Americans See Real Estate as a Better Investment Than Stocks or Gold

Last month, in a post on the Liberty Street Economics blog, the Federal Reserve Bank of New York noted that Americans believe buying a home is definitely or probably a better investment than buying stocks. Last week, a Gallup Poll reaffirmed those findings.

In an article on the current real estate market, Gallup reports:

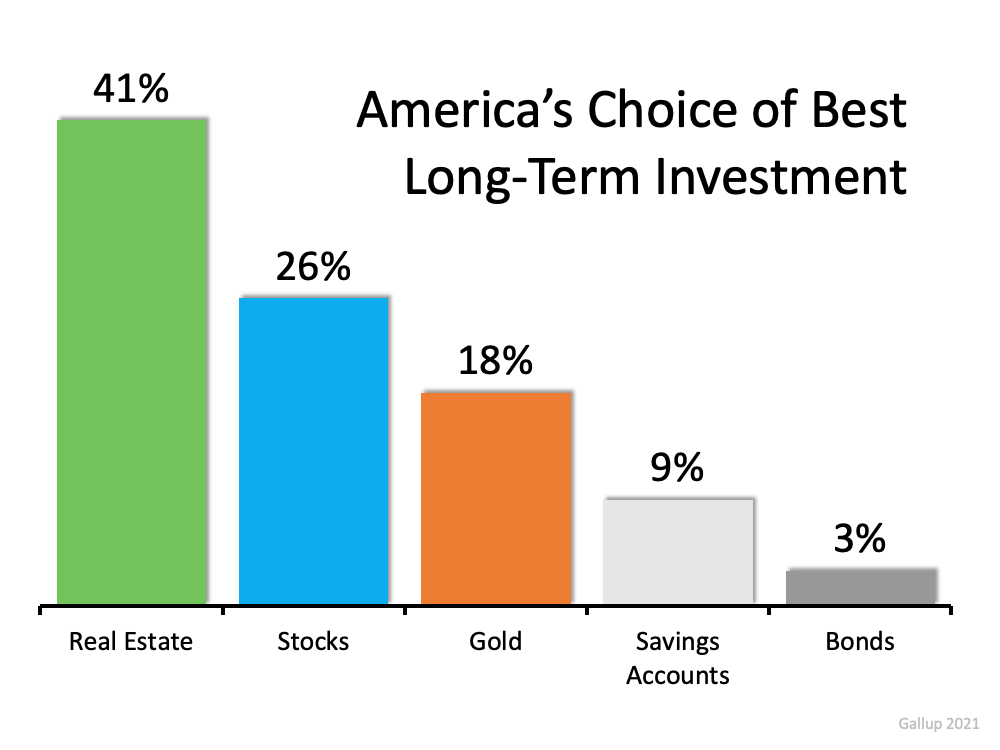

“Gallup usually finds that Americans regard real estate as the best long-term investment among several options — seeing it as superior to stocks, gold, savings accounts and bonds. This year, 41% choose real estate as the best investment, up from 35% a year ago, with stocks a distant second.”

Here’s the breakdown:

The article goes on to say:

“The 41% choosing real estate is the highest selecting any of the five investment options in the 11 years Gallup has asked this question.”

Is real estate really a secure investment right now?

Some question American confidence in real estate as a good long-term investment right now. They fear that the build-up in home values may be mirroring what happened right before the housing crash a little more than a decade ago. However, according to Merrill Lynch, J.P. Morgan, Morgan Stanley, and Goldman Sachs, the current real estate market is strong and sustainable.

As Morgan Stanley explains to their clients in a recent Thoughts on the Market podcast:

“Unlike 15 years ago, the euphoria in today’s home prices comes down to the simple logic of supply and demand. And we at Morgan Stanley conclude that this time the sector is on a sustainably, sturdy foundation . . . . This robust demand and highly challenged supply, along with tight mortgage lending standards, may continue to bode well for home prices. Higher interest rates and post pandemic moves could likely slow the pace of appreciation, but the upward trajectory remains very much on course.”

Bottom Line

America’s belief in the long-term investment value of homeownership has been, is, and will always be, very strong.

