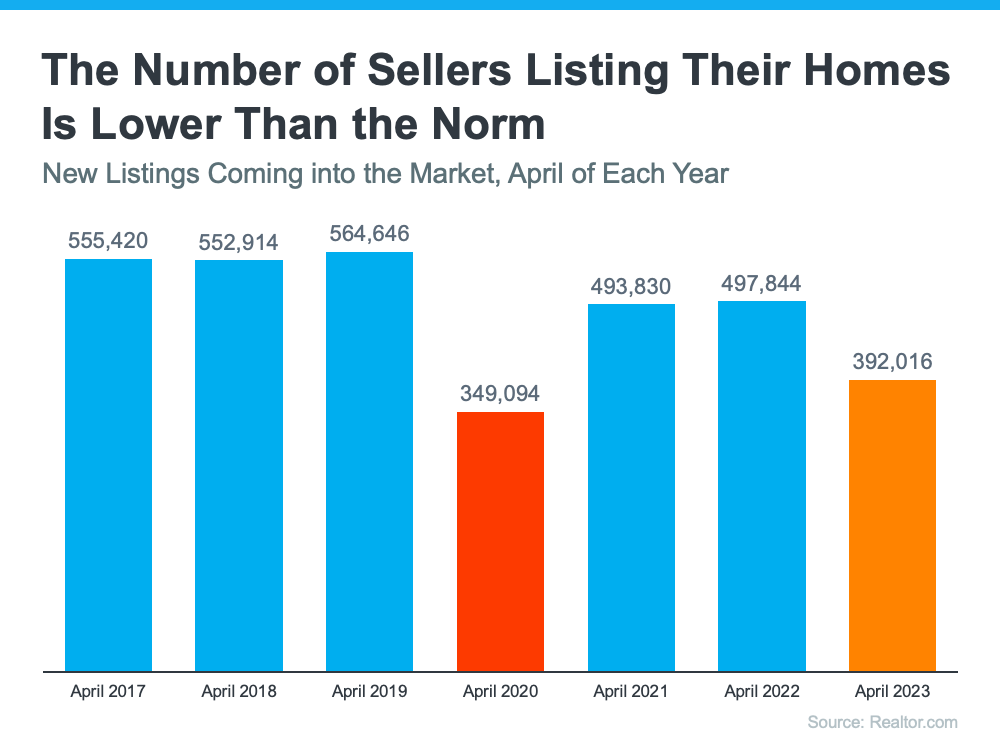

If you’re thinking about selling your house, you should know the number of homes for sale right now is low. That’s because, this season, there are fewer sellers listing their houses for sale than the norm.

Looking back at every April since 2017, the only year when fewer sellers listed their homes was in April 2020, when the pandemic hit and stalled the housing market (shown in red in the graph below). In more typical years, roughly 500,000 sellers add their homes to the market in April. This year, we saw fewer than 400,000 sellers entering the market in April (see graph below):

While there are a number of factors contributing to this trend, one thing keeping inventory low right now is that some homeowners are reluctant to move when the mortgage rate they have on their current house is lower than the one they could get today on their next house. It’s called rate lock.

As a recent survey from Realtor.com explains, 56% of people who are planning to sell in the next 12 months say they’re waiting for rates to come down.

While this wait-and-see approach is right for some sellers, it also creates an opening for more eager sellers to jump in now.

