How To Find the Best Deal Possible on a Home Right Now

Want to know how to find the best deal possible in today’s housing market? Here’s the secret.

Focus on homes that have been sitting on the market for a while.

Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook.

The Opportunity: 1 in 5 Homes Has Had a Price Cut This Year

According to Realtor.com, about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so many things in today’s housing market vary by region, that number is consistent throughout the country. That tells you one thing…

No matter where you live, there’s a chance to score a better deal. You just need to know where to look. And that’s where your agent comes in.

The Tactic: Target Homes That Have Been Sitting the Longest

Your agent can help you identify which homes have been on the market the longest. Those are the ones where you’re more likely to get a discount. That’s because the seller may be getting frustrated their house hasn’t sold yet, so they’re more willing to play ball.

And since a lot of buyers steer clear of homes that aren’t selling, you may be the only offer they get. So, you can lean in and push for a better deal. As Realtor.com explains:

“Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions . . . these concessions can end up knocking thousands of dollars off the price of a home.”

And they’re not the only ones calling out the opportunity you have right now. Bankrate also says:

“During the quieter fall and winter months, when fewer prospective buyers are shopping, home sellers may be more willing to lower their prices, or offer concessions, to attract those prospective buyers who are still looking.”

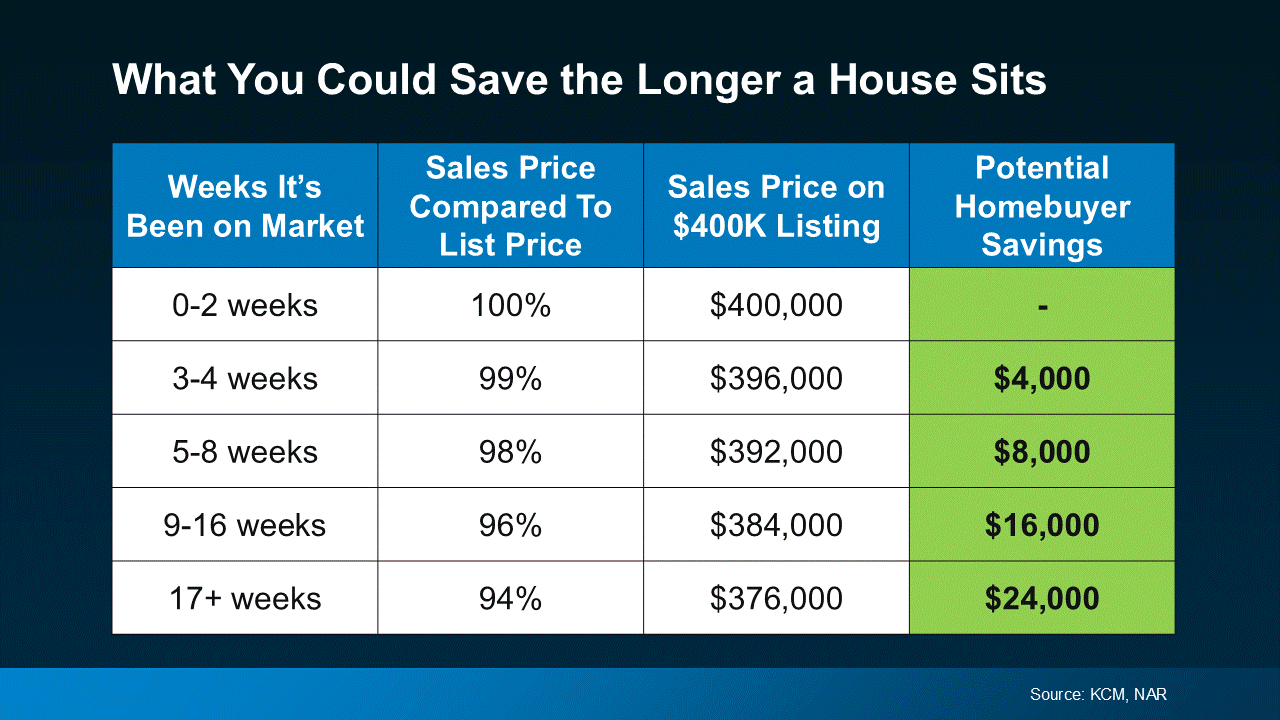

And the proof is in the data. The National Association of Realtors (NAR) shows a clear pattern: the longer a home stays on the market, the lower it tends to sell for compared to the original asking price.

So, if you’re serious about getting as much as you can for your money, focusing on these listings could be your best strategy yet.

