October Eastside Residential Statistics

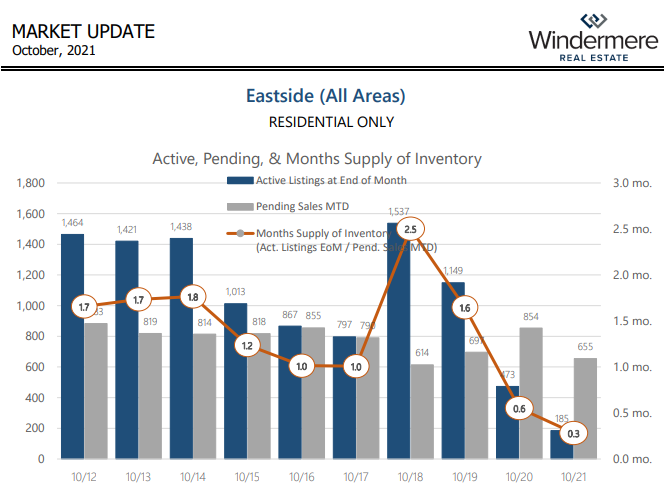

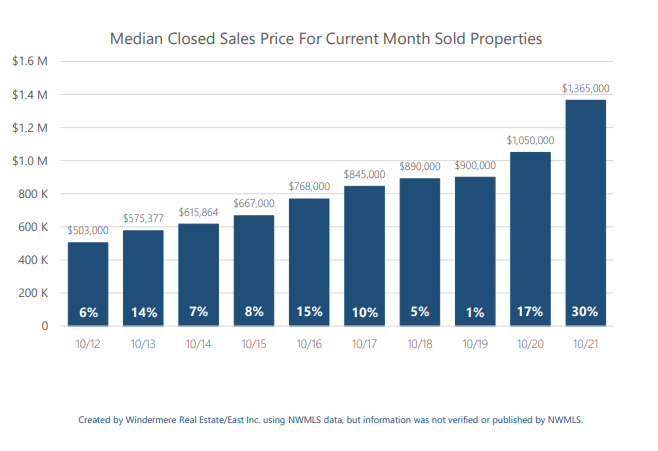

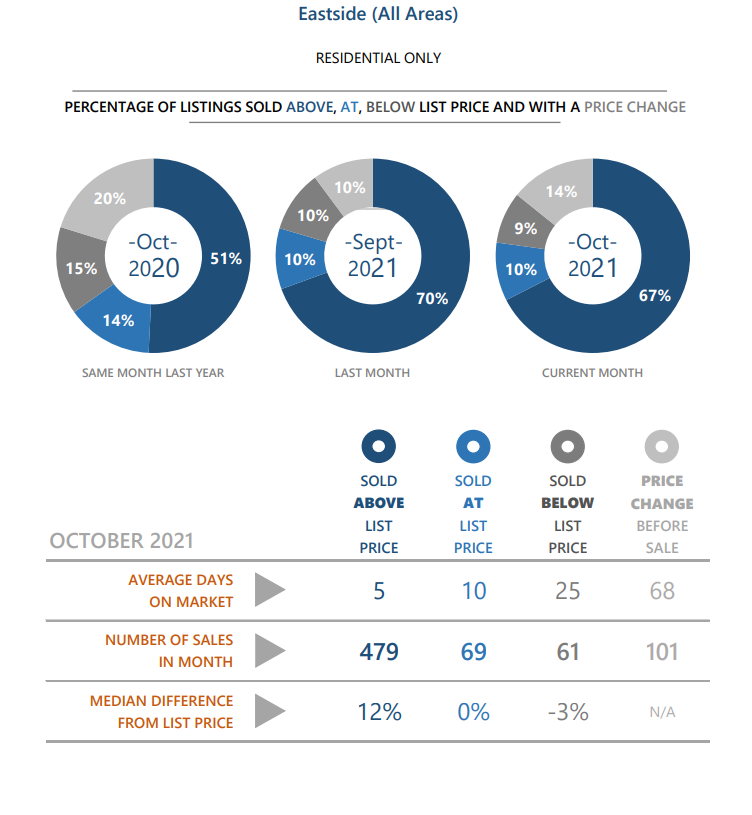

The market tightened in October with months of inventory dropping from 0.4 months to 0.3 months. That might seem like a small change, but it’s a 25% decrease from an already low number. The supply/demand imbalance resulted in 67% of the homes selling for a median of 12% over asking price. The homes selling with multiple offers still tend to be underpriced, but they are going higher than expected, so appreciation is still occurring. Historically, appreciation usually stalls by this time of the year. Year-over-year, prices are up 30%, which is likely higher than the actual number (appreciation is tricky to measure). Bottom line, it continues to be a great time to sell. It also continues to be tough for buyers, but with the right strategy and team it is completely possible. Please let me know if you would like to know what your home is worth or if you want to discuss winning in this crazy market. I am here to help!

Q3 2021 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

The emergence of the of COVID-19 Delta variant had a palpable impact on the region’s economy, which, naturally, impacted the job recovery. Employment levels in Western Washington had been picking up steam in the spring but started to slow quite dramatically over the summer. To date, the region has recovered more than 201,000 of the jobs that were lost due to the