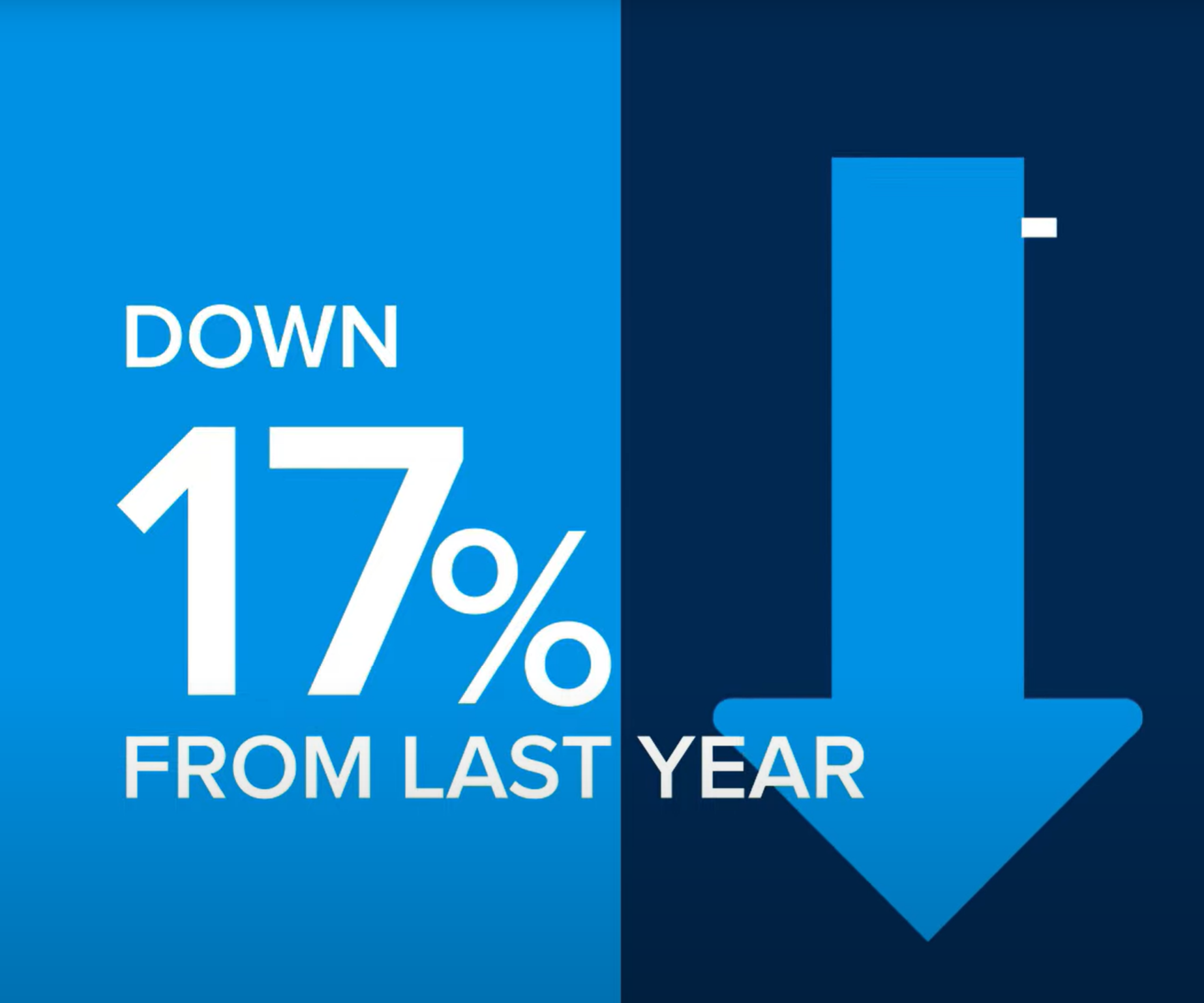

Yes, yes prices are down 17% year-over-year. Remember, this is OLD news, as the price correction occurred between April and August of last year. This year, prices are up 7% since January (9% since December, but December is always a wonky month). I’ve mentioned that it feels like a ‘normal’ (pre-pandemic) year. If that is the case, I would expect prices to level off soon, but with such low inventory, I’m not sure. I’m wondering (hoping, really) if inventory will have a post-Spring Break surge. This year all the Eastside and surrounding public schools had their Spring Break the same week (the week of April 10th)—a rarity. Sellers typically avoid listing just before or during Spring Break. As always, time will tell.

Trying To Buy a Home? Hang in There.

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them.

Long-Term Benefits Outweigh Short-Term Challenges

Owning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity. Freddie Mac puts it this way:

“Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.”