Even a Small Discount Can Go a Long Way

And while paying 94% of the original asking price may not sound like much of a deal, the savings add up. That’s roughly $24,000 in savings on the median priced home (see chart below):

Zillow sums it up best:

“If you’re a buyer who is hoping to strike a deal, look for homes that have been on the market for a while and that may already have lowered prices to entice buyers. You may find a motivated seller who is more willing to negotiate.”

Bottom Line

If you want to find the best deal possible on a home right now, start by looking where others aren’t.

With 1 in 5 sellers cutting prices and many growing more flexible by the week, the homes that have been sitting a little longer could be your best opportunity to save.

Let’s talk about where to find them in our area.

The Top 2 Things Homeowners Need To Know Before Selling

Here’s something you should know before you sell your house. The homeowners who win in today’s market aren’t the ones waiting it out or stepping back. They’re the ones who adapt from the start.

A number of homeowners this year didn’t get the outcome they wanted. But it’s not because something’s wrong with the market. It’s because something wasn’t right with their expectations.

Realtor.com reports 57% more homes have been taken off the market compared to last year. That means they listed… but didn’t sell. But here’s the honest truth. It was mostly because of two things: price and timing.

And if the seller had come in with the right mindset on each, their sale would’ve gone differently. Here are the top 2 things you can learn from those other sellers.

1. Price It Right from Day 1

Let’s start with the most common sticking point: the asking price. Today, 8 in 10 sellers expect to get their asking price or more. But that confidence doesn’t always line up with reality.

According to Redfin, only 1 in 4 (25.3%) sellers are actually getting more than their list price.

And here’s where the mismatch is coming from.

A few years ago, you could set any price and buyers would come running, no matter what the price tag said.

Odds are, you’d still sell for over asking. But things are different now.

Buyers have more options than they’ve had in years, so they can afford to be more selective. If your price feels even a little high to them, it’ll get overlooked in a heartbeat.

And for the homeowners who had that happen, some end up pulling their listings instead of making a simple adjustment that could have changed everything. Which is a shame, honestly. Because a small price tweak is usually all it takes to bring buyers in and get the deal done.

According to HousingWire, the average price cut right now is just 4%.

Think about that. Other sellers are listing too high and giving up rather than dropping their price 4%. If they’d just started 4% lower, they may have already sold. So, before you list, talk to your agent about what’s working nearby. They’ll help you find the sweet spot that’s competitive, realistic, and still protecting your bottom line.

And here’s the kicker. If you’ve been in your home for a while, your equity gives you room to set your list price more competitively and still come out way ahead. Unfortunately, those other sellers didn’t seem to realize that.

2. Don’t Rush the Process

Another common misstep: expecting your house to sell in a weekend.

