What a Fed Rate Cut Could Mean for Mortgage Rates

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.

The Fed Doesn’t Directly Set Mortgage Rates

Right now, all eyes are on the Fed. Most economists expect they’ll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.

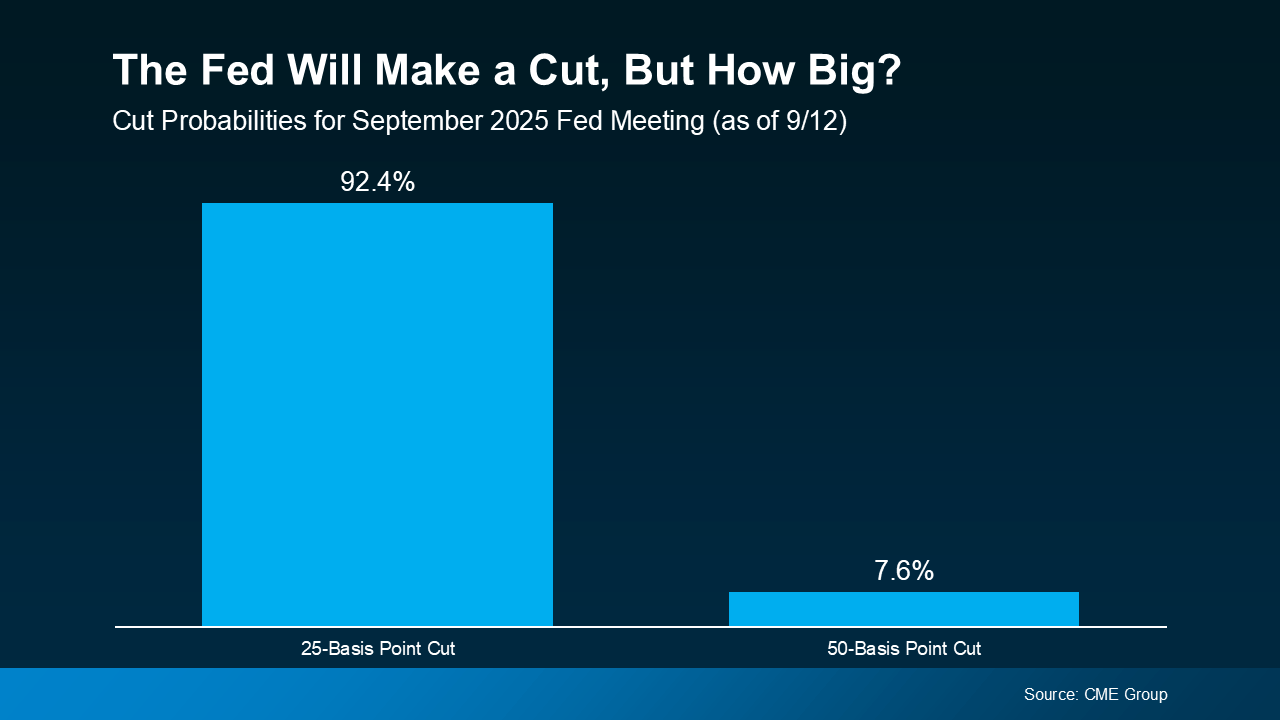

According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. And based on what we know now, there’s about a 92% chance it’ll be a small cut (25 basis points) and an 8% chance it will be a bigger cut (50 basis points):

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

Why Markets Already Saw This Cut Coming

Here’s the part that may surprise you. Mortgage rates tend to respond to what the financial markets think the Fed will do, before the Fed officially acts. Basically, when markets anticipate a Fed cut, that outlook gets priced into mortgage rates ahead of time.

That’s exactly what happened after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates ticked down as financial markets grew more confident a cut was coming soon. And even though inflation rose slightly in the latest CPI report, the Fed is still expected to make a cut.

So, if the Fed goes with a 25-basis point cut, as expected, that’s likely already baked in to current mortgage rates, and we may not see a dramatic drop.

But if they go bigger and drop their Federal Funds Rate by 50 basis points instead, mortgage rates could come down more than they already have.

So, Where Do Mortgage Rates Go from Here?