Local Market Update – May 2021

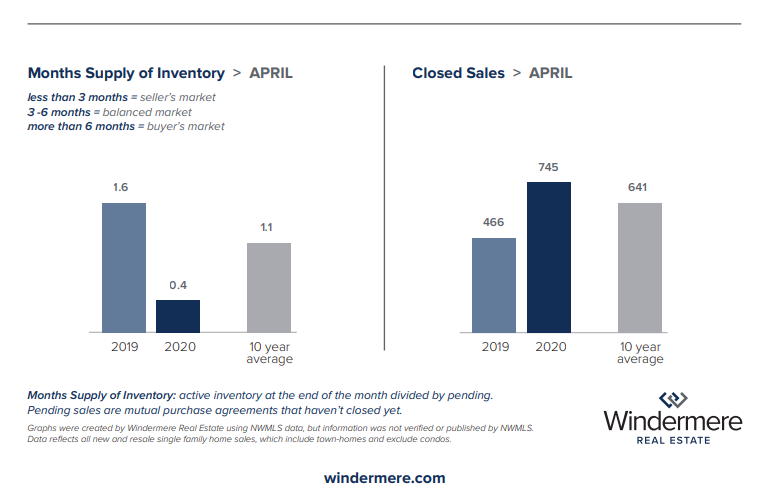

A sizeable increase in new listings in April offered some good news for buyers, but it was matched by an even greater increase in sales. With supplies depleted, and homes being snapped up within days, nearly every area saw double-digit price gains. The current forecast as we head towards summer: the market remains as hot as ever.

Despite the influx of new listings, inventory in the region remains one of the tightest in the country. At the end of the month there were 43% fewer homes on the market in King County than there were a year ago. Snohomish County had 49% less inventory, and has just 519 single-family homes for sale in the entire county. There were only 309 homes for sale on the Eastside, which stretches from Renton to Woodinville. Demand is so outstripping supply that 95% of the homes that sold last month on the Eastside sold within two weeks. In Seattle that number was 84%.

Home prices hit record highs in April, with nearly every area seeing double-digit price increases. The median price of a single-family home in King County last month was $830,000. Snohomish County’s median price soared to $675,000. Seattle’s median home price hit $875,000. All were new records. At $1.3 million, the median price on the Eastside was down slightly from its all-time high in March, but up a whopping 39% from the same time last year. In another show of the strength of the market, 82% of homes on the Eastside sold for over the list price. That compares with 60% of homes in Seattle. The Seattle market remains strong, however price appreciation there has slowed relative to other areas of King County and inventory has crept up. Condos present one bright spot for buyers. Price growth has been slower and inventory has been higher than for single-family homes. The $460,000 median price for a condo in King County is 45% less than the median price of a single-family home there.

Needless to say, this is a challenging market for buyers. With multiple offers and escalation clauses the norm, it’s critical to work with your broker on a plan to consider all possible scenarios when looking to buy a home. If you’re thinking about selling, it’s an ideal time to get a maximum return on your property before the prospect of rising interest rates starts to moderate the market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

4 Tips to Maximize the Sale of Your House

Homeowners ready to make a move are definitely in a great position to sell today. Housing inventory is incredibly low, driving up buyer competition. This gives homeowners leverage to sell for the best possible terms, and it’s fueling a steady rise in home prices.

In such a hot market, houses are selling quickly. According to the National Association of Realtors (NAR), homes are typically on the market for just 18 short days. Despite the speed and opportunity for sellers, there are still steps you can take to prep your house to shine so you get the greatest possible return.

1. Make Buyers Feel at Home

One of the ways to make this happen is to take time to declutter. Pack away any personal items like pictures, awards, and sentimental belongings. The more neutral and tidy the space, the easier it is for a buyer to picture themselves living there. According to the 2021 Profile of Home Staging by NAR:

“82% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house potentially attract the attention of more buyers and likely sell quickly, but the same report also notes:

“Eighteen percent of sellers’ agents said home staging increased the dollar value of a residence between 6% and 10%.”