pandemic, but we appear to be in a bit of a holding pattern. That said, the ending of enhanced unemployment benefits has led many business owners to see more applicants for open positions, so I am hopeful the numbers will pick back up as we move into the winter months. The most recent data (August) shows the region’s unemployment rate at a respectable 5%, but we still have a way to go before we reach the pre-pandemic low of 3.7%. On a county level, the lowest unemployment rate was in Kitsap County (4.4%) and the highest was in Grays Harbor County (6.6%). There are still many hurdles in front of us, but I believe we will continue to add jobs and reach full employment recovery by mid-2022.

WESTERN WASHINGTON HOME SALES

❱ Sales in the third quarter rose 6.4% year over year, with a total of 27,280 homes sold. The increase matched what we saw in the second quarter of this year.

❱ I was pleased to see sales growth continue. This rise was supported by a 28.4% increase in the number of homes for sale. Listings rose the most in Grays Harbor (+62.6%), Lewis (+53.6%), and Skagit (+52.0%) counties.

❱ Sales activity was mixed. Nine counties saw year-over-year growth, but sales slowed in six counties. That said, sales were up in every county other than King and San Juan compared to the second quarter of 2021.

❱ The ratio of pending sales (demand) to active listings (supply) showed pending sales outpacing listings by a factor of 4.6. Even with the increase in the number of new listings, the market is far from balanced.

