Why You Should Use a Real Estate Agent When You Buy a Home

If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t have to navigate all of that alone.

When it comes to buying a home, there are a lot of moving pieces. And that’s especially true in today’s housing market. The number of homes for sale is still low, and home prices and mortgage rates are still high. That combination can be tricky if you don’t have reliable expertise and a trusted advisor on your side. That’s why the best place to start is connecting with a local real estate agent.

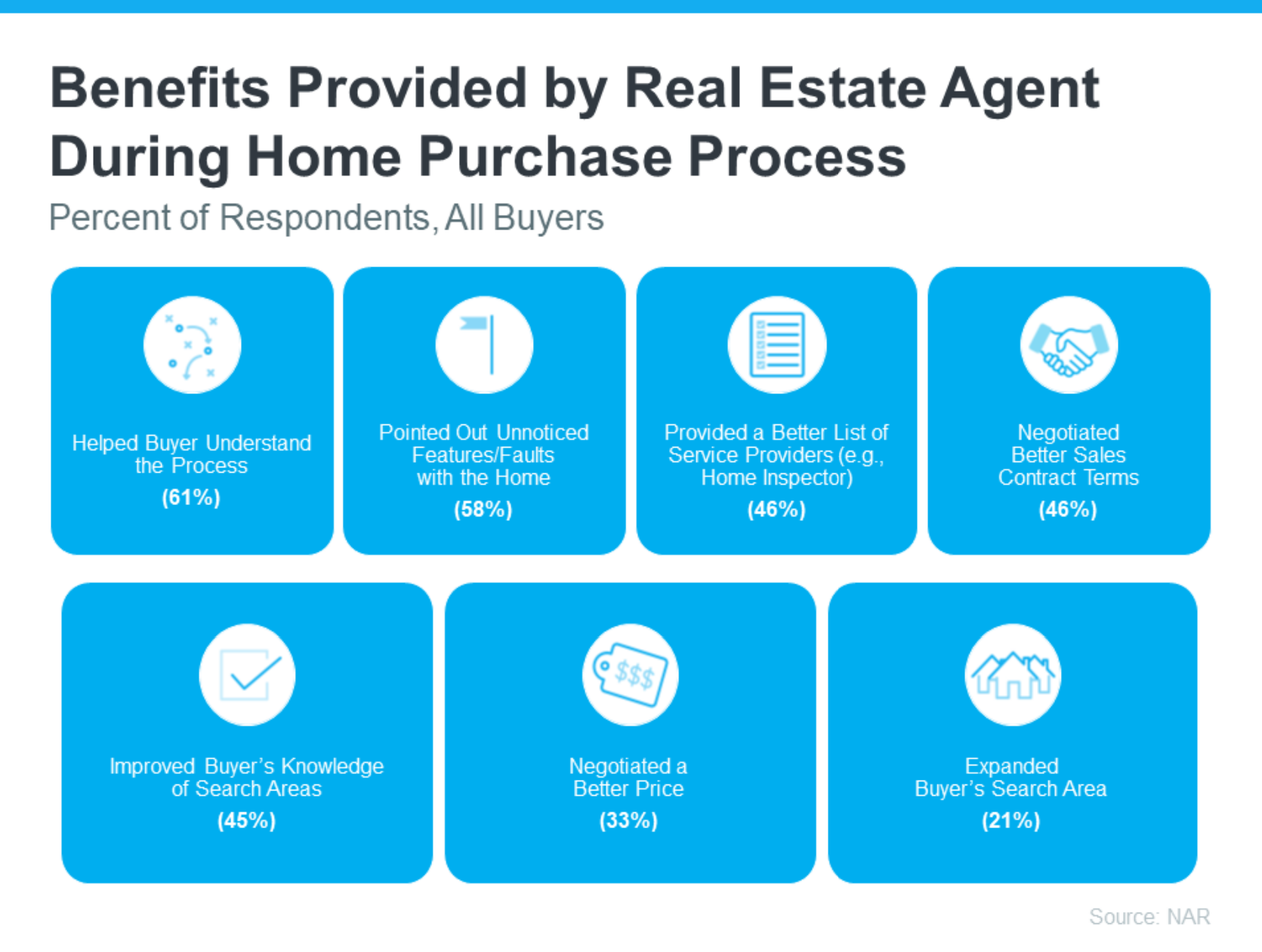

Agents Are the #1 Most Useful Source in the Buying Process

The latest annual report from the National Association of Realtors (NAR) finds recent homebuyers agree the #1 most useful source of information they had in the home buying process was a real estate agent. Let’s break down why.