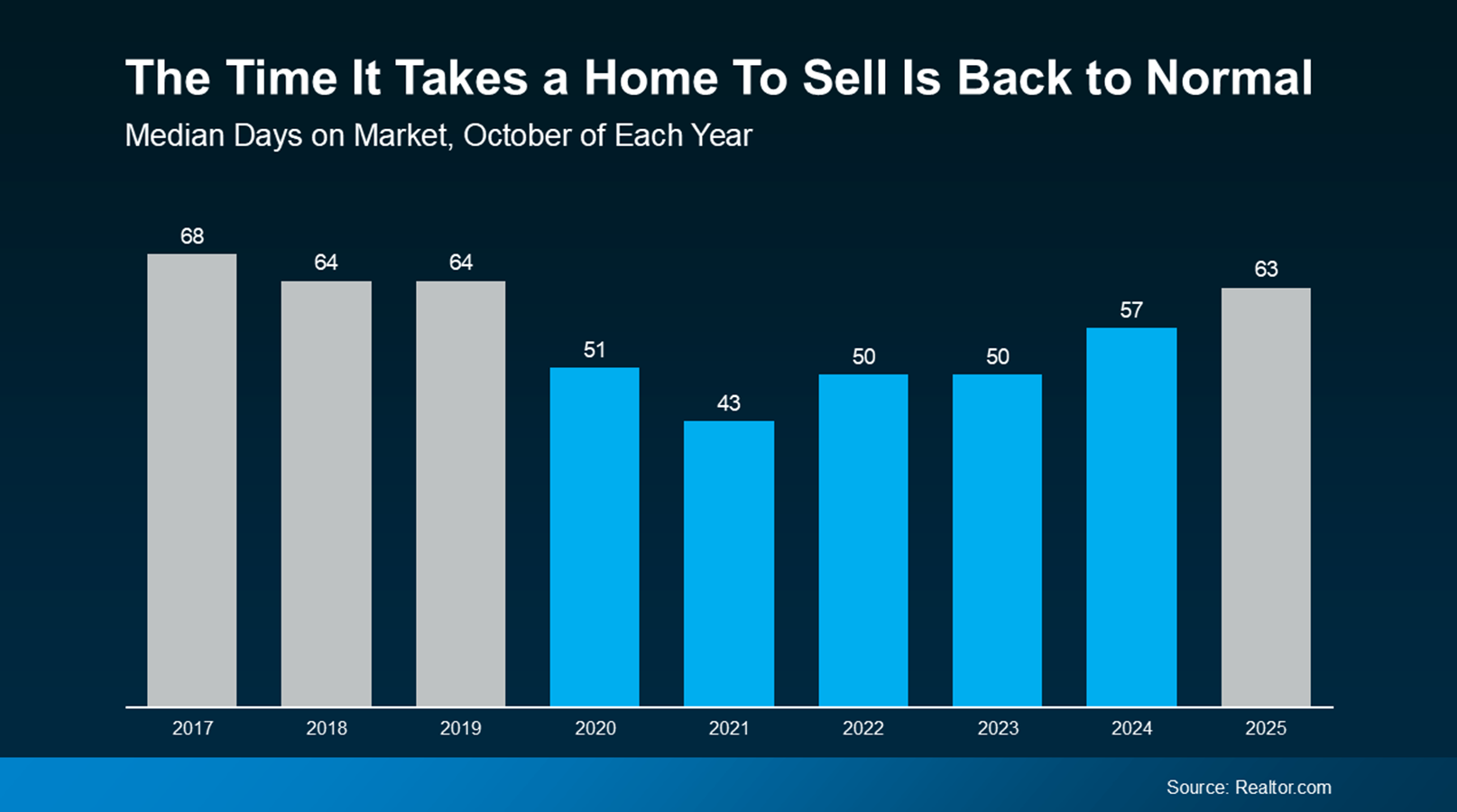

Many sellers right now remember when homes sold in as little as hours – and they expect that to happen today. But in most markets, that’s not the reality anymore.

It takes closer to 60 days to go from listed to sold, which is actually normal (see the gray in the graph below):

It just feels slower because they’re comparing it to the lightning-fast pace of 2020 and 2021.

Think of it like driving 65 mph on the highway, then exiting and going 25. It feels like you’re crawling, but it’s actually the right speed for where you are. That’s what other sellers can’t seem to get over. But you can get ahead of that, by knowing what to expect.

Today’s buyers are more intentional. They’re taking their time, weighing their options, and making thoughtful decisions, which is creating a much healthier housing market.

So, if you’re planning to sell, don’t expect it to happen instantly. And don’t assume your house won’t sell if it doesn’t go under contract in the first weekend.

It’s normal for these things to take time.

If you want to make sure your house sells as quickly as possible, talk to your agent about ways to stand out, whether that’s through staging, photography, or strategic pricing. With the right advice, the right price, and the right prep work, it can still sell quickly.

Bottom Line

If you’re thinking about selling, don’t let the market discourage you, let it guide you. The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You can still win if you price right, are patient, and work with a local agent who knows how to position your home from the start.

Because in today’s market, success isn’t about waiting for conditions to change. It’s about getting your expectations right from day one.

November 2025 Eastside Market Update

November 2025 Eastside Market Update

Eastside pricing is essentially flat year over year and month over month. Yes, technically prices slipped 2% (really 1.6%), but they also rose 2.4% the month before—so we’re basically right where we started. And honestly, this metric is tricky to measure with precision.

With 2.6 months of inventory, we’re sitting in a balanced market that leans toward sellers. That said, only 31% of homes are selling at or above the list price, compared to 50% a year ago. For the 17% of sellers who received multiple offers and went over asking, it feels like a seller’s market. But for the 20% who are taking 60+ days to sell, it feels more like a buyer’s market. The truth? We’re in a healthy, more “normal” market—just one that feels a bit weird and disconnected.

Inventory dropped 8% this month, but last year during this same window inventory fell by 20%. So not only do we have more inventory than we’ve seen in five years, but we’re also burning through it more slowly. That means we’ll likely enter the new year with the highest inventory levels we’ve had in half a decade. Even so, I still expect most appreciation to land in the first four months of the year. It’ll probably be modest—think 3% to 5%—so you might not feel it, even though it’s happening.

For buyers: With higher inventory, softer pricing, and interest rates expected to hover in the low 6s, it’s a solid window to buy—as long as you’re comfortable with the monthly payment and plan to stay put for at least 3 years (ideally 5+).

For sellers: Think of today’s market as both a price war and a beauty contest. Dramatic? Maybe. Helpful? Absolutely. Price on the conservative side—if it’s truly too low, the market will pull it up—and present your home in the best condition possible. Great prep and smart pricing still win.

