An Expert Makes All the Difference When You Sell Your House

If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale.

1. They’re Experts on Market Trends

With today’s housing market defined by change, it’s critical to work with someone who knows the latest information and how it impacts your goals. An expert real estate advisor knows about national trends and your local area too. More importantly, they’ll give insight to what all of this means for you, so they’ll be able to help you make a decision based on trustworthy, data-bound information.

2. A Local Professional Knows How To Set the Right Price for Your Home

Home price appreciation has moderated this year. If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. Pricing your house too high can deter buyers or cause your house to sit on the market for longer.

Real estate professionals look at a variety of factors, like the condition of your home and any upgrades you’ve made, with an unbiased eye. They compare your house to recently sold homes in your area to find the best price for today’s market so your house sells quickly.

3. A Real Estate Advisor Helps Maximize Your Pool of Buyers

Since buyer demand has cooled this year, you’ll want to do what you can to help bring in more buyers. Real estate professionals have a wide range of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS), to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides:

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.”

Without access to your agent’s tools and marketing expertise, your buyer pool – and your home’s selling potential – is limited.

4. A Real Estate Expert Will Read – and Understand – the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) puts it like this:

“There’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

5. A Local Professional Is a Skilled Negotiator

In today’s market, buyers are regaining some negotiation power. If you sell without an expert, you’ll be responsible for any back-and-forth. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

Bottom Line

Don’t go at it alone. If you’re planning to sell your house this spring, let’s connect so you have an expert by your side to guide you in today’s market.

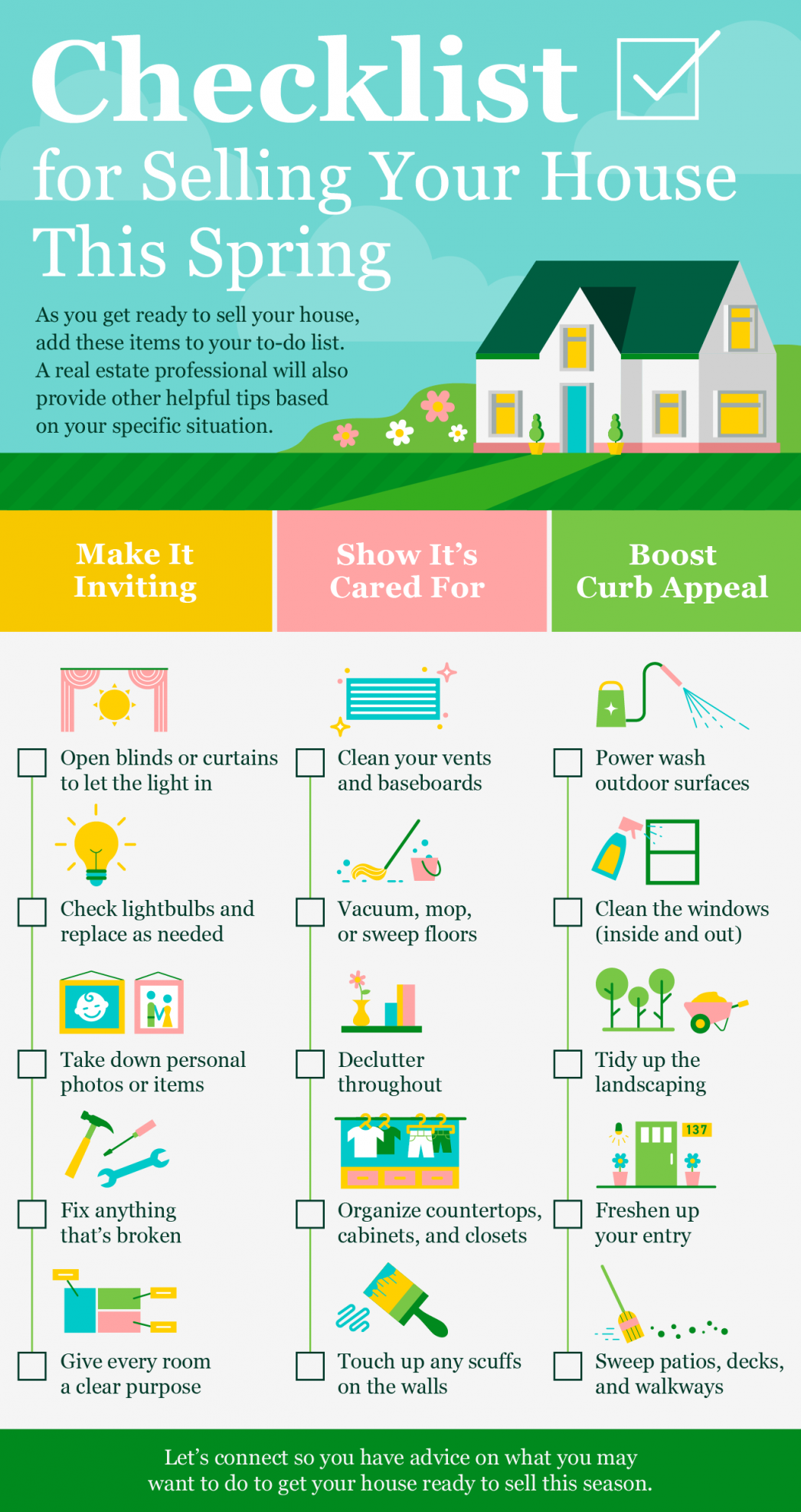

Checklist for Selling Your House This Spring

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

The Two Big Issues the Housing Market’s Facing Right Now

The Two Big Issues the Housing Market’s Facing Right Now

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:

“Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.”