How an Agent Helps When You Buy a Home

When you think about a real estate agent, you may think of someone taking you on home showings and putting together the paperwork, but a great agent does so much more than that. It’s not just being the facilitator for your purchase, it’s being your guide through every step.

The visual below shows some examples from that same NAR release of the many ways an agent adds value. It includes the percentage of homebuyers in that report who highlighted each of these benefits:

Here’s a bit more context on how the survey results noted an agent continually helps buyers in these situations:

- Helped Buyer’s Understand the Process: Do you know the difference between an inspection and an appraisal, what each report tells you, and why they’re both important? Or that there are things you shouldn’t do after applying for a mortgage, like buying appliances or furniture? An agent knows all of these best practices and will share them with you along the way, so you don’t miss any key steps by the time you get to the closing table.

- Pointed Out Unnoticed Features or Faults with the Home: An agent also has a lot of experience evaluating homes. They’ve truly seen it all. They’ll be able to pinpoint some things you may not have noticed about the home that could help inform your decision or at least what repairs you ask for.

- Provided a Better List of Service Providers: In a real estate transaction, there are a lot of people involved. An agent has experience working with various professionals in your area, like home inspectors, and can help connect you with the pros you need for a successful experience.

- Negotiated Better Contract Terms and Price: Did something pop up in the home inspection or with the appraisal? An agent will help you re-negotiate as needed to get the best terms and price possible for you, so you feel confident with your big purchase.

- Improved Buyer’s Knowledge of the Search Area: Moving to a new town and you’re not familiar with the area, or you’re staying nearby, but don’t know which neighborhoods are most affordable? Either way, an agent knows the local area like the back of their hand and can help you find the perfect location for your needs.

- Expanded Buyer’s Search Area: And if you’re not finding anything you’re interested in within your initial search radius, an agent will know other neighborhoods nearby you should consider based on what you like, what amenities you want, and more.

Bottom Line

If you’re looking to buy a home, don’t forget about the many ways an agent is essential to that process. Any hurdle that pops up, a negotiation that needs to take place, and more, your agent will know how to handle it while they make sure to minimize your stress along the way. Let’s connect to tackle this together.

Experts Project Home Prices Will Rise over the Next 5 Years

Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows that 23% of consumers think prices will fall over the next 12 months. That’s nearly one in four people who are dealing with that fear – maybe you’re one of them.

To help ease that concern, here’s what the experts say will happen with home prices not just next year, but over the next five years.