As Jessica Lautz, Vice President of Demographics and Behavior Insights for NAR, says:

“Staging a home helps consumers see the full potential of a given space or property…It features the home in its best light and helps would-be buyers envision its various possibilities.”

2. Keep It Clean

On top of making an effort to declutter, it’s important to keep your house neat and clean. Before a buyer stops by, be sure to pick up toys, make the beds, and wash the dishes. This is one more way to reduce the number of things that can distract a buyer from the appeal of the home.

Ensure your home smells fresh and clean as well. Buyers will remember the smell of your house, and according to the same report from NAR, the kitchen is one of the most important rooms of the house to focus on if you want to attract more buyers.

3. Give Buyers Access

Buyers are less likely to make an offer on your house if they aren’t able to easily schedule a time to check it out. If your home is available anytime, that opens up more opportunities for multiple buyers to go from curious to eager. It also allows buyers on tight schedules to still get in to see your house.

While health continues to be a great concern throughout the country, it’s important to work with your agent to find the best safety measures and digital practices for your listing. This will drive visibility and create access options that also keep everyone in the process safe.

4. Price It Right

Even in a sellers’ market, it’s crucial to set your house at the right price to maximize selling potential. Pricing your house too high is actually a detriment to the sale. The goal is to drive high attention from competing buyers and let bidding wars push the final sales price up.

Work with your trusted real estate professional to determine the best list price for your house. Having an expert on your side in this process is truly essential.

Bottom Line

If you want to sell on your terms, in the least amount of time, and for the best price, today’s market sets the stage to make that happen. Let’s connect today to determine the best ways to maximize the sale of your house this year.

This Isn’t a Bubble. It’s Simply Lack of Supply.

It’s a discouraging scene: Bidding wars, soaring prices, and fears that homeownership is becoming out of reach for millions of Americans. We’re in a housing frenzy, driven by a massive shortage of inventory — and no one seems to be happy about it.

Why it matters: Not all bubbles burst. Real estate, in particular, tends to rise in value much more easily than it falls. Besides, says National Association of Realtors chief economist Lawrence Yun, this “is not a bubble. It is simply lack of supply.”

By the numbers: America has a record-low number of homes available for sale — just 1.03 million, according to the latest NAR data. That compares to a peak of more than 4 million at the height of the last housing bubble, in July 2007.

- The total number of active listings this week is down a record 54% from the same week a year ago, per Realtor.com. That in turn has helped to drive national prices up 17.2% over last year.

- Almost half of homes now sell within one week of being listed, per Redfin.

- In Austin, Texas, the median listing price has risen 40% in one year to $520,000.

The big picture: Prices are being driven upwards by a combination of factors, including continued low mortgage rates, a pandemic-era construction slowdown, a desire for more space as people work increasingly from home, and a stock market driven increase in money available for downpayment.

- A rise in financial buyers — large corporations buying up homes to rent them out — is only making the market tighter, and decreasing the number of owner-occupied properties available.

- What’s missing: Unlike the mid-2000s, this time around there’s no exuberant culture of condo flipping. While interest rates are low, lending standards are still tight, making it hard to buy a house you can’t afford.

The good news is that rents have not been rising nearly as fast as prices. They stayed roughly flat during the pandemic, and are now rising at perhaps a 4% pace, Yun says.

Homebuyers are the biggest losers. In order to win bidding wars, many of them are being forced to make rushed and risky decisions. Successful bids often need to waive any financing contingency or right to inspect the property.

- That raises the terrifying prospect of putting down a large downpayment and then not being able to get a mortgage — and/or finding that the house requires hundreds of thousands of dollars in repairs.

The worst-case outcome, says Yun, would be if “rates remain low, demand picks up with new jobs, there’s no increase in supply, and the only thing that moves is home prices, until people get priced out. That would mean we are creating a divided society of haves and have-nots.”

- The best-case outcome, on the other hand, would be a construction boom accelerated by President Biden’s infrastructure plan, which would create more supply and help to stop the rise in prices.

The bottom line: Housing prices are likely to remain high and rising for a while yet.