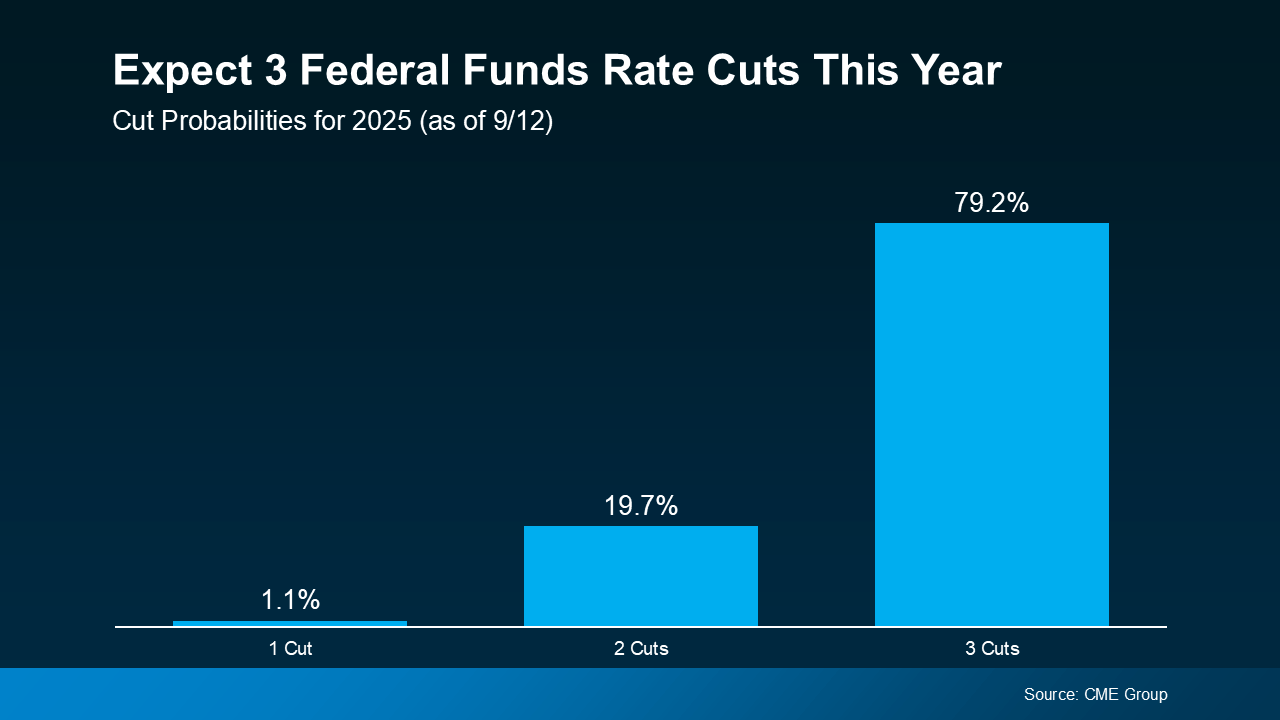

While the upcoming cut may not move the needle much, many experts expect the Fed could cut the Federal Funds Rate more than once before the end of the year. Of course, that’s if the economy continues to cool (see graph below):

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

If multiple rate cuts happen, or even if markets just believe they will, mortgage rates could ease further in the months ahead. But here’s the catch – all of this depends on how the economy evolves. Surprise inflation data or unexpected shifts could quickly change the outlook.

Bottom Line

Mortgage rates likely won’t drop sharply overnight, and they won’t mirror the Fed’s moves one-for-one. But if the Fed begins a rate-cutting cycle, and markets continue to expect it, mortgage rates could trend lower later this year and into 2026.

If you’ve been waiting and watching the housing market, now’s the time to talk strategy. Even small changes in rates can make a meaningful difference in affordability, and understanding what’s ahead helps you make the best decision for your situation.

What Everyone’s Getting Wrong About the Rise in New Home Inventory

You may have seen talk online that new home inventory is at its highest level since the crash. And if you lived through the crash back in 2008, seeing new construction is up again may feel a little scary.

But here’s what you need to remember: a lot of what you see online is designed to get clicks. So, you may not be getting the full story. A closer look at the data and a little expert insight can change your perspective completely.