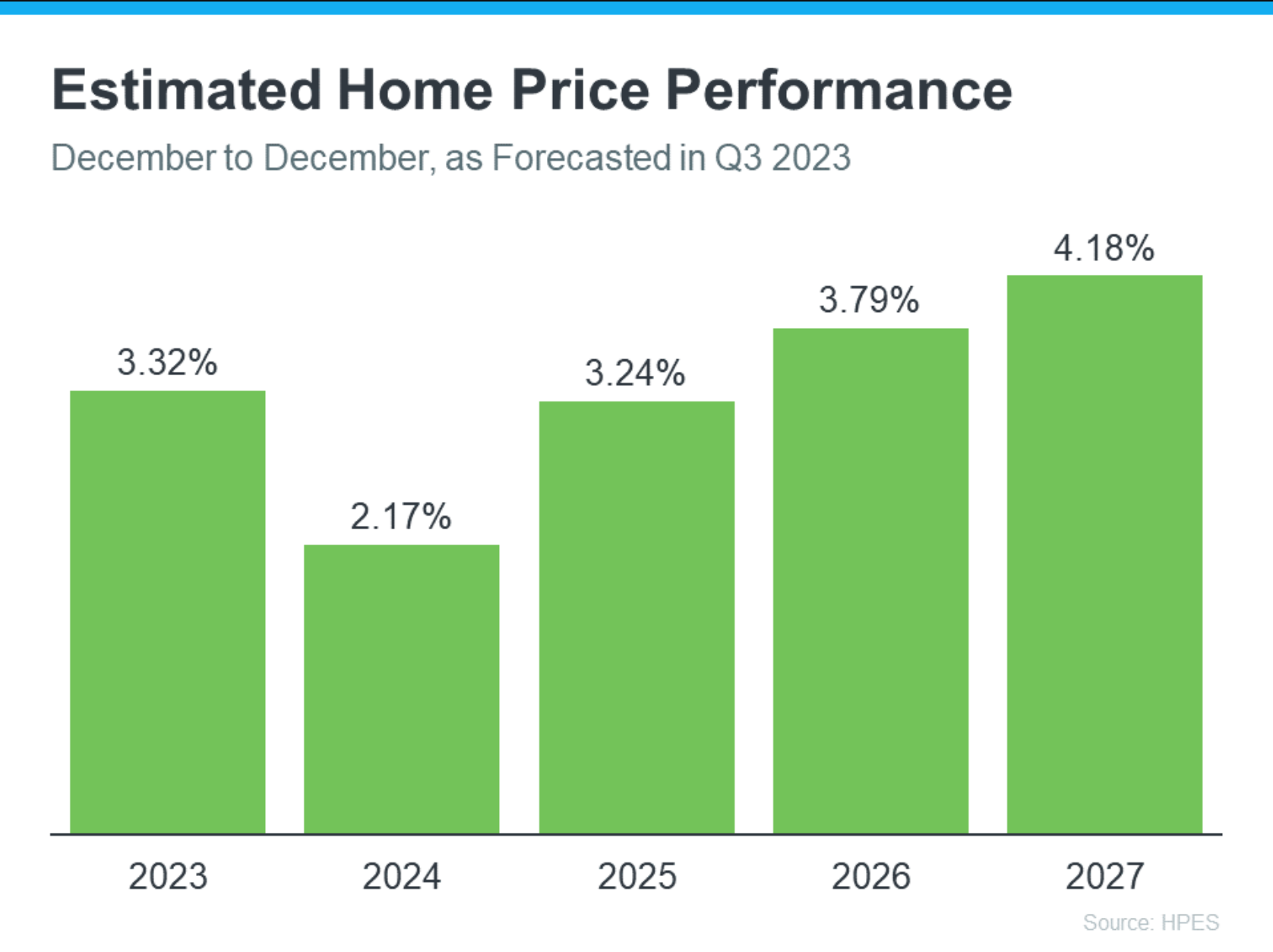

Experts Project Ongoing Appreciation

While seeing a small handful of expert opinions may not be enough to change your mind, hopefully, a larger group of experts will reassure you. Here’s that larger group.

The Home Price Expectation Survey (HPES) from Pulsenomics is a great resource to show what experts forecast for home prices over a five-year period. It includes projections from over 100 economists, investment strategists, and housing market analysts. And the results from the latest quarterly release show home prices are expected to go up every year through 2027 (see graph below):

And while the projected increase in 2024 isn’t as large as 2023, remember home price appreciation is cumulative. In other words, if these experts are correct after your home’s value rises by 3.32% this year, it should go up by another 2.17% next year.

If you’re worried home prices are going to fall, here’s the big takeaway. Even though prices vary by local area, experts project they’ll continue to rise across the country for years to come at a pace that’s more normal for the market.

