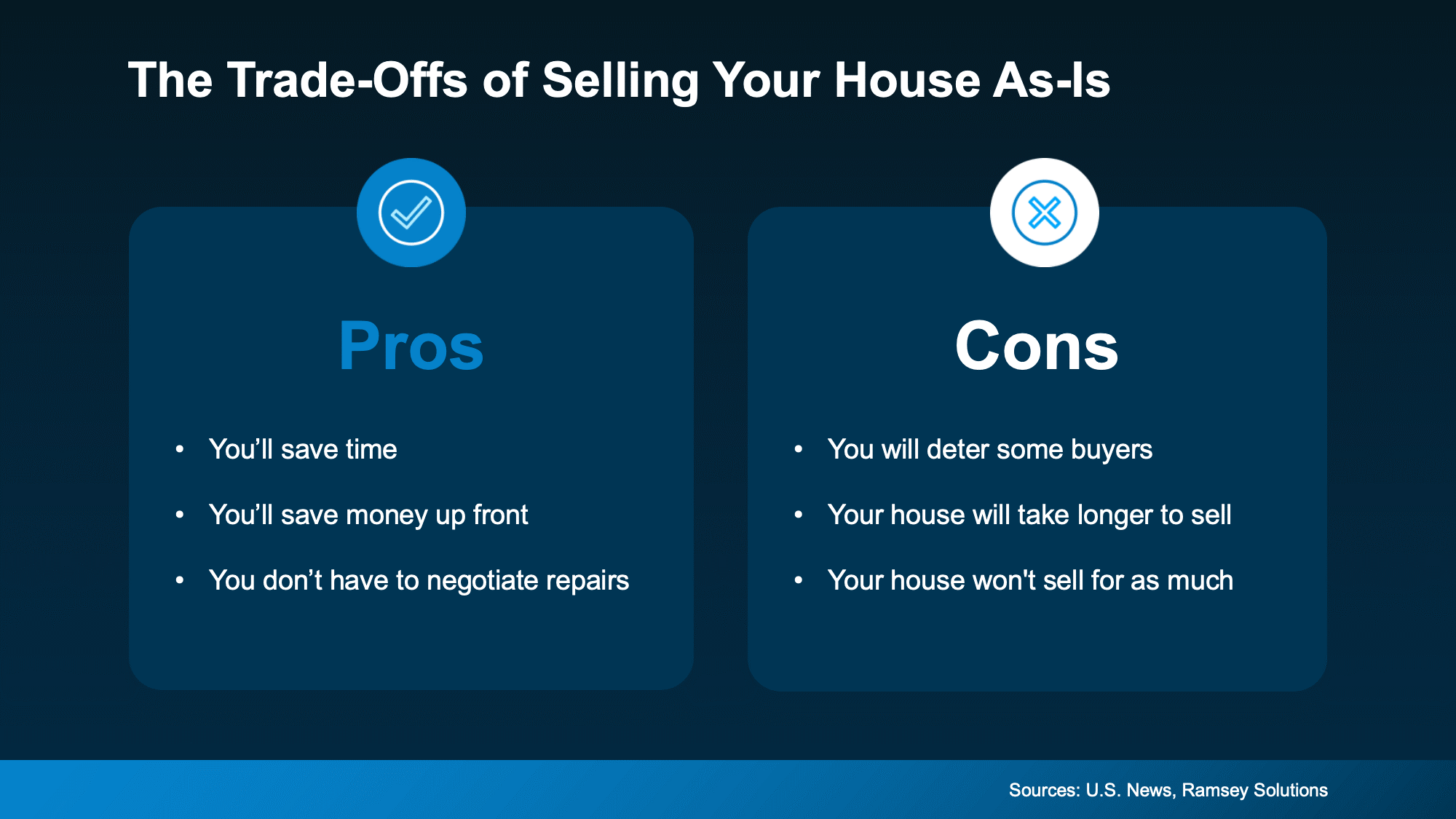

Sellers should approach the market as both a price war and a beauty competition.