Why This Isn’t Like 2008

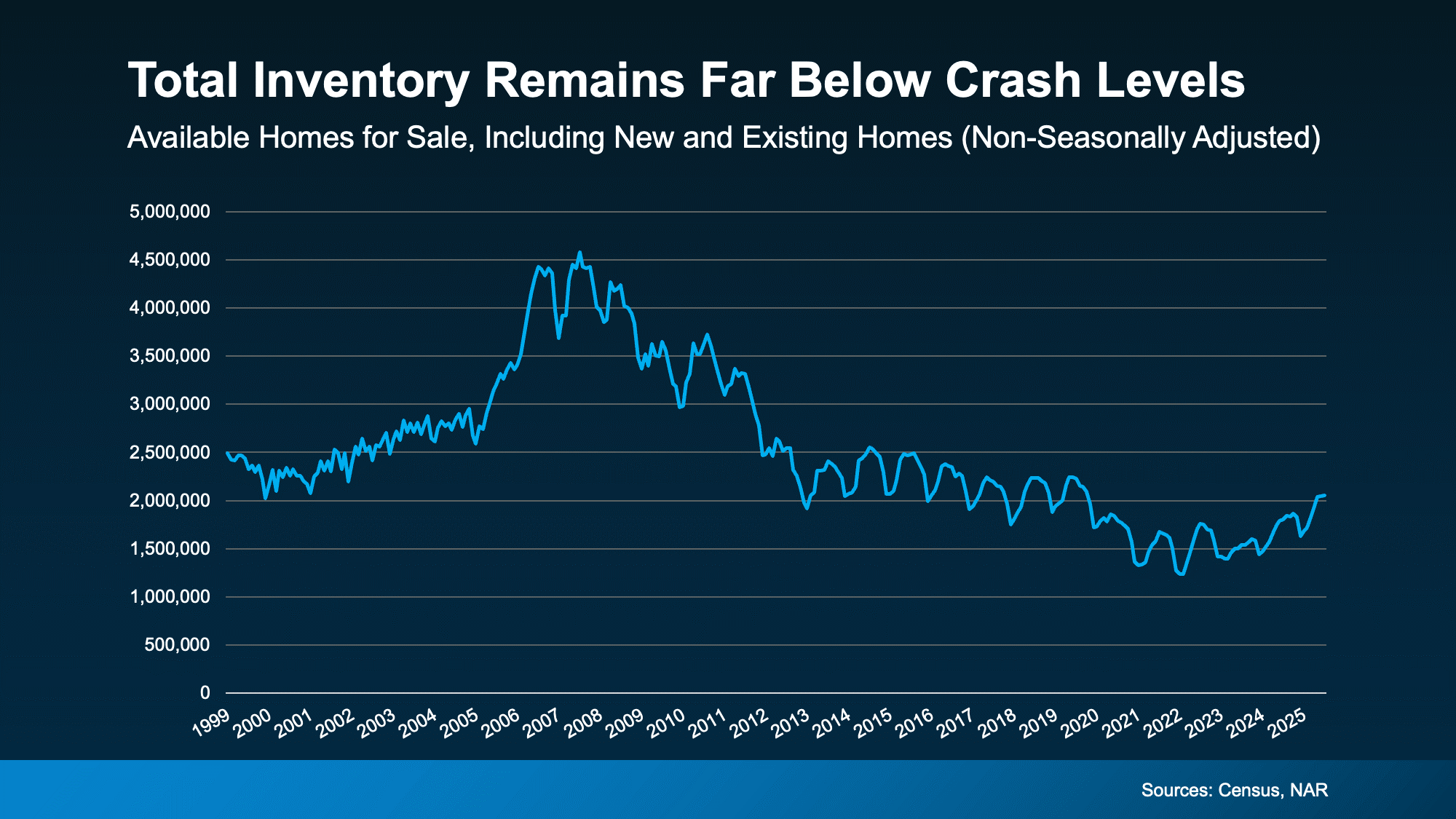

While it’s true the number of new homes on the market hit its highest level since the crash, that’s not a reason to worry. That’s because new builds are just one piece of the puzzle. They don’t tell the full story of what’s happening today.

To get the real picture of how much inventory we have and how it compares to the surplus we saw back then, you’ve got to look at both new homes and existing homes (homes that were lived in by a previous owner).

When you combine those two numbers, it’s clear overall supply looks very different today than it did around the crash (see graph below):

So, saying we’re near 2008 levels for new construction isn’t the same as the inventory surplus we did the last time.