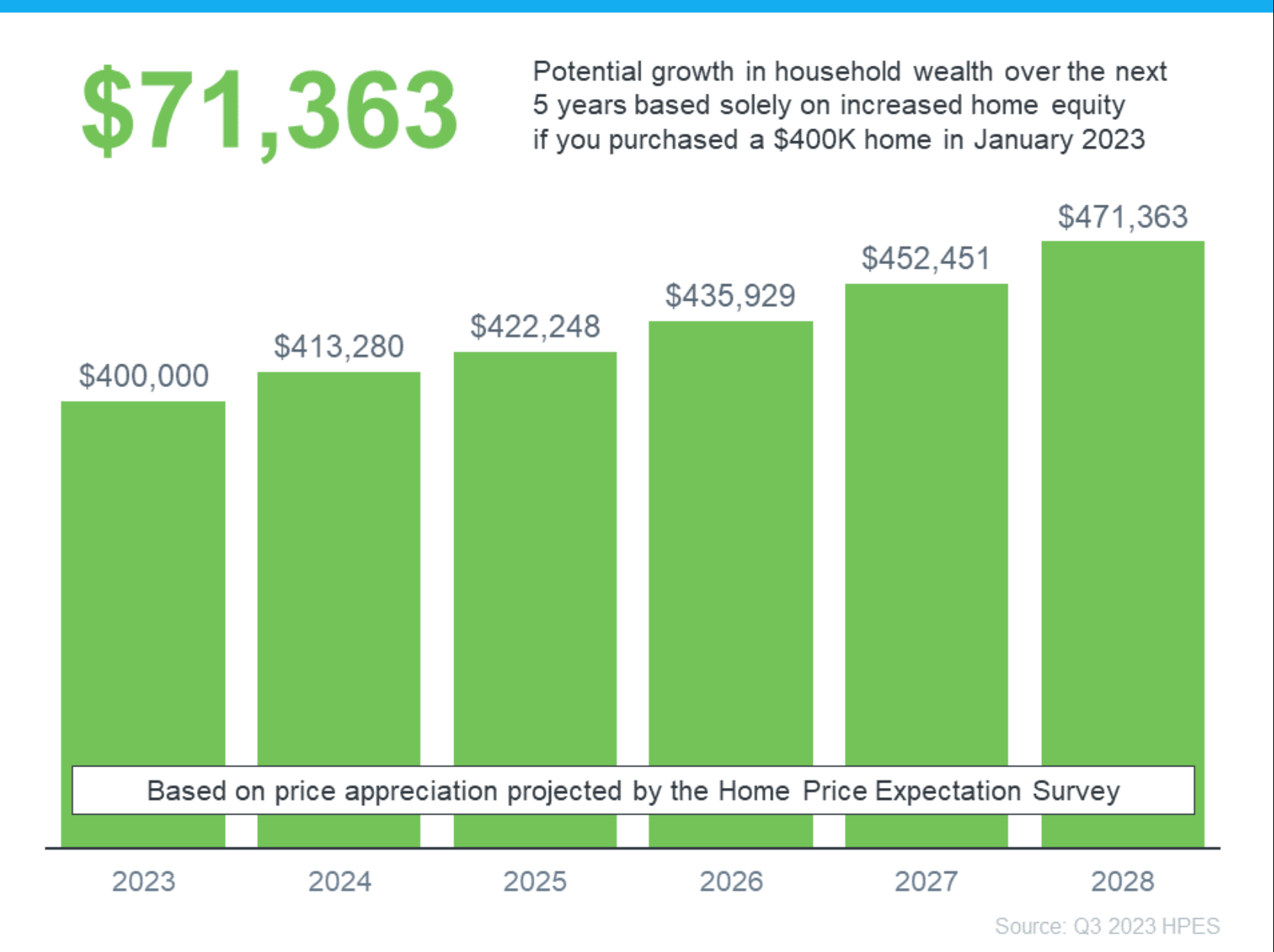

What Does This Mean for You?

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using the expert projections from the HPES. Check out the graph below:

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

Bottom Line

If you’re someone who’s worried home prices are going to fall, rest assured a lot of experts say it’s just the opposite – nationally, home prices will continue to climb not just next year, but for years to come. If you have any questions or concerns about what’s next for home prices in our local area, let’s connect.