The VA Home Loan Advantage: What Every Veteran Should Know Right Now

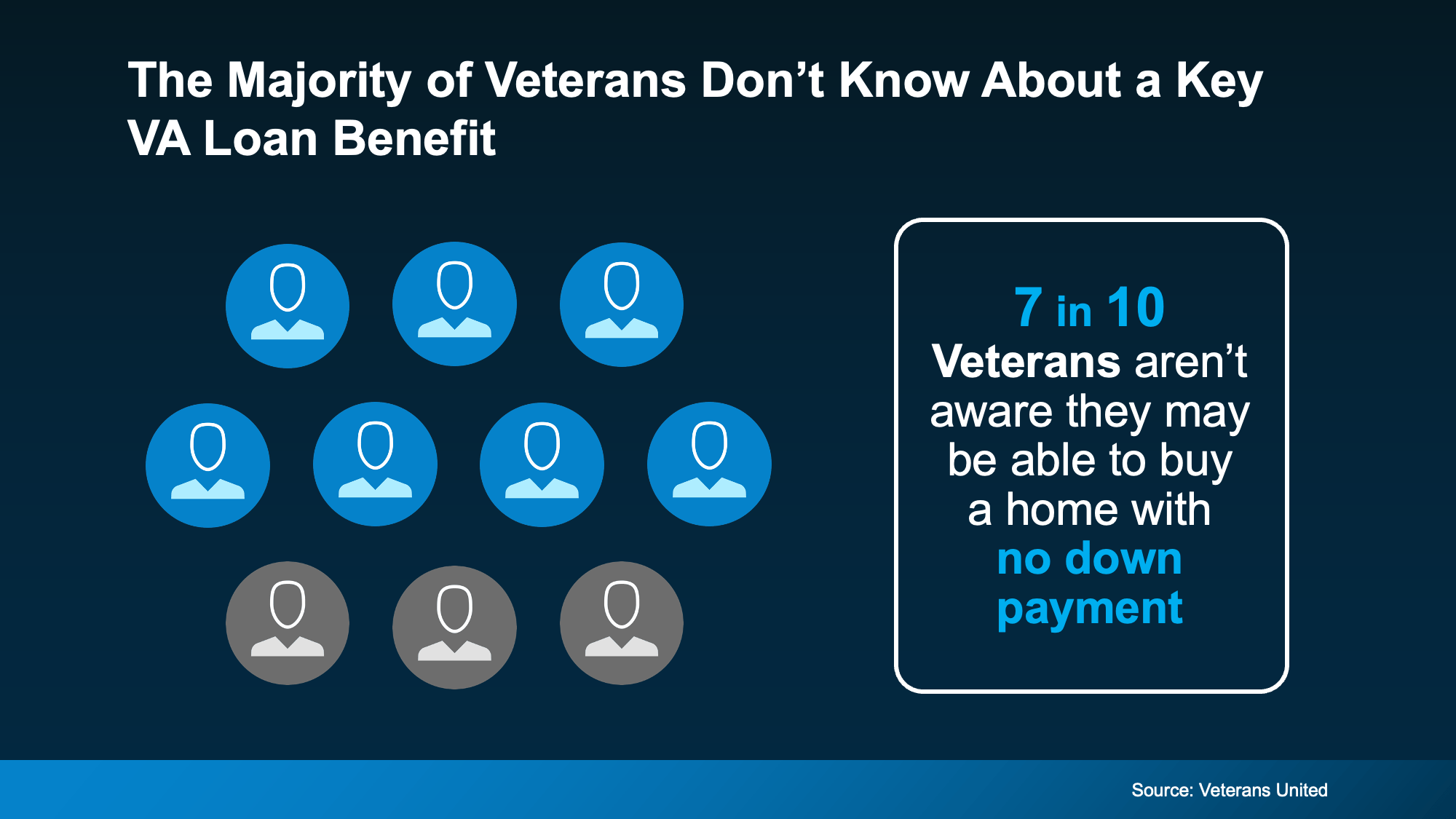

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there. The chance to buy a home without having a down payment.

Unfortunately, 70% of Veterans (that’s 7 out of every 10) don’t know about this benefit, according to Veterans United.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

Why VA Home Loans Can Be a Great Option

For nearly 80 years, VA loans have made homeownership possible for millions of Veterans and active-duty service members.

Here are just a few of the top perks according to the Department of Veteran Affairs:

- Options for $0 Down Payment: Many Veterans can buy a home without spending years saving up.

- Fewer Upfront Costs: The VA limits which types of closing costs Veterans have to pay, helping you keep more cash on hand when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, lowering your monthly costs.

These features make VA loans a great way for service members (or their family) to build stability, save money, and start creating long-term wealth through homeownership.

Can You Still Get a VA Loan with the Government Shutdown?