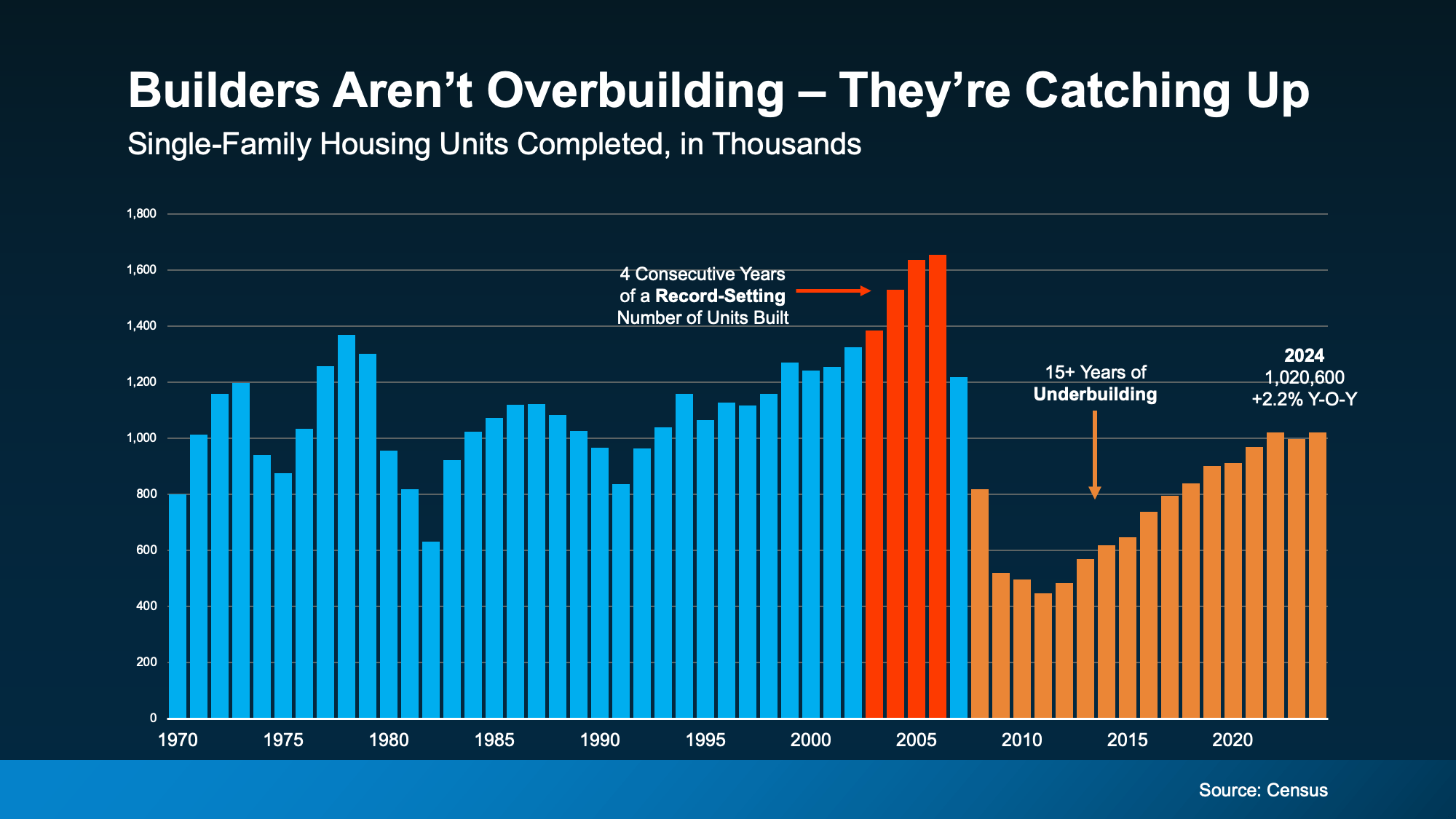

Builders Have Actually Underbuilt for Over a Decade

And here’s some other important perspective you’re not going to get from those headlines. After the 2008 crash, builders slammed on the brakes. For 15 years, they didn’t build enough homes to keep up with demand. That long stretch of underbuilding created a major housing shortage, which we’re still dealing with today.

The graph below uses Census data to show the overbuilding leading up to the crash (in red), and the period of underbuilding that followed (in orange):

Basically, we had more than 15 straight years of underbuilding – and we’re only recently starting to slowly climb out of that hole. But there’s still a long way to go (even with the growth we’ve seen lately). Experts at Realtor.com say it would take roughly 7.5 years to build enough homes to close the gap.

Of course, like anything else in real estate, the level of supply and demand is going to vary by market. Some markets may have more homes for sale, some less. But nationally, this isn’t like the last time.

Bottom Line

Just because there are more new homes for sale right now, it doesn’t mean we’re headed for a crash. The data shows today’s overall inventory situation is different.

If you have questions or want to talk about what builders are doing in our area, let’s connect.

History Shows the Housing Market Always Recovers

Now that the market is slowing down, homeowners who haven’t sold at the price they were hoping for are increasingly pulling their homes off the market. According to the latest data from Realtor.com, the number of homeowners taking their homes off the market is up 38% since the start of this year and 48% since the same time last June. For every 100 new listings in June, about 21 homes were taken off the market.