Is Wall Street Buying Up All the Homes in America?

If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve probably heard mention of investors, and wondered how they’re impacting the housing market right now. That could leave you asking yourself questions like:

- How many homes do investors own?

- Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

To answer those questions, here’s the real story of what’s happening based on the data.

Let’s start with establishing how many single-family homes (SFHs) there are and what portion of those are rentals owned by investors. According to SFR Investor, which studies the single-family rental market in the United States, there are eighty-two million single-family homes in this country. But how many of them are actually rentals?

According to data shared in a recent post, sixty-eight million (82.93%) of those homes are owner-occupied – meaning the person who owns the home lives in it. If you subtract that sixty-eight million from the total number of single-family homes (82 million), that leaves just about fourteen million homes left that are single-family rentals (SFRs).

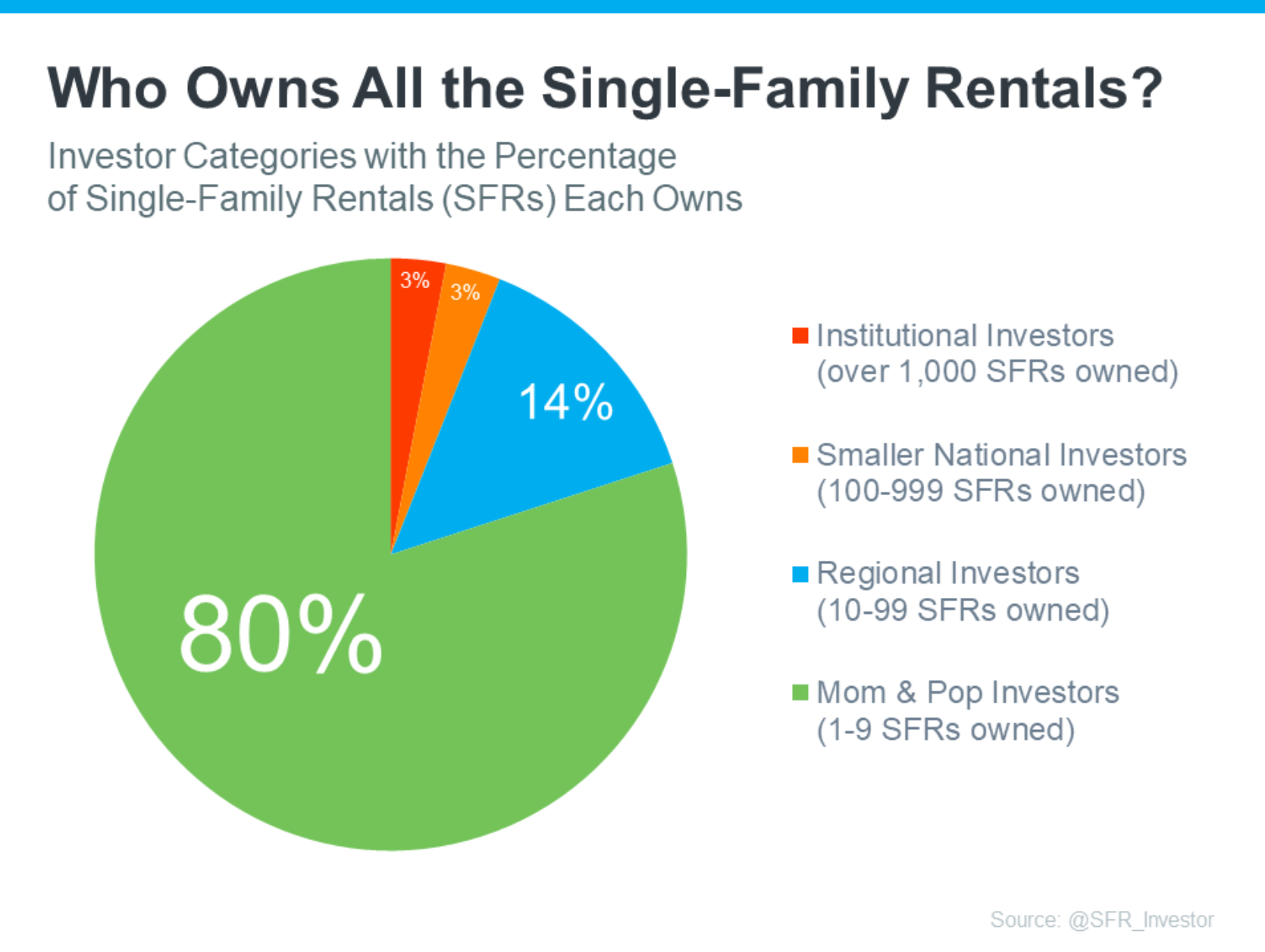

Do institutional investors own all of those remaining fourteen million homes? Not even close. Let’s take it one step further. There are four categories of investors:

- The mom & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- Smaller national investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These categories show that not all investors are large institutional investors. To help convey that even more clearly, here are the percentages of rental homes owned by each type of investor (see chart below):

As you can see in the chart, despite what the news and social media would have you believe, the green shows the vast majority are not owned by large institutional investors. Instead, most are owned by small mom & pop investors, like your friends and neighbors.