Article written by

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to Foreclosure

There has been a lot of discussion as to what will happen once the 2.3 million households currently in forbearance no longer have the protection of the program. Some assume there could potentially be millions of foreclosures ready to hit the market. However, there are four reasons that won’t happen.

1. Almost 50% Leave Forbearance Already Caught Up on Payments

According to the Mortgage Bankers Association (MBA), data through March 28 show that 48.9% of homeowners who have already left the program were current on their mortgage payments when they exited.

- 26.6% made their monthly payments during their forbearance period

- 14.7% brought past due payments current

- 7.6% paid off their loan in full

This doesn’t mean that the over two million still in the plan will exit exactly the same way. It does, however, give us some insight into the possibilities.

2. The Banks Don’t Want the Houses Back

Banks have learned lessons from the crash of 2008. Lending institutions don’t want the headaches of managing foreclosed properties. This time, they’re working with homeowners to help them stay in their homes.

As an example, about 50% of all mortgages are backed by the Federal Housing Finance Agency (FHFA). In 2008, the FHFA offered 208,000 homeowners some form of Home Retention Action, which are options offered to a borrower who has the financial ability to enter a workout option and wants to stay in their home. Home retention options include temporary forbearances, repayment plans, loan modifications, or partial loan deferrals. These helped delinquent borrowers stay in their homes. Over the past year, the FHFA has offered that same protection to over one million homeowners.

Today, almost all lending institutions are working with their borrowers. The report from the MBA reveals that of those homeowners who have left forbearance,

- 35.5% have worked out a repayment plan with their lender

- 26.5% were granted a loan deferral where a borrower does not have to pay the lender interest or principal on a loan for an agreed-to period of time

- 9% were given a loan modification

3. There Is No Political Will to Foreclose on These Households

The government also seems determined not to let individuals or families lose their homes. Bloomberg recently reported:

“Mortgage companies could face penalties if they don’t take steps to prevent a deluge of foreclosures that threatens to hit the housing market later this year, a U.S. regulator said. The Consumer Financial Protection Bureau (CFPB) warning is tied to forbearance relief that’s allowed millions of borrowers to delay their mortgage payments due to the pandemic…mortgage servicers should start reaching out to affected homeowners now to advise them on ways they can modify their loans.”

The CFPB is proposing a new set of guidelines to ensure people will be able to retain their homes. Here are the major points in the proposal:

- The proposed rule would provide a special pre-foreclosure review period that would generally prohibit servicers from starting foreclosure until after December 31, 2021.

- The proposed rule would permit servicers to offer certain streamlined loan modification options to borrowers with COVID-19-related hardships based on the evaluation of an incomplete application.

- The proposal rule wants temporary changes to certain required servicer communications to make sure borrowers receive key information about their options at the appropriate time.

A final decision is yet to be made, and some do question whether the CFPB has the power to delay foreclosures. The entire report can be found here: Protections for Borrowers Affected by the COVID-19 Emergency Under the Real Estate Settlement Procedures Act (RESPA), Regulation X.

4. If All Else Fails, Homeowners Will Sell Their Homes Before a Foreclosure

Homeowners have record levels of equity today. According to the latest CoreLogic Home Equity Report, the average equity of mortgaged homes is currently $204,000. In addition, 38% of homes do not have a mortgage, so the level of equity available to today’s homeowners is significant.

Just like the banks, homeowners learned a lesson from the housing crash too.

“In the same way that grandparents and great grandparents were shaped by the Great Depression, much of the public today remembers the 2006 mortgage meltdown and the foreclosures, unemployment, and bank failures it created. No one with any sense wants to repeat that experience…and it may explain why so much real estate equity remains mortgage-free.”

What does that mean to the forbearance situation? According to Black Knight:

“Just one in ten homeowners in forbearance has less than 10% equity in their home, typically the minimum necessary to be able to sell through traditional real estate channels to avoid foreclosure.”

Bottom Line

The reports of massive foreclosures about to come to the market are highly exaggerated. As Ivy Zelman, Chief Executive Officer of Zelman & Associates with roughly 30 years of experience covering housing and housing-related industries, recently proclaimed:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link