Let’s break down these two big issues in today’s housing market.

Rate-Locked Homeowners

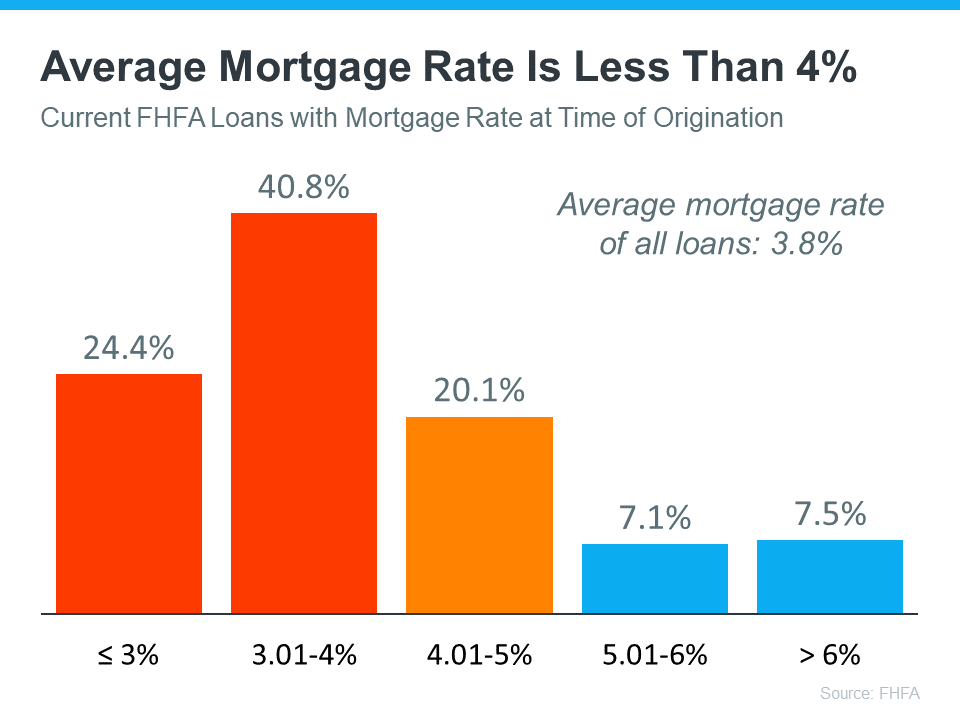

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked.

When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens.

The Fear of Not Finding Something To Buy

The other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options. That includes newly built homes, especially right now when builders are offering concessions like mortgage rate buydowns.

What Does This Mean for You?

These two issues are keeping the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market is a sweet spot that can work to your advantage.

Be sure to work with a local real estate professional to explore the options you have right now, which could include leveraging your current home equity. According to ATTOM:

“. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.”

This could make a major difference when you move. Work with a local real estate expert to learn how putting your equity to work can keep the cost of your next home down.

Bottom Line

Rate-locked homeowners and the fear of not finding something to buy are keeping housing inventory low across the country. But as mortgage rates start to come down this year and homeowners explore all their options, we should expect more homes to come to the market.

February Eastside Stats

Median pricing crept-up 2% since last month but is down 13% year-over-year. (Note, year-over-year deprecation will continue through June or July.) Interestingly, King County’s year-over-year pricing is flat and Seattle is up 2%, (but, they both will have depreciation next month). Making an analogy, the Eastside was an intense roller coaster like California Screaming/Incredicoaster; whereas, King County and Seattle were a kiddie coaster, like Goofy’s Sky School. Looking bigger picture at Eastside year-over-year pricing, we had 32% (!!) appreciation in 2022 and 22% (!) appreciation in 2021, which lands us 48% higher than January 2020 pricing—not too shabby. Those who bought around the peak should rest assured that they secured the lowest interest rates in history and their monthly payment is lower than if they bought at today’s pricing (and hopefully they can hold on to the home for a several years as pricing will rise). Lastly, at 1.4 months of inventory, we are solidly in a sellers’ market. We need more inventory, which is usually the case in January, so I’m not panicking (yet). Some say the Super Bowl is the kick-off of the real estate season, but I think it’s after mid-winter break (the week of President’s Day) where we really start to see more inventory. Time will tell.

Experts Forecast a Turnaround in the Housing Market in 2023

The housing market has gone through a lot of change recently, and much of that was a result of how quickly mortgage rates rose last year.

Now, as we move through 2023, there are signs things are finally going to turn around. Home price appreciation is slowing from the recent frenzy, mortgage rates are coming down, inflation is easing, and overall market activity is starting to pick up. All of that’s great news for the housing market this year. Here’s what experts are saying.

Cristian deRitis, Deputy Chief Economist, Moody’s Analytics:

“The current state of the housing market is that it is certainly in transition.”

Susan Wachter, Professor of Real Estate and Finance, University of Pennsylvania’s Wharton School:

“Housing is going to ease up. I think 2023 will be a turnaround year.”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“Mortgage rates have fallen in the recent past weeks, so I’m very hopeful that the worst in home sales is probably coming to an end.”

Robert Dietz, Chief Economist and Senior Vice President, National Association of Home Builders (NAHB):

“. . . it appears a turning point for housing lies ahead. In the coming quarters, single-family home building will rise off of cycle lows as mortgage rates are expected to trend lower and boost housing affordability.”

Bottom Line

If you’re thinking about making a move this year, a turnaround in the housing market could be exactly what you’ve been waiting for. Let’s connect to talk about the latest trends in our area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link