And if you’ve made that same choice, you’re probably frustrated things didn’t go the way you wanted. It’s hard when you feel like the market isn’t working with you. But while slowdowns can be painful in the moment, history tells us they don’t last forever.

History Repeats Itself: Proof from the Past

This isn’t the first time the housing market has experienced a slowdown. Here are some other notable times when home sales dropped significantly:

- 1980s: When mortgage rates climbed past 18%, buyers stopped cold. Sales crawled for years. But as soon as rates came down, sales surged back, and the market found its footing again.

- 2008: The Great Financial Crisis was one of the toughest housing downturns in history. Sales and prices both dropped hard. Still, sales rebounded once the economy recovered.

- 2020: During COVID, sales disappeared overnight, and many people had to put their plans on hold. Yet the recovery was faster than anyone expected, with a surge of buyers re-entering the market as soon as restrictions eased.

The lesson is clear: no matter the cause, the market always rebounds.

Today’s Situation: Where We Stand Now

Over the past few years, home sales have been sluggish. And one big reason why is affordability. Mortgage rates rose at a record-breaking pace in 2022, and home prices were climbing at the same time. That combination put buying out of reach for many people. And when demand slows, home sales do too.

The Outlook: Why Things Will Improve

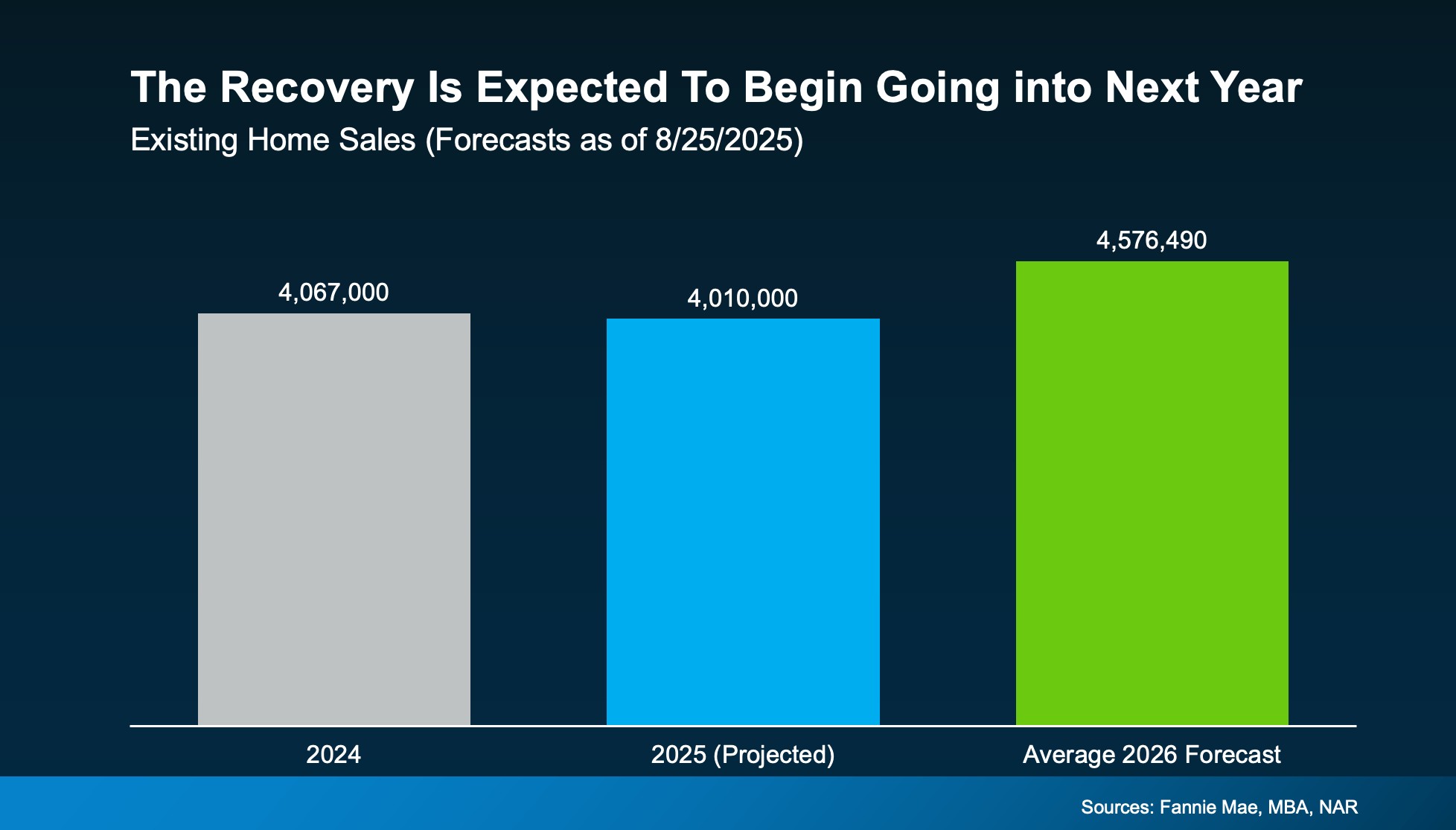

But here’s the encouraging part. Forecasts show sales are expected to pick up again moving into 2026.

Last year, just about 4 million homes sold (shown in gray in the graph below). And this year is looking very similar (shown in blue). But the average of the latest forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) show the experts believe there will be around 4.6 million home sales in 2026 (shown in green).

