Homeownership Helps Protect You from Inflation

Some Highlights

- Wondering if it makes sense to buy a home today even when inflation is high? When other costs go up due to inflation, buying a home helps you keep your monthly housing expense steady.

- Rents typically increase with inflation. Maybe that’s why, according to a recent survey, 65.1% of landlords say they plan to raise the rent of at least one of their properties within the next 12 months.

Especially when inflation is up, having a stable housing payment can be helpful. Let’s connect so you can learn more and start your journey to owning a home today

Saving for a Down Payment? Here’s What You Need To Know.

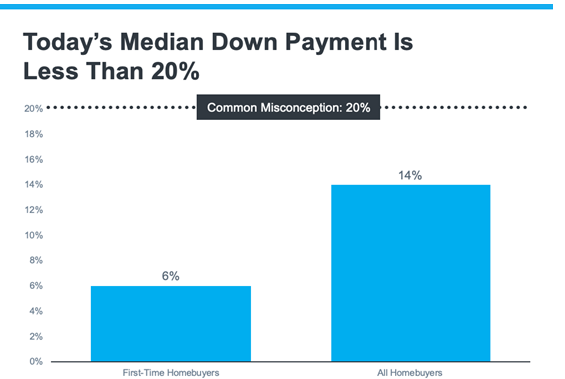

If you’re planning to buy your first home, then you’re probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case. As the National Association of Realtors (NAR) notes:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

And a recent Freddie Mac survey finds:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Here’s the good news. Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize.

According to NAR, the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

What does this mean for you? It means you may not need to save as much as you originally thought.

Learn About Options That Can Help You Toward Your Goal

And it’s not just how much you need for your down payment that isn’t clear. There are also misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too.

According to Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. That same resource goes on to say:

“You don’t have to be a first-time buyer. Over 38% of all programs are for repeat homebuyers who have owned a home in the last 3 years.”

Plus, there are even loan types, like FHA loans with down payments as low as 3.5% as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Bottom Line

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation about your homebuying goals.

The Main Reason Mortgage Rates Are So High

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions:

- Why Are Mortgage Rates So High?

- When Will Rates Go Back Down?

Here’s context you need to help answer those questions.