The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. Those benefits are worth the short-term challenges today’s sellers’ market presents.

Mortgage Rates Are Constantly Changing

Mortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently:

“Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .”

Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. Hannah Jones, Economic Data Analyst at realtor.com, explains:

“As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.”

The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked.

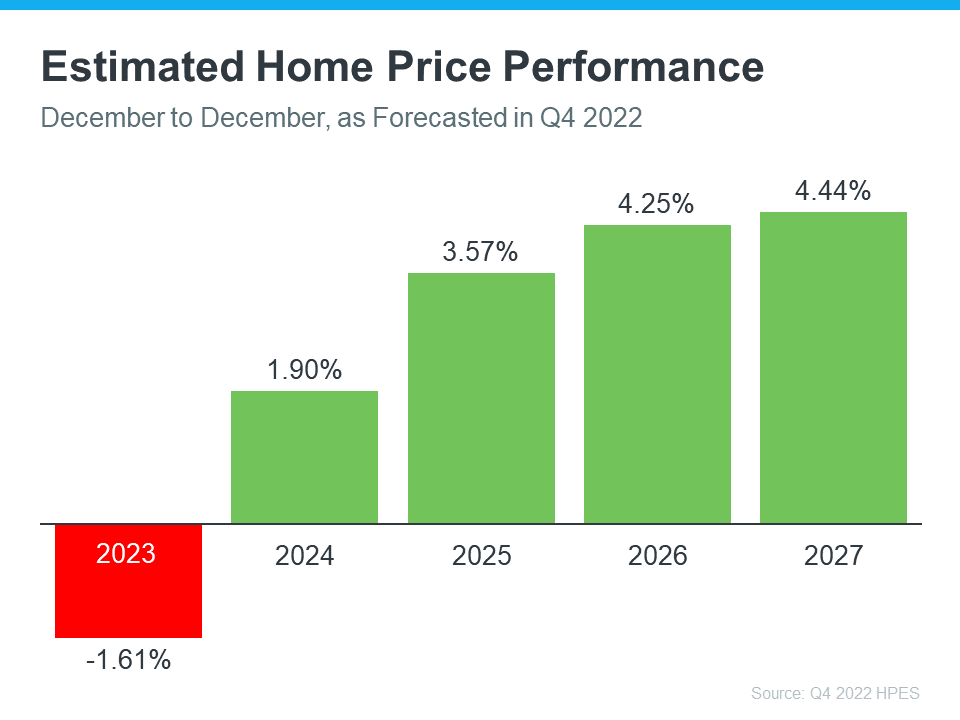

Home Prices Will Increase

According to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year (see graph below):

Rising home prices in the coming years means two things for you as a buyer:

- Waiting to buy a home could mean it’ll become more expensive to do so.

- Buying now means the value of your home, and your net worth, will likely grow over time.

Bottom Line

If you’ve been trying to buy a home, hang in there. Mortgage rates have ticked down some recently, home prices are forecast to increase in the coming years, and the long-term benefits of homeownership outweigh many of the short-term challenges.