And a big reason behind that projection is the expectation that mortgage rates will come down a bit, making it easier for more buyers to jump back in.

That means what’s happening now is part of a cycle we’ve seen before. Every slowdown in the past has eventually given way to more activity, and this one will too.

Just like the 1980s, 2008, and 2020, today’s dip in home sales is temporary.

What That Means for You

If you’ve paused your moving plans, you did what you thought was right. Your frustration is valid. But it’s also important to remember the bigger picture. Housing slowdowns don’t last forever.

That’s where your local real estate agent comes in. Their job is to keep a close eye on the market for you. When the first signs of a rebound appear, they’ll help you spot the shift early so you can relist with confidence.

Bottom Line

If today’s housing market feels stuck, remember it’s never stayed down for good. Slowdowns end, activity returns, and people get moving again. So, let’s connect, because when the next wave of buyers shows up, you won’t want to miss it.

As activity picks up again, will you be ready to put your house back on the market, or do you need to move sooner?

From Frenzy to Breathing Room: Buyers Finally Have Time Again

If you tried to buy a home a few years ago, you probably still remember the frenzy. Homes were listed one day and gone the next. Sometimes it only took hours. You had to drop everything to go and see the house, and if you hesitated even slightly, someone else swooped in and bought it – sometimes even sight unseen.

That kind of intensity pushed a lot of buyers to the sidelines. It was stressful, chaotic, and for many, really discouraging.

But here’s what you need to know: those days are behind us.

Today’s market is moving slower, in the best possible way. And that’s creating more opportunity for buyers who felt shut out in recent years.