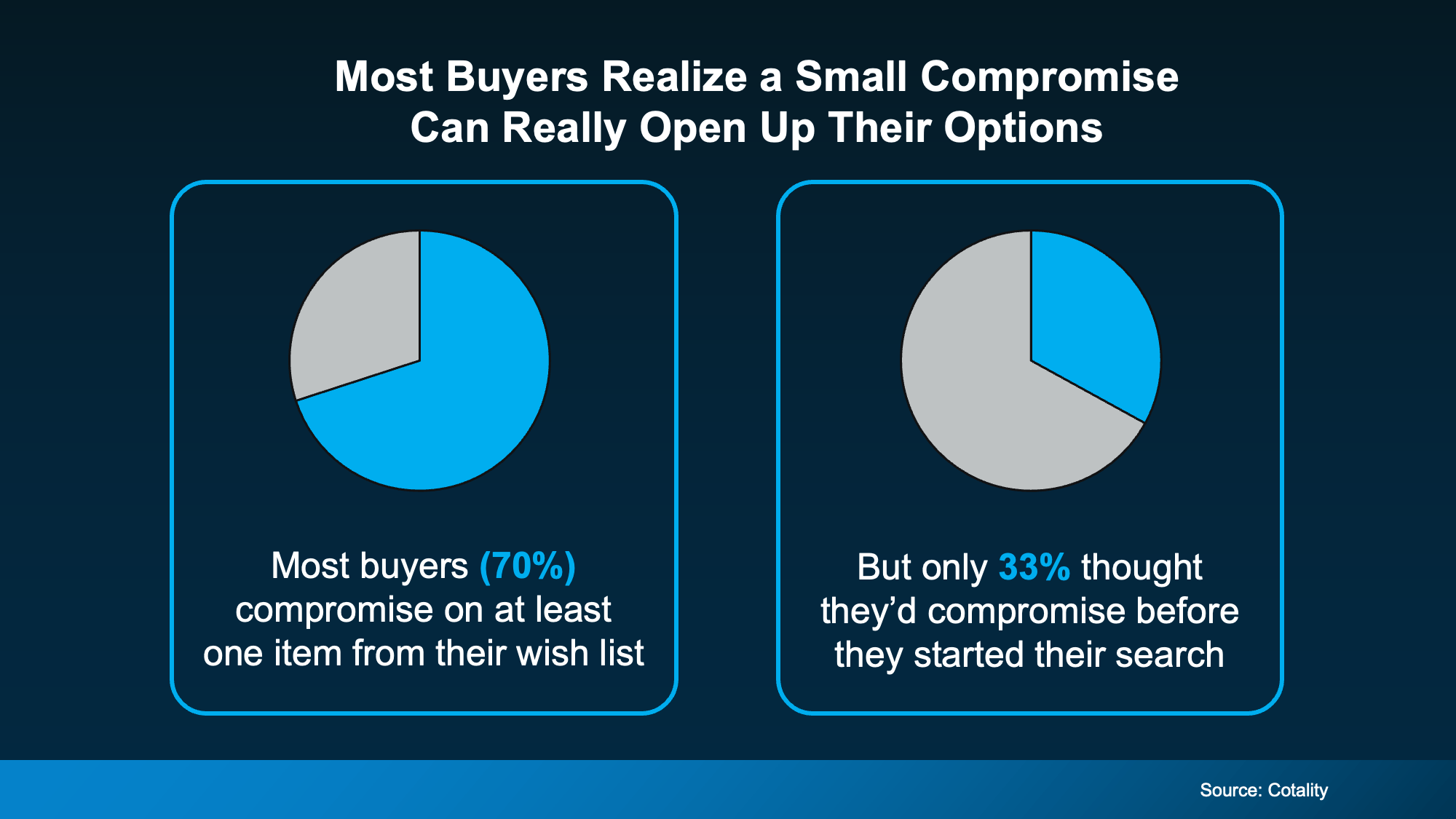

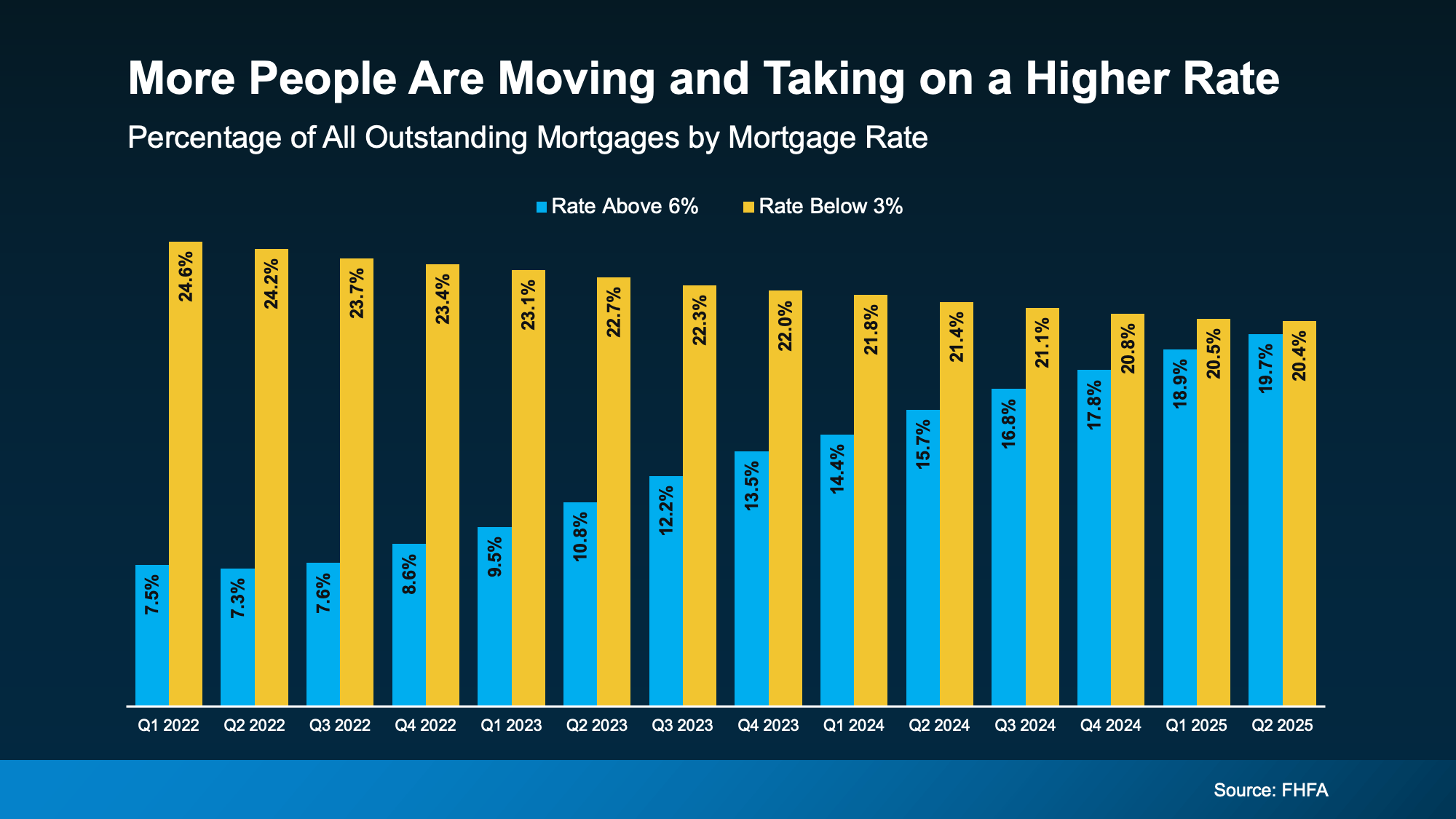

Buyers can buy with confidence—and if possible, go against the grain. Homes that others overlook often offer the best opportunities (easier said than done, I know).

I’m very curious to see how the rest of January unfolds

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link