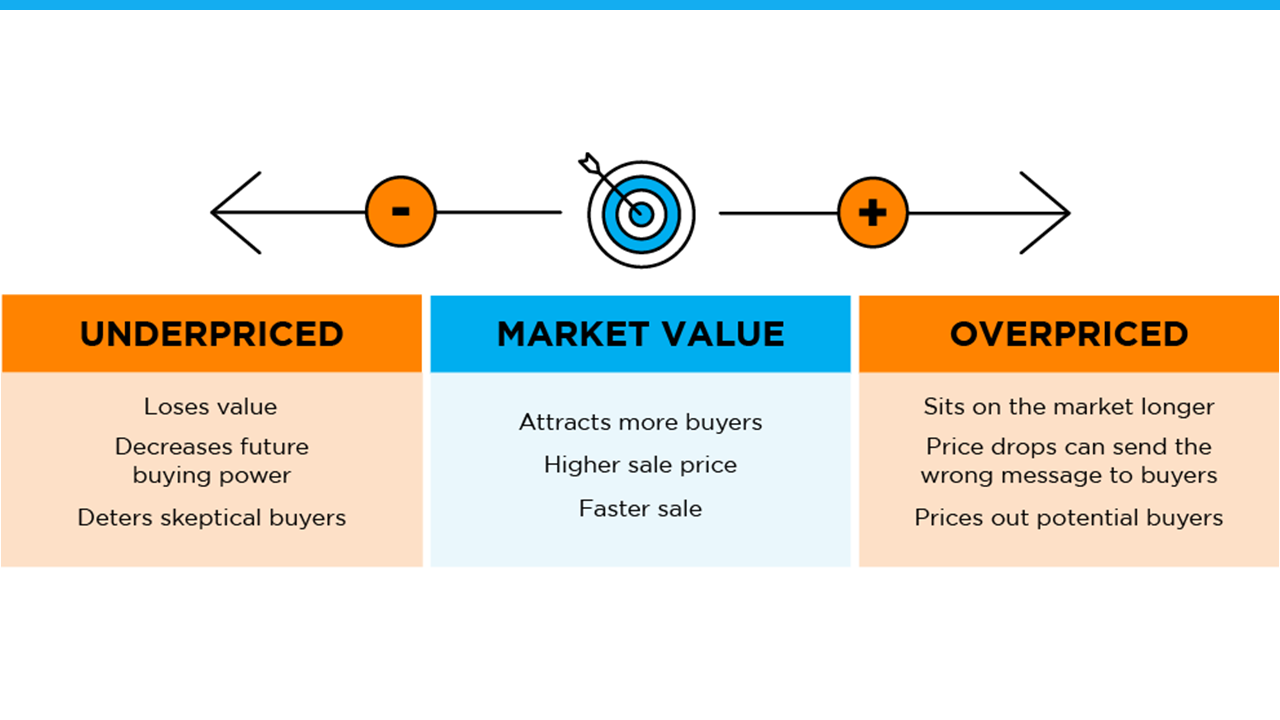

If your current house truly doesn’t fit your needs anymore and you’re ready to move, don’t miss this chance to stand out. When fewer sellers are putting their homes up for sale, buyers will have fewer options, so you set yourself up to get the most eyes possible on your house. That’s why your house could see multiple offers as buyers compete over the limited supply of homes for sale – especially if you price it right.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Inventory levels are still at historic lows . . . Consequently, multiple offers are returning on a good number of properties.”

Bottom Line

If you’re ready to sell now, beat the competition before it comes onto the market. If you do, your house should stand out and could get multiple offers. Let’s connect to get you market ready.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