But lately, there’s been some confusion about whether VA loans are still available due to the government shutdown. And that uncertainty has kept some Veterans from taking the next step.

While there may be processing delays, Veterans United explains you can still get a loan:

“There’s been a lot of confusion and uncertainty about how a government shutdown will affect VA home loans . . . The good news is that the shutdown has minimal impacts on VA lending. Lenders are still able to order appraisals, obtain a borrower’s Certificate of Eligibility, submit the VA Funding Fee and more. In short, Veterans are still able to use their home loan benefit to buy a home or refinance an existing mortgage.”

So, despite the headlines, you can still use your VA home loan benefits today. The process is ready when you are. It just may take more time to go through.

Why the Right Agent and Lender Matter

Just remember, using your VA home loan is easier (and smoother) when you have the right team behind you. As VA News puts it:

“Choosing a military-friendly broker or agent who understands the VA home loan application process can make all the difference in the homebuying experience. Finding the right agency or brokerage is just as important as locking in a good VA mortgage lender. Communication is key to getting to the loan closing table.”

A knowledgeable agent and an experienced lender can help you navigate every step, all the way from qualifying to closing. With their help, you can make sure you’re getting the most out of your benefits.

Bottom Line

If you’re a Veteran, a VA home loan is one of the most valuable benefits you’ve earned through your service. It offers options for no down payment, limited closing costs, and more.

Want to learn more? Talk to a lender so you can take full advantage of the benefits you’ve earned.

Thought the Market Passed You By? Think Again.

If you stepped back from your home search over the past few years, you’re not alone – and you’re definitely not out of options. In fact, now might be the ideal time to take another look. With more homes to choose from, prices leveling off in many areas, and mortgage rates easing, today’s market is offering something you haven’t had in a while: options.

Experts agree, buyers are in a better spot right now than they’ve been in quite a long time. Here’s what they have to say.

Affordability Is Finally Improving

Lisa Sturtevant, Chief Economist at Bright MLS, says affordability is finally starting to turn the corner:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Mortgage rates have eased from their recent highs, price growth has slowed, and that one-two combo is making homes more affordable than they’ve been in months.