1. Why Are Mortgage Rates So High?

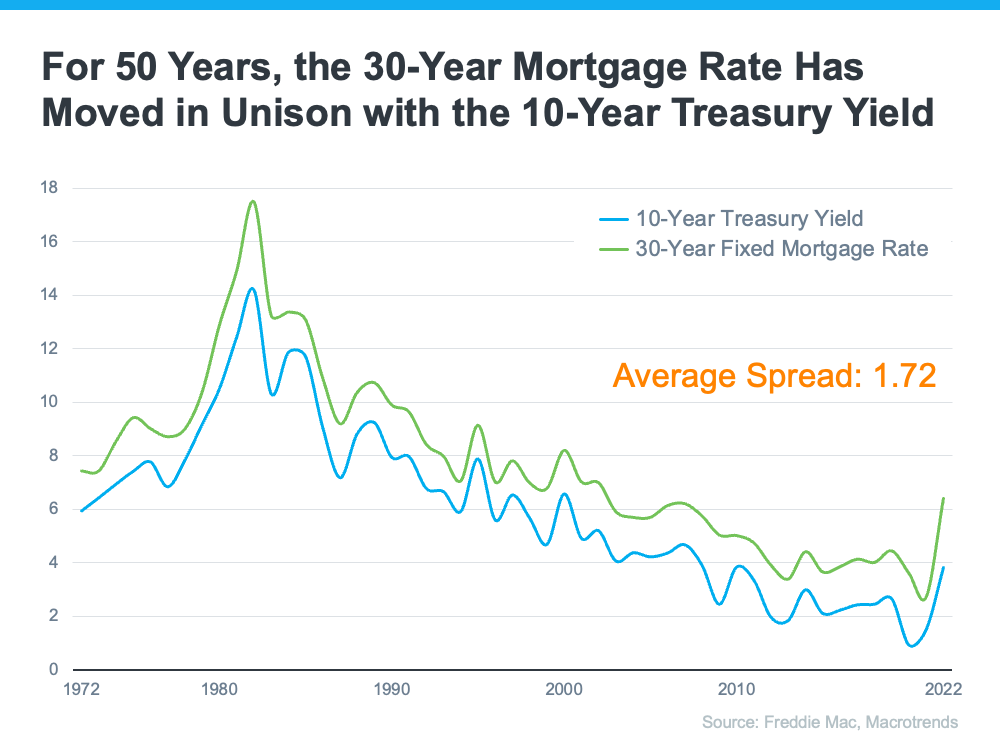

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

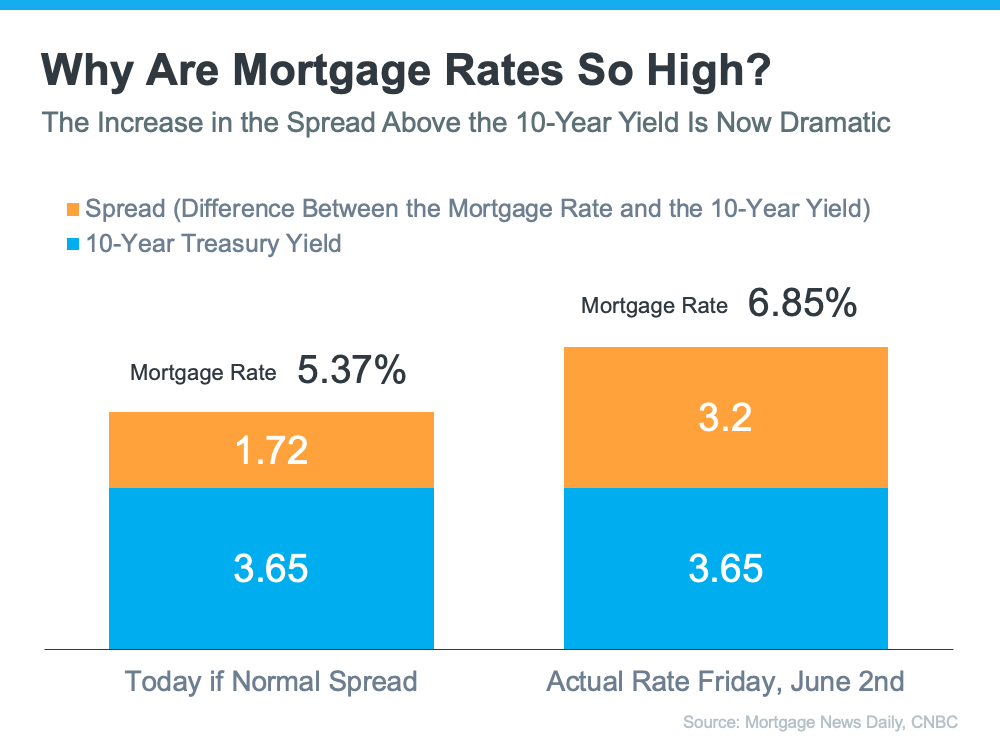

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

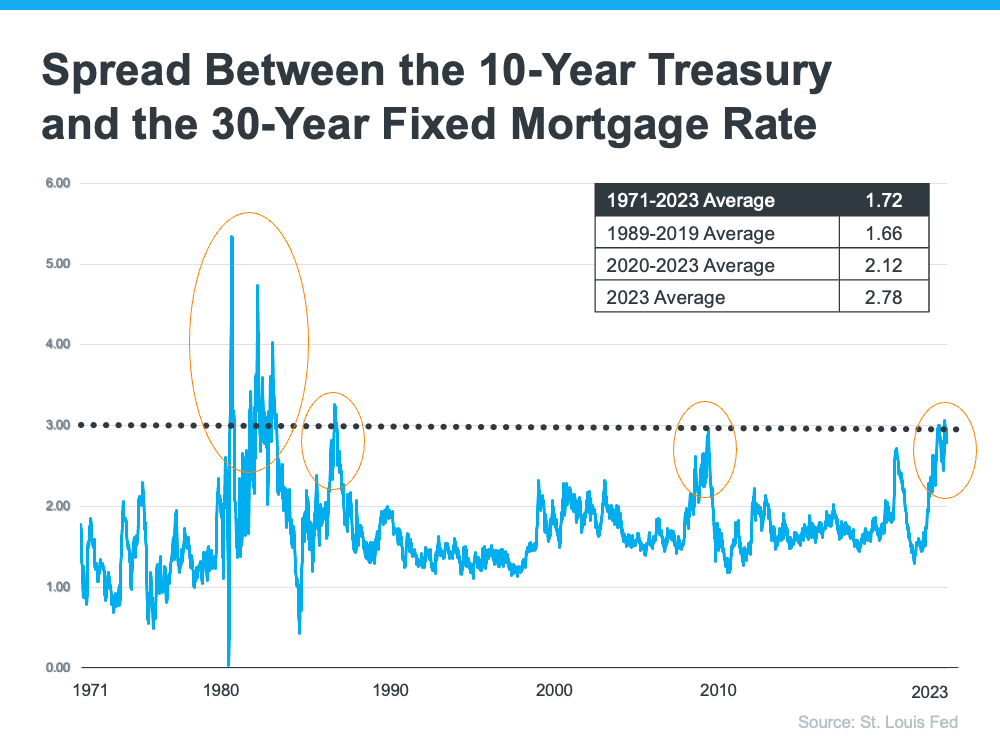

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09.”

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

The True Value of Homeownership

Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership provides.

Of course, there are financial reasons to buy a house, but it’s important to consider the non-financial benefits that make a home more than just where you live.

Here are three ways owning your home can give you a sense of accomplishment, happiness, and pride.

You May Feel Happier and More Fulfilled

Owning a home is associated with better mental health and well-being. Gary Acosta, CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), explains:

“Studies have shown the emotional and psychological benefits that homeownership has on a person’s health and self-esteem . . .”

Similarly, Habitat for Humanity says:

“Residential stability among homeowners is related to improved life satisfaction, . . . along with better physical and mental health.”

So, according to the experts, owning a home can improve your psychological wellness by making you feel happier and more accomplished.

You Can Engage in Your Neighborhood and Grow Your Sense of Community

Your home connects you to your community. Homeowners tend to stay in their homes longer than renters, and that can help you feel more connected to your community because you have more time to build meaningful relationships. And, as Acosta says, when people stay in the same area for a longer period of time, it can lead to them being more involved:

“Homeowners also tend to be more active in their local communities . . .”

After all, it makes sense that someone would want to help improve the area they’re going to be living in for a while.

You Can Customize and Improve Your Living Space

Your home is a place that’s all yours. When you own it, unless there are specific homeowner’s association requirements, you’re free to customize it however you see fit. Whether that’s small home improvements or full-on renovations, your house can be exactly what you want and need it to be. As your tastes and lifestyle change, so can your home. As Investopedia tells us:

“One often-cited benefit of homeownership is the knowledge that you own your little corner of the world. You can customize your house, remodel, paint, and decorate without the need to get permission from a landlord.”

Renting can limit your ability to personalize your living space, and even if you do make changes, you may have to undo them before your lease ends. The ability homeownership gives you to customize and improve where you live creates a greater sense of ownership, pride, and connection with your home.

Bottom Line

Owning your home can change your life in a way that gives you greater satisfaction and happiness. Let’s connect today if you’re ready to explore homeownership and all it has to offer.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link