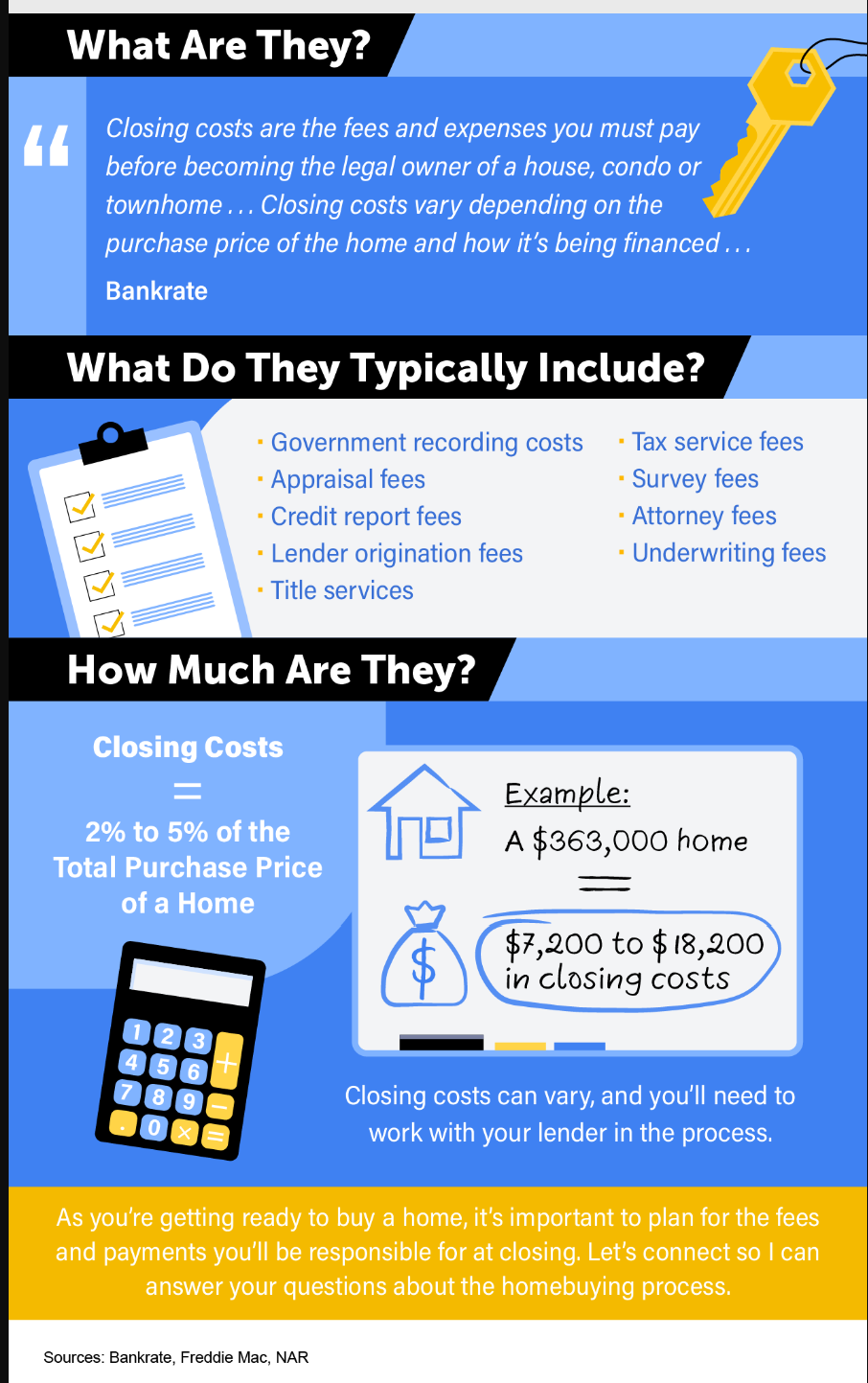

Facts About Closing Costs

Some Highlights

- If you’re thinking about buying a home, be sure to plan for closing costs.

- Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal fees, and more.

- Let’s connect so I can answer your questions about the homebuying process.

Leverage Your Equity When You Sell Your House

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this:

“Home equity is the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

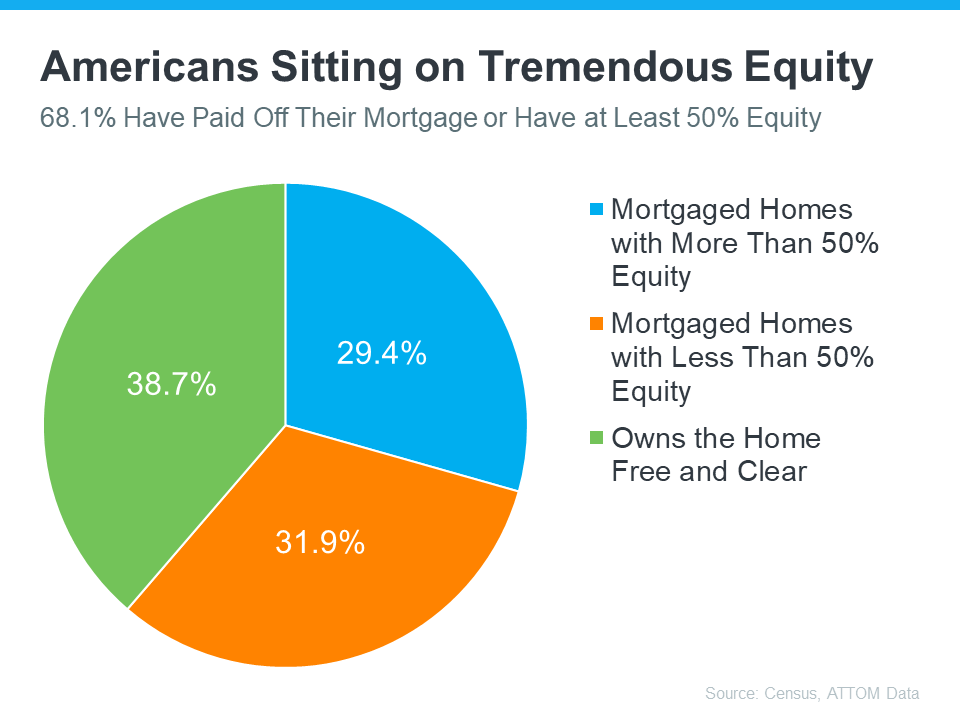

Majority of Americans Have a Large Amount of Equity

If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of equity right now (see graph below):

And having such large amounts of equity is a benefit to homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

“Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008.”

Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home.

Bottom Line

By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect today so you can find out how much home equity you have and start planning your next move.

March Eastside Stats

The shocking year-over-year number has arrived: prices are down 21%. Not to sound like a broken record, but remember the drop occurred between the April 2022 peak ($1.7M) to August 2022 ($1.35M). Since August, prices have flattened, dipped a bit in the 4th quarter, and then up 2% for 2 consecutive months in 2023. Additionally, 17% of the homes sold a median of 4% over asking, which is more than double January where 8% sold a median of 3% over asking. Curious about what February 2022 stats were? Me too, a jaw-dropping 87% of the homes sold a median of 23% (!) over asking. Those were crazy, crazy days! With 1.1 months of inventory, we are solidly in a Seller’s Market. What’s that you say? Bank failures? Buyer activity this past week didn’t appear impacted. Time will tell.

What Buyer Activity Tells Us About the Housing Market

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News:

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News:

“Housing markets have cooled slightly, but demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.”

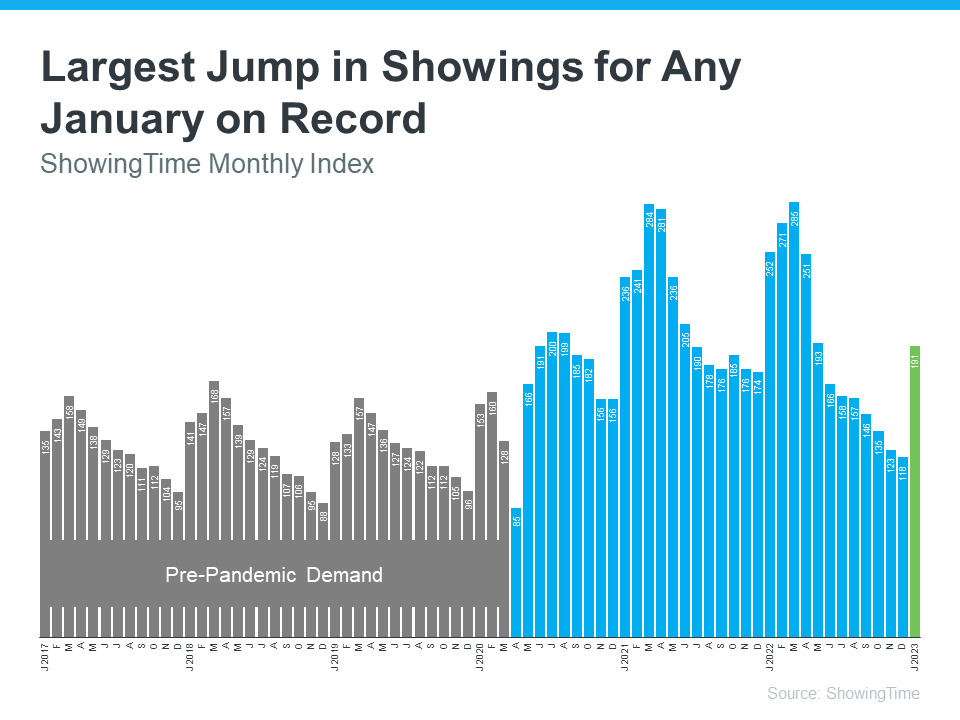

That activity can be seen in the latest ShowingTime Showing Index, which is a measure of buyers actively touring available homes (see graph below):

The 62% jump in showings from December to January is one of the largest on record. There were also more showings in January than in any other month since last May. As you can see in the graph, it’s normal for showings to increase early in the year, but the jump this January was larger than usual, and a lot of that has to do with mortgage rates. Michael Lane, VP of Sales and Industry at ShowingTime+, explains:

“It’s typical to see a seasonal increase in home showings in January as buyers get ready for the spring market, but a larger increase than any January before after last year’s rapid cooldown is significant. Mortgage rate activity this spring will play a big role in sales activity, but January’s home showings are a positive sign that buyers are getting back out there . . .”

It’s important to note that mortgage rates hovered in the low 6% range in January, which played a role in the high number of showings. What does this mean? When mortgage rates eased, buyer interest climbed. The jump in home showings early this year makes one thing clear – while rates may be volatile right now, there are interested buyers out there, and when mortgage rates are favorable, they’re ready to make their move.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link