There Are More Homes on The Market

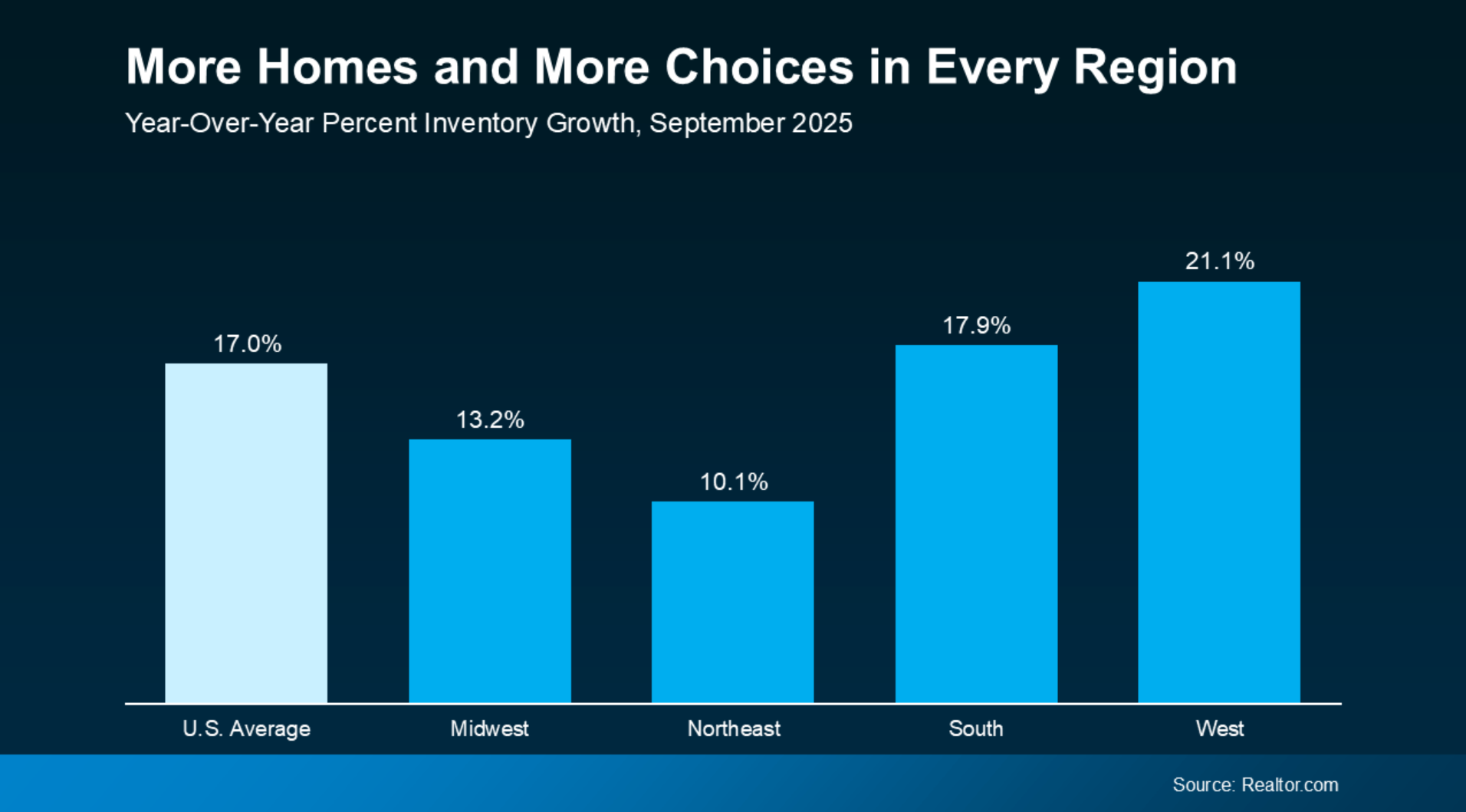

And a big reason prices are easing is because there are more homes on the market. According to the latest from Realtor.com, there are 17% more homes for sale today than there were at this time last year. That means more options, less competition with other buyers, and a chance to find the space that actually works for you.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), shares:

“Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price. Current inventory is at its highest since May 2020, during the COVID lockdown.”

Take a look at the numbers.

As Yun notes, inventory is up everywhere. Compared to this time last year, every region of the country has more homes on the market than at this time last year (see graph below):

That translates to more homes to choose from, whether you’re looking for a bigger backyard, a shorter commute, or finally ditching your rental.