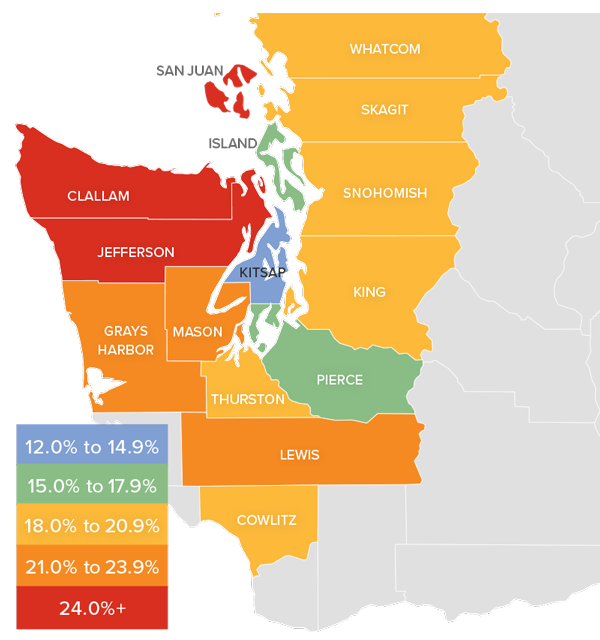

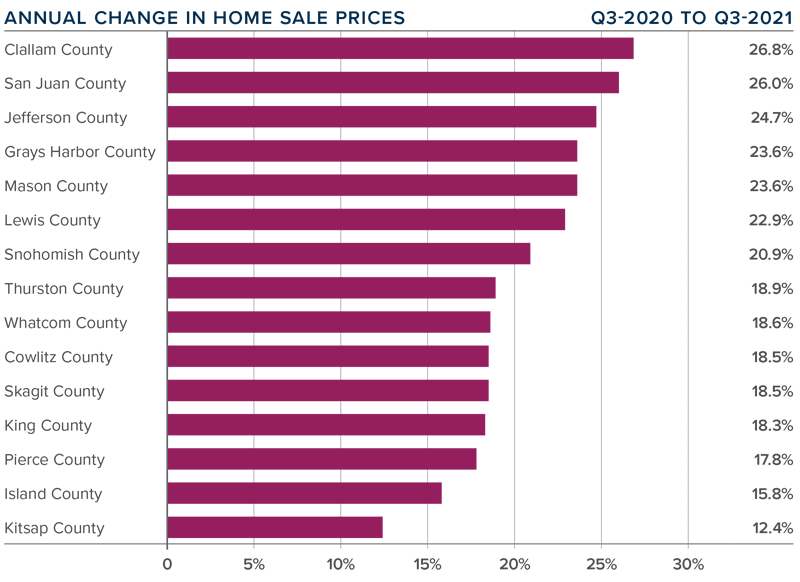

WESTERN WASHINGTON HOME PRICES

❱ Home prices rose 18.9% compared to a year ago, with an average sale price of $726,168—another all-time record.

❱ When compared to the same period a year ago, price growth was strongest in Clallam, San Juan, and Jefferson counties, but all markets saw prices rise more than 12% from a year ago.

❱ Average sale prices pulled back 1.1% compared to the second quarter of this year. Given the massive increase in value over the past few years, it is not at all surprising. The key indicator has been a softening in list prices and that naturally translates to slower price growth. This is nothing to be worried about. It simply suggests that the market may finally be heading back to some sort of balance.

❱ Relative to the second quarter of this year, all counties except San Juan (-0.1%), Island (-0.5%), and Whatcom (-0.5%) saw higher sale prices.

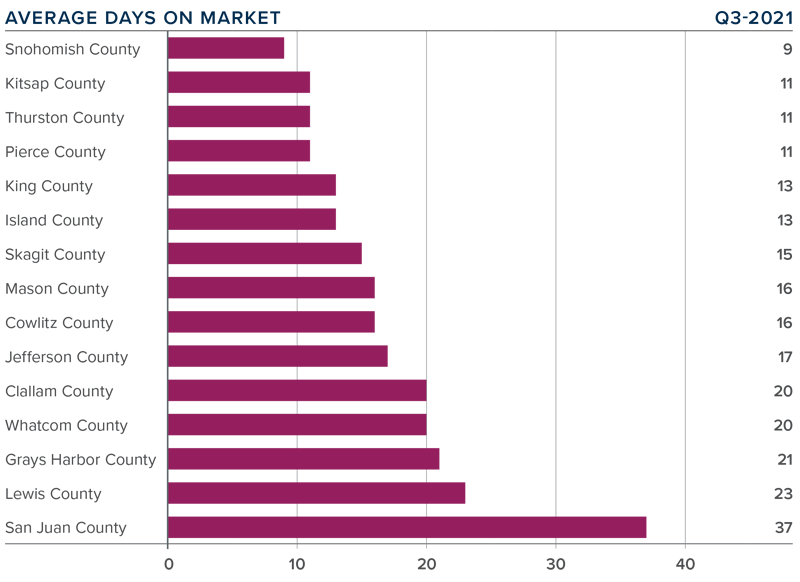

DAYS ON MARKET

❱ It took an average of 17 days for a home to sell in the third quarter. This was 19 fewer days than in the same quarter of 2020, and 1 fewer day than in the second quarter of this year.