What’s actually happening is, that there are people out there, just like you, who believe in homeownership, and they view buying a home (or a second home) as an investment. Maybe they saw an opportunity to buy a second home over the last few years to use it as a rental and generate additional income. Or maybe they just decided to keep their first house rather than sell it when they moved up.

So, don’t believe everything you read or hear about institutional investors. They aren’t buying up all the homes and making it impossible for the average person to buy. That’s just not what the numbers show. Institutional investors are actually the smallest piece of the pie chart.

Bottom Line

While it’s true that institutional investors are a player in the single-family rental marketplace, they’re not buying up all of the houses on the market. If you have other questions about things you’re hearing about the housing market, let’s connect so you have an expert to give you the context you need.

2024 Housing Market Forecast

Some Highlights

- Thinking of buying or selling a house and wondering what the new year holds for the housing market? Experts forecast home prices to end this year up 2.8% and to rise another 1.5% in 2024. And climbing prices help make homeownership a good investment.

- Plus, home sales are projected to increase in 2024. That’s good news because it means experts are forecasting more activity as people continue to move.

- If you’re planning to buy or sell, it’s helpful to know what experts project for the housing market. Let’s connect to talk about the latest forecasts and craft a plan together.

Life-Changing Events That Move the Housing Market

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Reasons People Still Need To Move Today