But not all markets are the same…

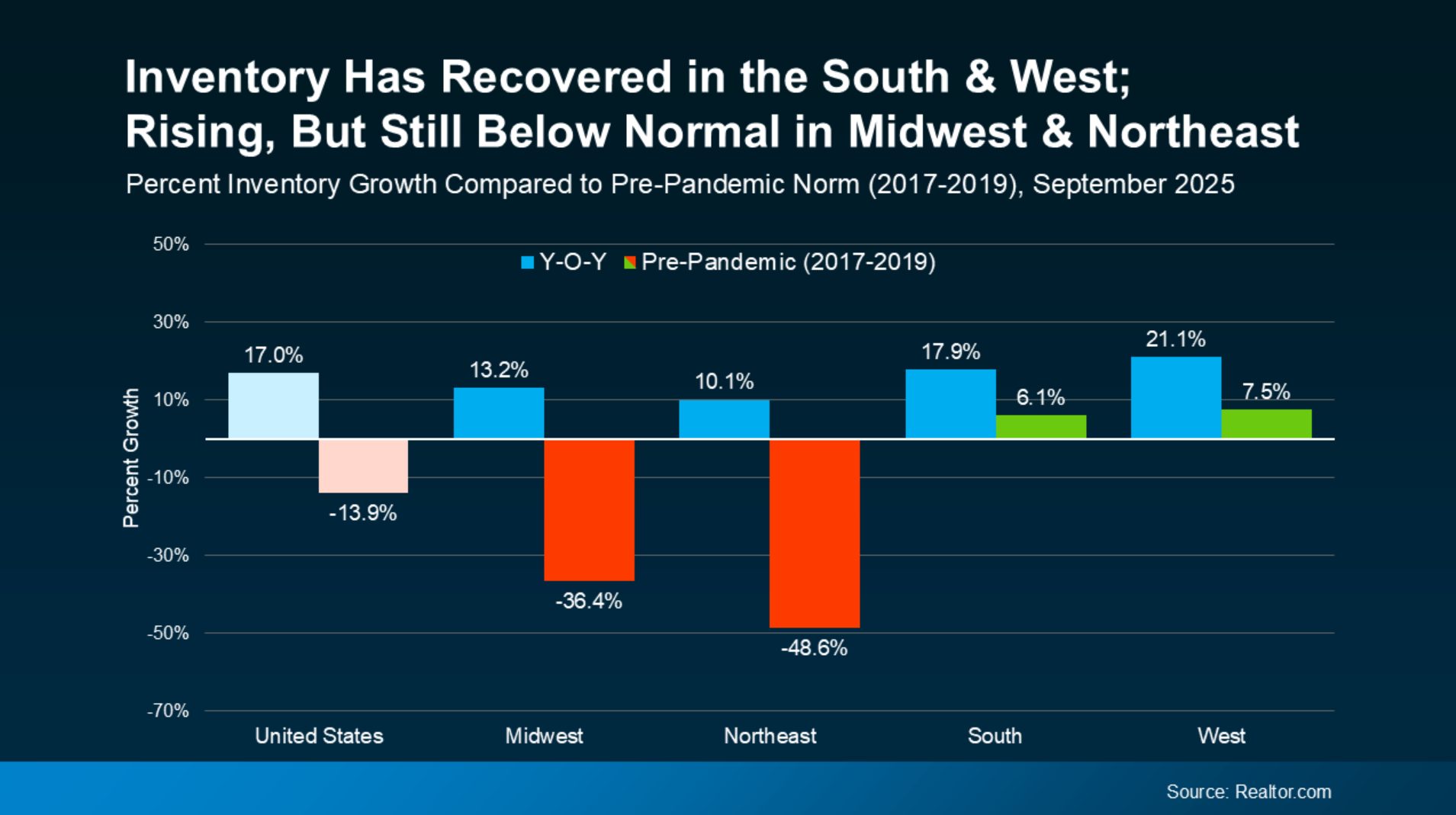

When you compare current inventory growth to pre-pandemic norms (2017–2019), the picture changes a bit, depending on where you are (see graph below):

The green bars show where inventory has fully recovered (and even grown above pre-pandemic levels) in the South and the West. Supply, however, is still tighter in the Northeast and Midwest, as shown in the red bars, where inventory is still below normal.

And here’s why that’s still a win everywhere.

When you step back and look at the bigger picture, with inventory up in every region, that means more choices everywhere, even if some areas have more homes for sale than others.

And with fewer buyers in the market and more homes for sale, sellers are willing to negotiate to get a deal done.

All of that adds up to a win for today’s buyers.

And it’s also why working with a local expert really makes a difference. What’s happening in your zip code or neighborhood might look different than the national or regional trend. But the overall takeaway is clear: with more homes on the market, buyers have more leverage than they did a year or more ago.

So, if you stepped away from your search because things felt too competitive, too pricey, you were worried about finding a home, or it was all just too much to process, this could be your moment to take another look.

And if you’re not quite ready to go all in, that’s okay too. You can start by planning ahead. That means working with a trusted agent who can help you break down your budget, narrow your search, and make sure you’re prepped and ready when the right home hits the market.

Bottom Line

Want to know what’s happening in our area? Let’s have a conversation so you can get a custom overview of what’s available right now and learn how to be ready when the timing is right for you.

Because this isn’t 2021.

This isn’t even 2023 or 2024.

This is a new market – and you might be surprised by what you find.

Why Some Homes Sell Quickly – and Others Don’t Sell at All

A few years ago, inventory hit a record low. Just about anything sold – and fast. But now, there are far more homes on the market. Listings are up almost 20% from this time last year. And in some areas, supply is even back to levels we last saw in 2017–2019. For sellers, that means one thing:

Your house needs to stand out and grab attention from day one.

