When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs as you plan your move.

One thing that may be working in your favor is how few homes there are for sale right now. Here’s what you need to know about the current inventory situation and what it means for you.

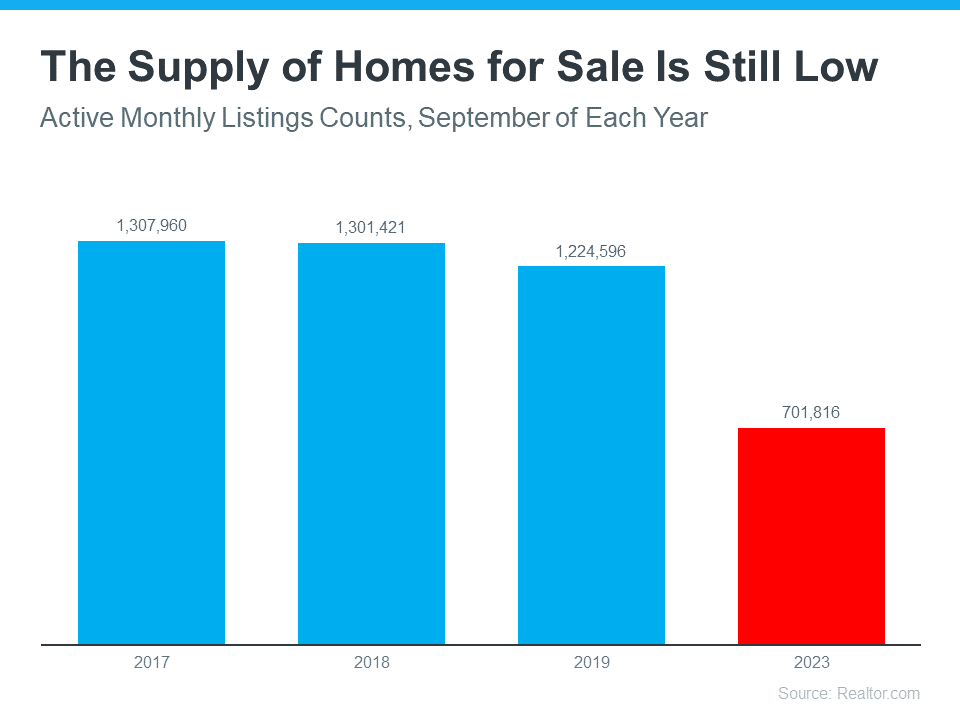

The Supply of Homes for Sale Is Far Below the Norm

When you’re selling something, it helps if what you’re selling is in demand, but is also in low supply. Why? That makes it even more desirable since there’s not enough to go around. That’s exactly what’s happening in the housing market today. There are more buyers looking to buy than there are homes for sale.

To tell the story of just how low inventory is, here’s the latest information on active listings, or homes available for sale. The graph below uses data from Realtor.com to show how many active listings there were in September of this year compared to what’s more typical in the market.

As you can see in the graph, if you look at the last normal years for the market (shown in the blue bars) versus the latest numbers for this year (shown in the red bar), it’s clear inventory is still far lower than the norm.

What That Means for You

Buyers have fewer choices now than they did in more typical years. And that’s why you could still see some great perks if you sell today. Because there aren’t enough homes to go around, homes that are priced right are still selling fast and the average seller is getting multiple offers from eager buyers. Based on the latest data from the Confidence Index from the National Association of Realtors (NAR):

- 69% of homes sold in less than a month.

- 2.6 offers: the average number of offers on recently sold homes.

An article from Realtor.com also explains how the limited number of houses for sale benefits you if you’re selling:

“. . . homes spent two weeks less on the market this past month than they did in the average September from 2017 to 2019 . . . as still-limited supply spurs homebuyers to act quickly . . .”

Bottom Line

Because the supply of homes for sale is so low, buyers desperately want more options – and your house may be just what they’re looking for. Let’s connect to get your house listed at the right price for today’s market. You could still see it sell quickly and potentially get multiple offers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link