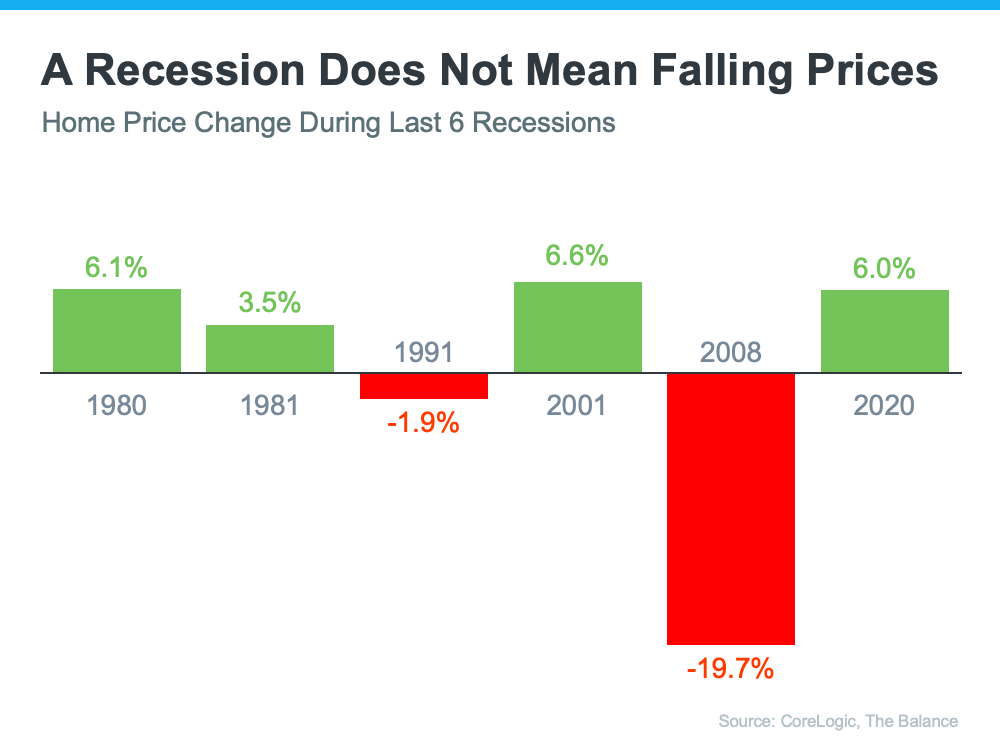

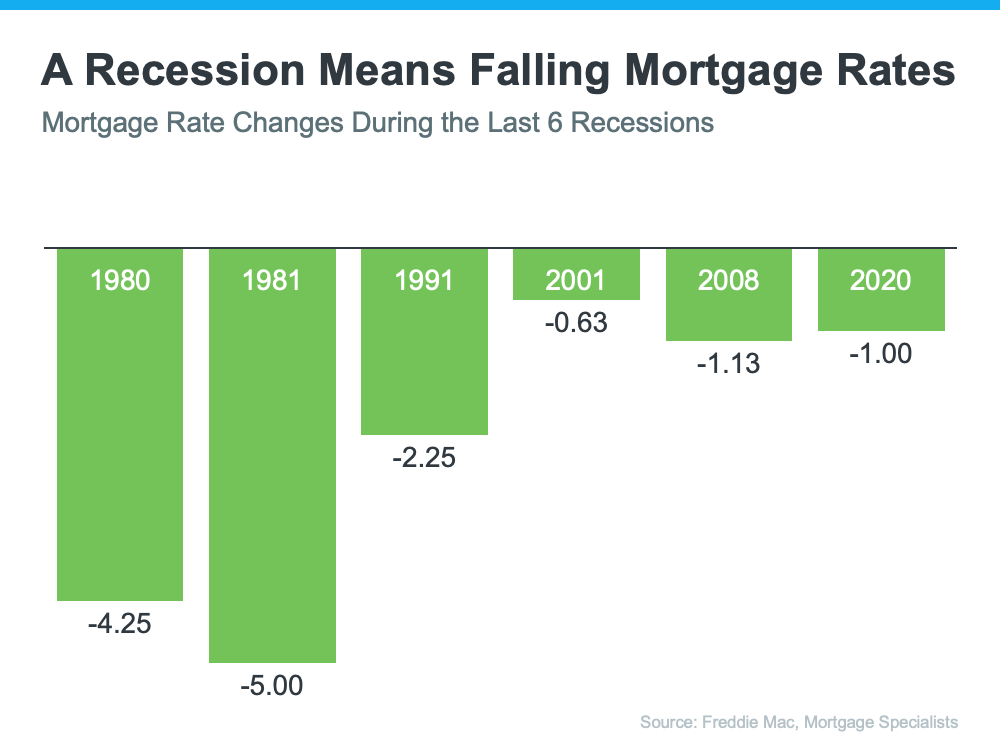

Everywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do officially enter a recession, it’ll be mild and short. As the Federal Reserve

Everywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do officially enter a recession, it’ll be mild and short. As the Federal Reserve