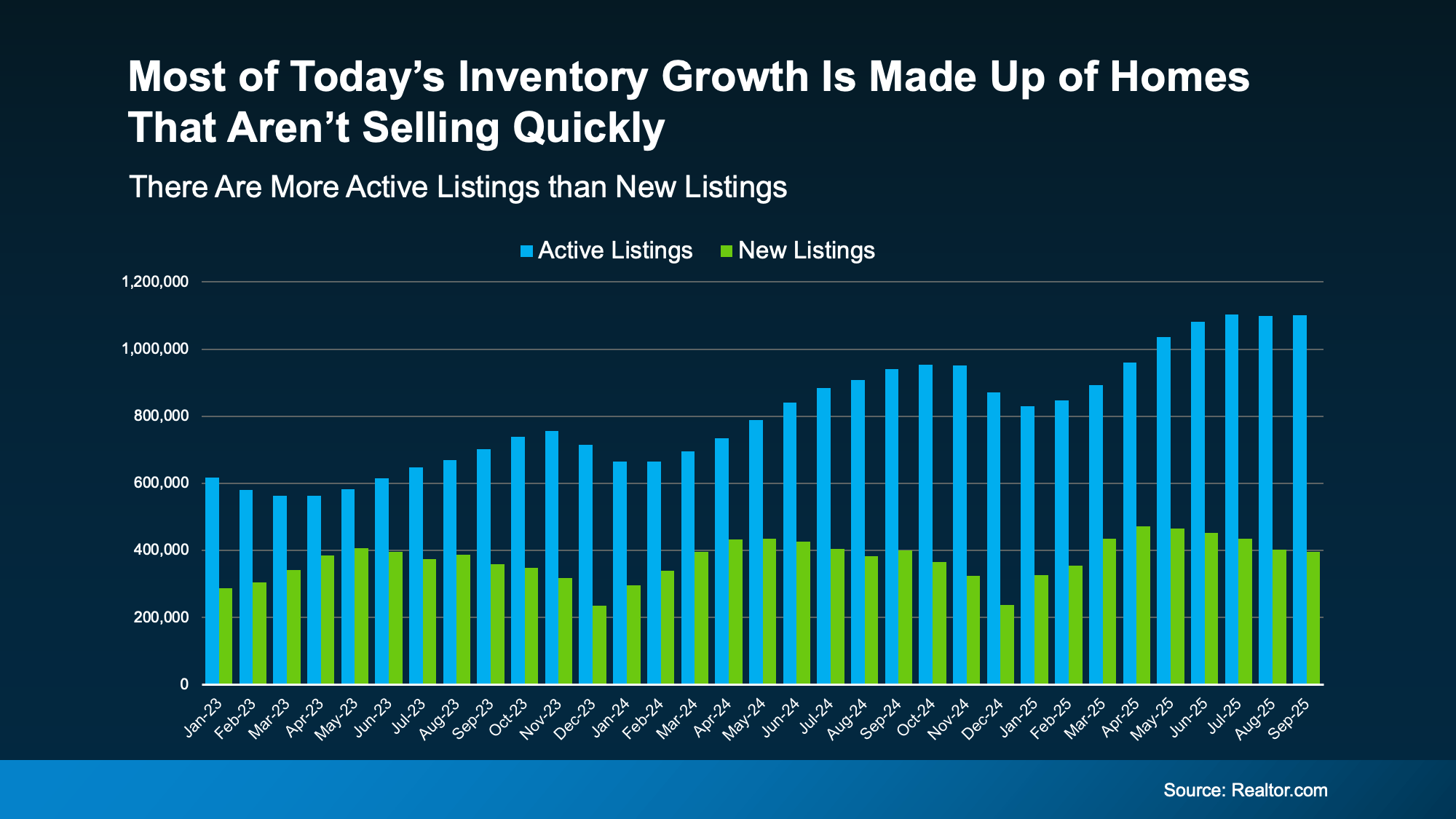

That’s especially true when you consider why the number of homes for sale is up. Here’s how it works. Available inventory is a mix of:

- Active Listings: homes that have been sitting on the market, but haven’t sold yet

- New Listings: homes that were just put on the market

Data from Realtor.com shows most of the inventory growth lately is actually from active listings that are staying on the market and taking longer to sell (see the graph below).

The blue bars show active listings. These are the homes that are sitting month to month and not selling. The green bars are new listings, the homes that were just put on the market. And it’s clear there are fewer new listings compared to how many are staying on the market unsold.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Why Some Homes Sell and Others Sit

The secret to selling in today’s market is simple. Make sure your house is easy for buyers to say yes to as soon as it is listed.

Price it based on current conditions (not what your neighbor sold for 3 years ago). Make important repairs. And highlight the best things about your house. If you do that, it will sell in any market – sometimes even faster than you’d think. Because the truth is, homes that are priced right today are still selling.

It’s the homeowners who are clinging to outdated expectations that are seeing their house sit and their listing go stale. According to Redfin and HousingWire, here are some of the most common reasons sales stall out:

- Priced it too high from the start

- Skipped necessary repairs before listing

- Didn’t stage the house well

- Sellers won’t negotiate with buyers

- Limited availability for showings

- Ineffective marketing or listing pictures

Most of those things didn’t matter as much just a few years ago. When inventory was at a record low, sellers could skip the prep, name their price, and still walk away with multiple offers over their asking price.

But today’s market is different now that inventory has grown. And that means your approach needs to be different too.

You don’t want to try out old strategies and aim too high just to see what sticks. Your first few weeks on the market are everything. That’s when your listing gets the most attention – and when pricing or presentation mistakes hurt the most. Get it wrong up front and your house will sit…and sit. Get it right, and it’ll be snatched up before you know it.

The Right Agent Helps Your House Stand Out

Selling quickly isn’t about luck. It’s about knowing how to play to the market you’re in. And that’s where your agent comes in.

A great agent will analyze your local market, suggest a price based on the latest comparables sold in your neighborhood, and create a marketing plan that makes buyers pay attention from day one. They’ll also walk you through any repairs you need to make or whether you need to bring in a staging company. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

That’s the power of getting it right (and getting expert help) from the start.

Bottom Line

There are more homes for sale today than there were even just a year ago, but that doesn’t have to work against you.

When your house is priced right, shows well, and is marketed effectively, it will sell. Let’s connect if you want to know how to make that happen in our market this fall.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link