❱ Mirroring the second quarter, Snohomish, Kitsap, Thurston, and Pierce counties were the tightest markets in Western Washington, with homes taking an average of 9 days to sell in Snohomish County and 11 days in the other three counties. The greatest reduction in market time compared to a year ago was in San Juan County where it took 102 fewer days for homes to sell.

❱ All counties contained in this report saw the average time on market drop from the same period a year ago, but eight counties saw market time rise from the second quarter; however, the increases were minimal.

❱ Even with inventory levels increasing in most markets, the region’s housing market remains remarkably tight. That said, I do see some of the heat dissipating and I am hopeful that if inventory levels continue rising, we will start a slow move back toward a balanced market.

CONCLUSIONS

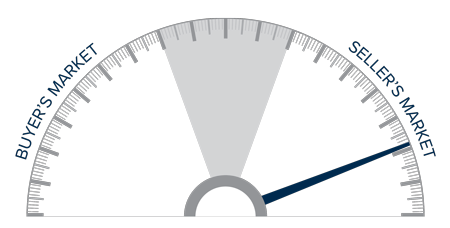

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Even given the speedbump that hit the region’s economy with the emergence of the Delta variant, the housing market remains remarkably resilient. Demand from buyers continues to be very strong, and modestly increasing inventory levels appear to have—at least for the time being—reduced some of the fever from the market. Mortgage rates remain very favorable, and my current forecast is for them to stay in the low- to mid-3% range until next summer. Rising inventory levels have led price growth to slow and days on market to start increasing, which may be a sign that the market is retreating from a prolonged period of exuberance.

As we move through the balance of the year, I believe demand will remain solid, but we will continue to see price growth soften as more listings compete for the buyers that are out there. That is not to say price growth will turn negative; rather it suggests that we are slowly moving back toward a more balanced market. That said, the market certainly still favors home sellers. As such, I am leaving the needle in the same position as the second quarter. I may move it a little in the direction of buyers next quarter if the current trend continues through the winter months.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Knowledge Is Power When It Comes to Appraisals and Inspections

Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and leading some buyers to consider waiving those contingencies to stand out in the crowded market.

But is that the best move? Buying a home is one of the most important transactions in your lifetime, and it’s critical to keep your best interests in mind. Here’s a breakdown of what to expect from the appraisal and the inspection, and why each one can potentially save you a lot of time, money, and headaches down the road.

Home Appraisal

The home appraisal is a critical step for securing a mortgage on your home. As Home Light explains:

“. . . lenders typically require an appraisal to ensure that your loan-to-value ratio falls within their underwriting guidelines. Mortgages are secured loans where the lender uses your home as collateral in case you default on the agreed-upon payments.”

Put simply: when you apply for a mortgage, an unbiased appraisal – typically required by your lender – is the best way to verify the value of the home. That appraisal ensures the lender doesn’t loan you more than what the home is worth.

When buyers are competing like they are today, bidding wars and market conditions can push prices up. A buyer’s contract price may end up higher than the value of the home – this is known as an appraisal gap. In today’s market, it’s common for the seller to ask the buyer to make up the difference when an appraisal gap occurs. That means, as a buyer, you may need to be prepared to bring extra money to the table if you really want the home.

Home Inspection

Like the appraisal, the inspection is important because it gives an impartial evaluation of the home. While the appraisal determines the current value of the home, the inspection determines the current condition of the home. As the American Society of Home Inspectors puts it:

“Home inspections are the opportunity to discover major defects that were not apparent at a buyer’s showing. . . . Your home inspection is to help you make an informed decision about the house, including its condition.”