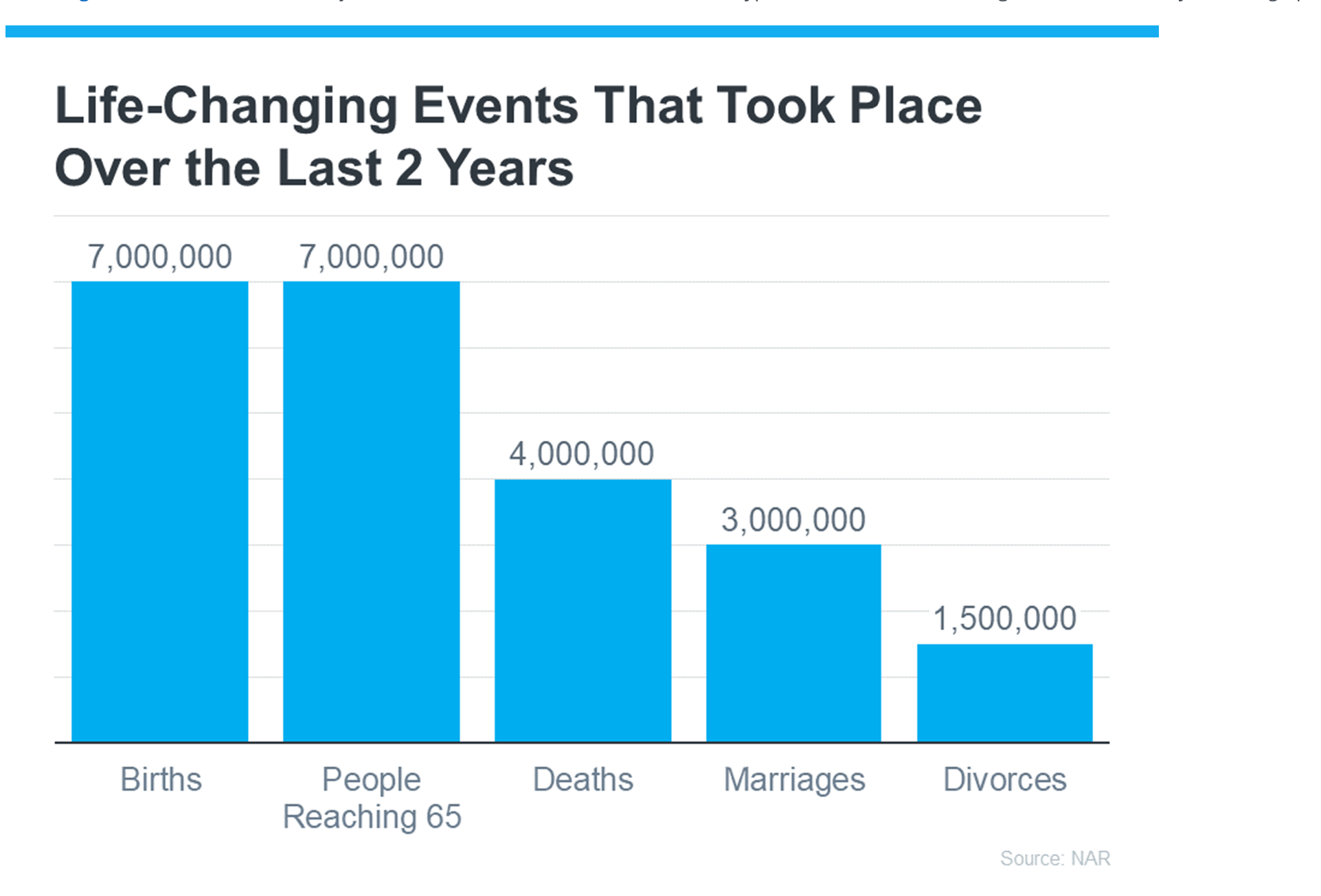

According to the National Association of Realtors (NAR) there have been a lot of this type of milestone or life change over the last two years (see graph below):

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

“Because high mortgage rates, elevated home prices, and stubbornly low inventory make today’s housing market particularly challenging, many of today’s buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

Lean On a Real Estate Professional for Help

Whether you’re beginning your search for a home or preparing to sell your current house, you don’t have to go it alone. With their expertise, a real estate agent is an invaluable partner who can help you smoothly transition through these big moments in your life. Here are just a few examples.

When Buying a Home

If you’re welcoming a new addition and want more space, the need for a new home may be a top priority. While higher home prices and mortgage rates are creating challenges for buyers, you may have to find a way to meet your changing needs, even with today’s mortgage rates.

A skilled real estate agent can help. Their expertise and knowledge of the local housing market can save you a considerable amount of time and stress. An agent will take the time to understand your specific needs, budget, and preferences, allowing them to narrow down your search and present you with suitable options.

When Selling a House

If you’re retiring or going through a separation or divorce, your main focus may be to make the most out of your investment when selling your house, so you can find one that works better for you moving forward.

This is another place where a real estate agent’s expertise truly shines. They can accurately assess your home’s market value, suggest improvements to enhance its appeal, and craft a strategic marketing plan. Their negotiation skills are a big asset when it comes to making sure you get a fair price for your house, allowing you to move on to the next chapter of your life with confidence and peace of mind.

No matter your situation, lean on a trusted professional for help as you buy or sell a home.

Bottom Line

If recent life-changing events have you wanting or needing to move, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link