The Stat That Changes Everything

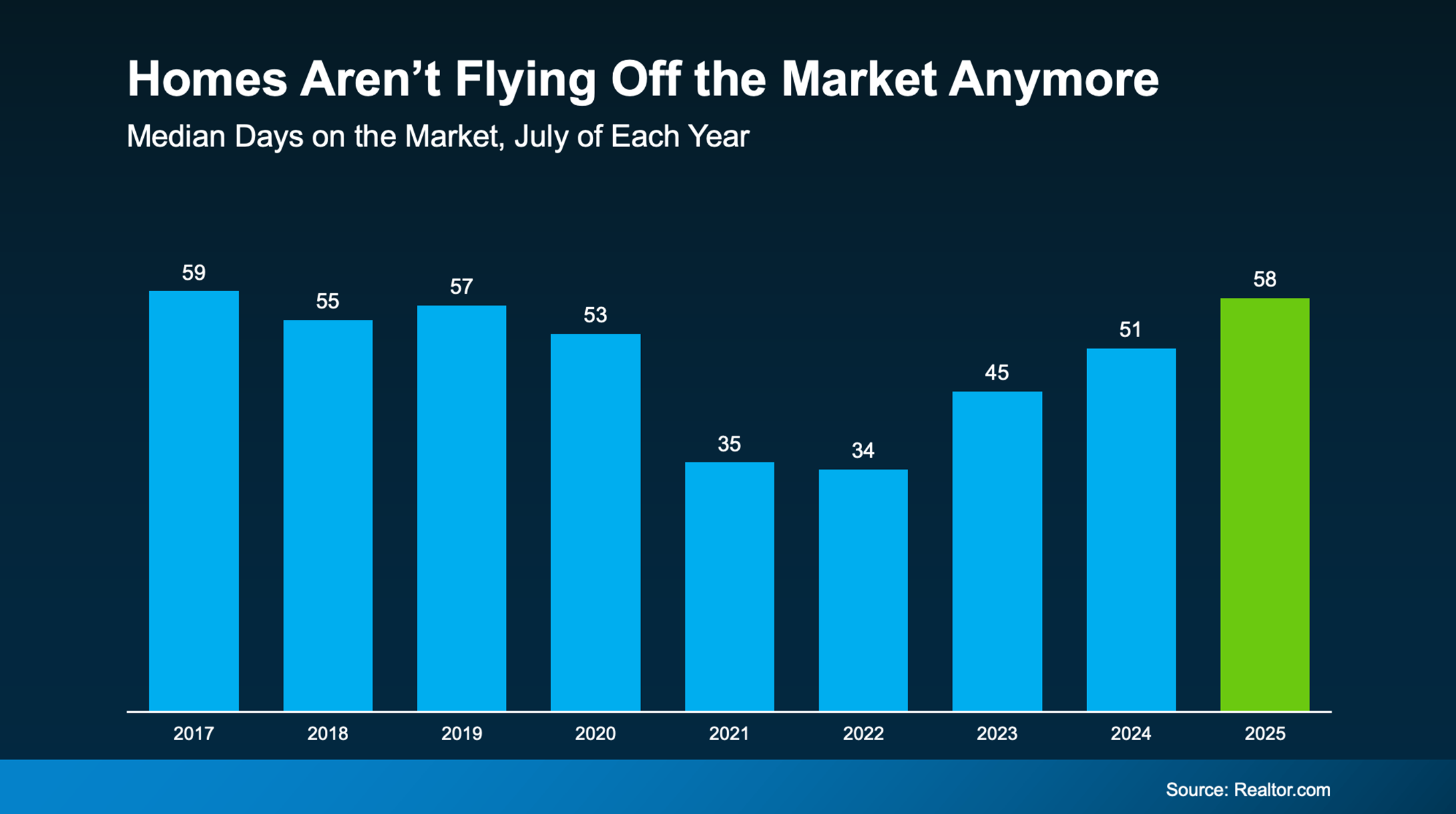

According to the latest data, homes are spending an average of 58 days on the market. That’s much more normal. And it’s a big improvement compared to the height of the pandemic, when homes were flying off the shelves in a matter of days (see graph below):

That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got:

Time to think.

Time to negotiate.

Time to make a smart move without all the pressure.

More Time Means Less Stress (and More Leverage)

Based on the data in the graph above, you have an extra week to decide compared to last year. And nearly double the time you would have had at the market’s peak.

Back then, fear of missing out drove buyers to act fast, sometimes too fast. Today, the pace is slower, which means you’re in control. As Bankrate puts it:

“For years, buyers have been racing to snag homes because of the fierce competition. But the market’s cooled off a bit now, and that gives buyers some breathing room. Homes are staying listed longer, so buyers can slow down, weigh their options and make more confident decisions.”

With more homes on the market and fewer buyers racing to grab them, the balance has shifted. Bidding wars aren’t as common, and that means you may have room to negotiate. And you can actually take a breath before you make your decision.