If there are any concerns during the inspection – an aging roof, a malfunctioning HVAC system, or any other questionable items – you have the option to discuss and negotiate any potential issues with the seller. Your real estate advisor can help you navigate this process and negotiate what, if any, repairs need to be made before the sale is finalized.

Keep in mind – home inspections are critical because they can shed light on challenges you may face as the new homeowner. Without an inspection, serious, sometimes costly issues could come as a surprise later on.

4 Tips To Prep for Your Home Sale This Fall

Even in a hot sellers’ market like today’s in which homes are selling so quickly, it’s still important to make a good first impression on potential buyers. Taking the time upfront to prep your house appropriately can bring in the greatest return on your investment.

Here are four simple tips to make sure you maximize the sale of your house this fall.

1. Price It Right

One of the first things buyers will notice is the price of your house. That’s why it’s important to price it right. Your goal in pricing your house is to draw attention from competing buyers and let bidding wars push the final sales price up. Pricing your house too high to begin with could put you at a disadvantage by discouraging buyers from making an offer.

Your trusted real estate advisor can help you find the price for your home that reflects the current market value. Lean on your agent to help you with this crucial first step.

2. Keep It Clean

It may sound simple, but keeping your house clean is key to making sure it gets the attention it deserves. As realtor.com says in the Home Selling Checklist:

“When selling your home, it’s important to keep everything tidy for buyers. . . . Remember to take special care with the bathroom, making sure the tile, counters, shower, and floors shine.”

Before each buyer visits, assess your space and determine what needs your attention. Wash the dishes, make the beds, and put away any toys. Doing these simple things can reduce any potential distractions for buyers.

3. Make It Easy To Visit

Giving buyers the opportunity to see your house on their schedule can be a true game-changer. Buyers are less likely to make an offer if it’s difficult to plan a tour or they can’t easily fit it into their schedule. Making your house available as often as possible helps create opportunities for more buyers to fall in love with your house.

Rest assured your trusted real estate advisor will keep your health and safety top of mind when buyers tour your home. Agents use the latest guidance to stay up to date on any protocols and sanitization recommendations.

4. Help Buyers Feel at Home

Finally, it’s important for buyers to see all the possible ways they can make your house their next home. As the realtor.com article puts it:

“The goal is to create a blank canvas on which buyers can project their own visions of living there, and loving it.”

An easy first step to create this blank canvas is removing personal items – pictures, awards, and sentimental belongings – from your space. If you’re unsure what should be packed away and what can stay, consult your trusted real estate advisor. Spending the time on this step can pay off in the long run, as the 2021 Profile of Home Staging from the National Association of Realtors notes:

“Eighteen percent of sellers’ agents said home staging increased the dollar value of a residence between 6% and 10%.”

Early October is the Sweet Spot for Buyers

Are you looking to buy a home? If so, we’ve got good news for you.

While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today? As a buyer, you’re likely braving bidding wars and weighing low mortgage rates versus price appreciation as you search for your dream home. If you find yourself a bit discouraged, hear this: there are clear signs buyers may have more opportunities this fall.

According to realtor.com, the sweet spot for buyers is just around the corner. In a recent study, experts analyzed housing market trends by looking at data from the past several years. When applied to the current market, experts determined the ideal week to buy a home this year. The research says:

“Nationally, the best time to buy in 2021 is the week of October 3-9. This week historically has shown the best balance of market conditions that favor buyers.”

So, what’s that mean for you? If you’re looking to buy a home, there’s a golden window of opportunity coming. Here’s what you can expect from that week.

Increased Housing Supply

The number of homes available for sale should increase. According to realtor.com, you can expect to see more new listings come to market the week of October 3. The findings estimate we’ll see roughly 17.6% more homes available than we saw at the start of the year.

This means you’ll have more options to choose from which should be a welcome relief in a market with tight housing supply.