More listings + a slower pace = less stress and more opportunity

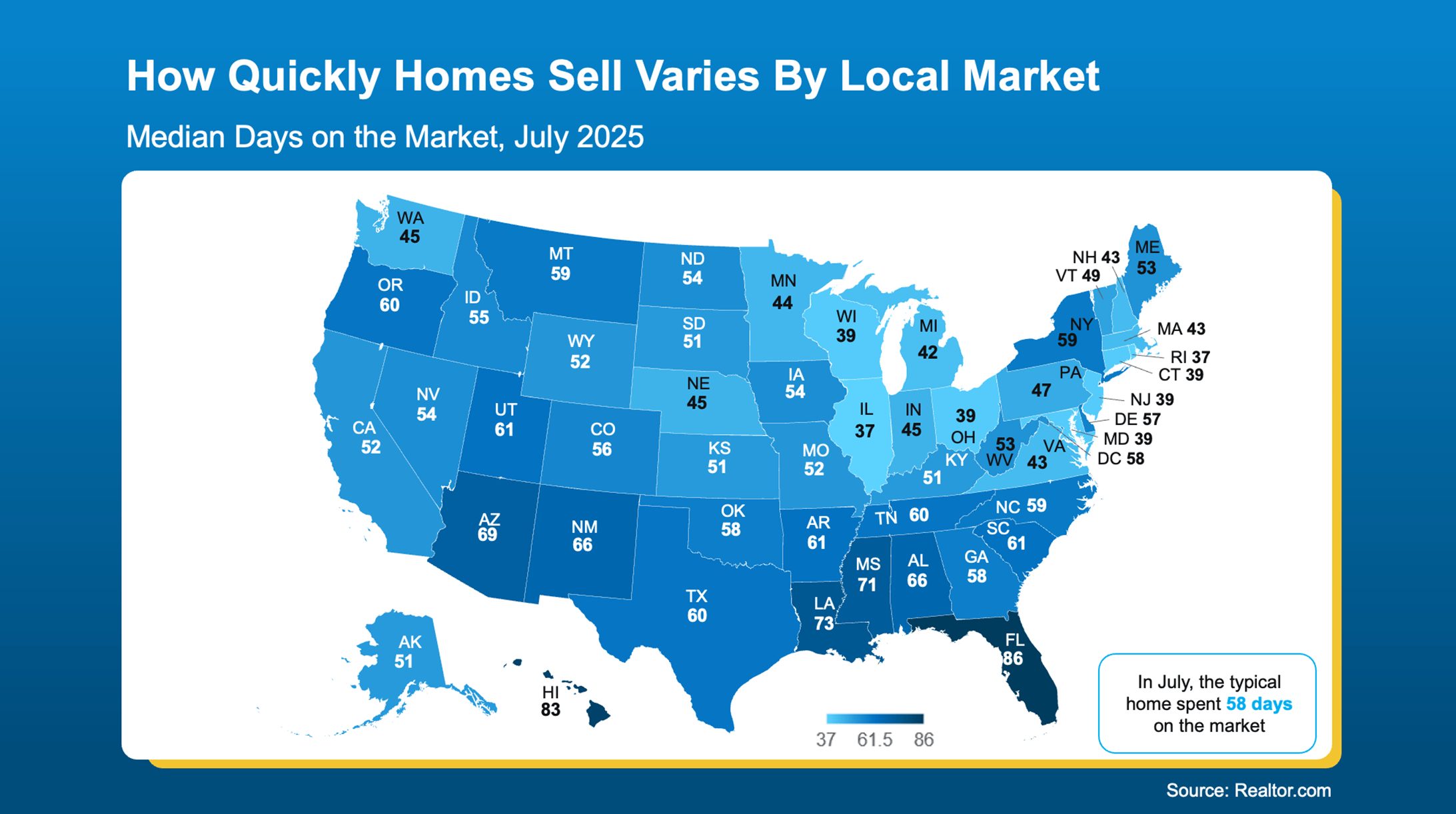

But, and this is important, it still depends on where you’re buying. Nationally, homes are moving slower. But your local market sets your real pace. Some states are moving faster than others. It may even vary down to the specific zip code or neighborhood you’re looking at. And that’s why working with an agent to know what’s happening in your area is more important than ever.

To see how your state compares to the national average (58 days), check out the map below:

As Realtor.com explains:

“While national headlines might suggest a buyer’s market is taking hold, the reality on the ground depends heavily on where and what you’re trying to buy. Local trends can diverge sharply from national averages, especially when you factor in price range, property type, and post-pandemic market dynamics.”

A smart local agent can tell you exactly when to move fast and when you can take your time, so you never miss the right home for you.

Bottom Line

If the chaos of the past few years drove you to hit pause, this is your green light. The market’s pace has shifted. You have more time. More options. More power.

And with the right agent guiding you, you’re in the best position you’ve been in for years.

Let’s talk about what the pace looks like in our area, and if now could be the right time for you to re-enter the market.

Eastside August Stats

Prices softened month-over-month across King County. Year-over-year, Seattle — which continues to outpace the rest of the county — is up 4%, while the Eastside is down 2% and King County overall is holding flat. We haven’t seen Seattle outpace the Eastside since the pandemic, and honestly, we’re now looking at inventory and sales numbers that feel a lot like 2019 levels nationwide. (For the data nerds among us, that’s an interesting throwback.)

New listings dropped for the second month in a row — right on schedule for this time of year — and inventory dipped ever so slightly, leaving us with 2.4 months of supply. Technically, that’s a balanced market, but for homes that don’t sell in the first two weeks, it can feel like a buyer’s market.

Here’s the real jaw-dropper: only 37% of homes sold at or above list price — the lowest I can remember seeing. Just a few months ago, that number was closer to 70%. While it feels dramatic, this is closer to a “normal” market. Buyers now have room to breathe and think critically. Sellers, on the other hand, need to be game-on when it comes to presentation, pricing, and marketing — which, again, is just how a healthy market works.

If you’re wondering how to make today’s market work in your favor, let’s talk strategy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link