Fewer Bidding Wars

With more homes available, you should also see a slight decline in the number of bidding wars. Having more options means buyers may not be competing as intensely for the homes on the market because there are more choices to go around.

This means when you write an offer, you may have less competition and a better chance of being the top bid. Just remember, it’s still important to come in with a strong offer.

Adjusted Homes Prices

As we move into the end of the year, the findings from realtor.com note this week may also be one of the peak weeks for price reductions in 2021. Historically the data shows an average of 7.0% of homes have a price reduction that week. Why? When housing supply ticks up, sellers need to look for other ways to make their house stand out.

This means, while home prices are still appreciating overall, you may see some homes with price adjustments from eager sellers. The process of closing a house takes time. To close before end of year, sellers may be more motivated this October.

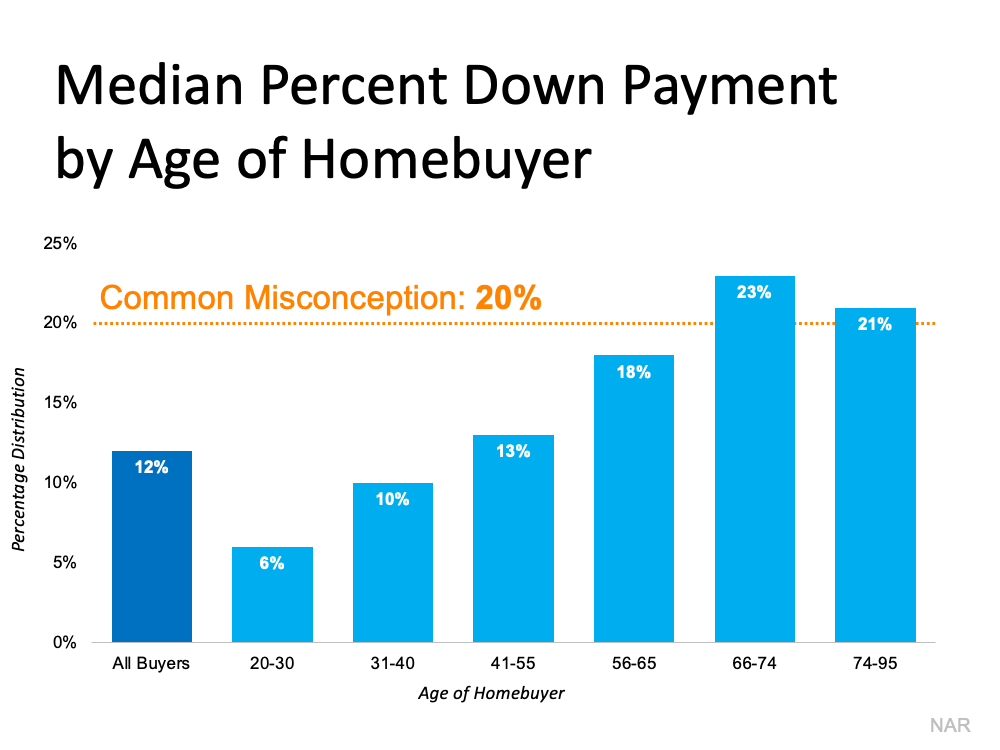

Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle.

That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re able can benefit buyers, putting 20% down is not mandatory. As Freddie Mac puts it:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

If saving that much money sounds overwhelming, you might be ready to give up on the dream of homeownership before you even begin – but you don’t have to. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today’s average down payment is only 12%. That number is even lower for first-time homebuyers, whose average down payment is only 7%.

Based on the Home Buyers and Sellers Generational Trends Report from NAR, the graph below shows an even closer look at the down payment percentage various age groups pay:

As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home.

What does this mean for you?

If you’re a prospective homebuyer, it’s important to know you don’t have to put the full 20% down. And while saving for any down payment amount may feel like a challenge, keep in mind there are programs for qualified buyers that allow them to purchase a home with a down payment as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, you do need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link